Singapore Airlines 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

Singapore Airlines Annual Report 05/06

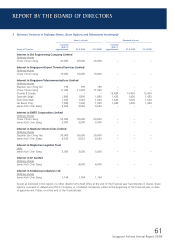

Performance of Subsidiary Companies (continued)

SIA Engineering Group (continued)

Share of profits from associated and joint venture companies grew by $30 million (+39.9 per cent) to $106 million, representing

40.1 per cent of the Group’s profit before tax.

Profit before tax rose 35.5 per cent (+$69 million) to $263 million.

Equity attributable to equity holders of the Company increased 21.0 per cent to $1,039 million for the financial year ended

31 March 2006. This was mainly due to the profit attributable to equity holders of the Company of $231 million for 2005-06,

share options exercised during the year of $36 million and share-based payment made amounting to $7 million. This was partially

offset by payment of dividends in 2005-06 amounting $87 million.

Net asset value per share increased 15.8 cents to 100.2 cents. Return on average equity holders’ funds was 24.3 per cent, an

increase of 5.2 percentage points from 2004-05. Basic earnings per share rose 33.2 per cent to 22.5 cents.

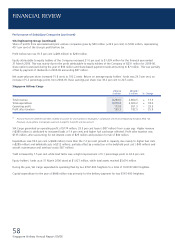

Singapore Airlines Cargo

2005-06 2004-05

R1

$ million $ million % Change

Total revenue 3,244.6 2,864.5 + 13.3

Total expenditure 3,070.8 2,603.2 + 18.0

Operating profit 173.8 261.3 – 33.5

Profit after taxation 135.3 182.5 – 25.9

R1 Financial results for 2004-05 have been restated to account for share options to employees in compliance with Financial Reporting Standards (FRS) 102.

Previously, share options to employees were not charged to the profit and loss account.

SIA Cargo generated an operating profit of $174 million, 33.5 per cent lower (-$87 million) from a year ago. Higher revenue

(+$380 million) is attributed to increased loads (+7.4 per cent) and higher fuel surcharge collected. Profit after taxation was

$135 million, after accounting for net interest costs of $25 million and provision for tax of $40 million.

Expenditure rose 18.0 per cent (+$468 million) more than the 7.2 per cent growth in capacity, due mainly to higher fuel costs

(+$289 million) and bellyhold costs (+$212 million), partially offset by a reduction in the bellyhold pool cost (-$40 million) and

aircraft maintenance and overhaul costs (-$57 million).

Yield increased by 7.5 per cent while load factor saw a slight improvement of 0.1 percentage point to 63.6 per cent.

Equity holders’ funds as at 31 March 2006 stood at $1,927 million, while total assets reached $3,614 million.

During the year, SIA Cargo expanded its operating fleet by two B747-400 freighters to a total of 16 B747-400 freighters.

Capital expenditure for the year of $448 million was primarily for the delivery payment for two B747-400 freighters.

FINANCIAL REVIEW