Singapore Airlines 2006 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132

Singapore Airlines Annual Report 05/06

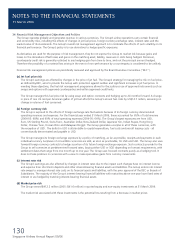

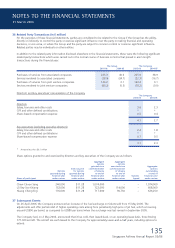

35 Financial Instruments (in $ million) (continued)

(b) Interest rate risk

The following tables set out the carrying amount, by earlier of contractual repricing or maturity dates, of the Group’s and

Company’s fi nancial instruments that are exposed to interest rate risk:

Within 1 1-2 2-3 3-4 4-5 More than

year years years years years 5 years Total

2006

Group

Fixed rate

Bonds 382.4 – – – – – 382.4

Bank overdrafts 0.4 – – – – – 0.4

Notes payable – – – 200.0 – 900.0 1,100.0

Obligations under fi nance leases* 434.3 138.2 17.1 18.4 19.8 68.4 696.2

Floating rate

Obligations under fi nance leases 366.7 2.0 – – – – 368.7

Cash and bank balances 3,151.6 – – – – – 3,151.6

Bank overdrafts 10.0 – – – – – 10.0

Loans 140.7 – – – – – 140.7

Company

Fixed rate

Bonds 382.4 – – – – – 382.4

Notes payable – – – – – 900.0 900.0

Funds from subsidiaries 1,220.9 – – – – – 1,220.9

Obligations under fi nance leases* 419.5 122.3 – – – – 541.8

Floating rate

Cash and bank balances 2,765.1 – – – – – 2,765.1

Bank overdrafts 9.0 – – – – – 9.0

2005

Group

Fixed rate

Bonds 88.6 301.2 – – – – 389.8

Bank overdrafts 0.8 – – – – – 0.8

Notes payable – – – – 200.0 900.0 1,100.0

Obligations under fi nance leases* – 422.8 126.7 – – – 549.5

Floating rate

Obligations under fi nance leases 585.7 – – – – – 585.7

Cash and bank balances 2,840.2 – – – – – 2,840.2

Bank overdrafts 25.4 – – – – – 25.4

Loans 167.8 – – – – – 167.8

Company

Fixed rate

Bonds 88.6 301.2 – – – – 389.8

Notes payable – – – – – 900.0 900.0

Funds from subsidiaries 758.8 – – – – – 758.8

Obligations under fi nance leases* – 422.8 126.7 – – – 549.5

Floating rate

Cash and bank balances 2,509.1 – – – – – 2,509.1

Bank overdrafts 24.3 – – – – – 24.3

* The Group and Company have entered into interest rate swap agreements to swap the fl oating rate lease liabilities into fi xed rate.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006