Singapore Airlines 2006 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

Singapore Airlines Annual Report 05/06

2 Accounting Policies (continued)

(ad)

FRS and INT FRS not yet effective (continued)

INT FRS 104: Determining whether an arrangement contains a lease

This interpretation, effective for annual fi nancial periods beginning on or after 1 January 2006, requires the determination

of whether an arrangement is, or contains a lease, to be based on the substance of the arrangement and requires an

assessment of whether the arrangement is dependent on the use of a specifi c asset or assets and the arrangement

conveys a right to use the asset.

The Group expects that the adoption of the interpretation above is not expected to have a signifi cant impact on the

fi nancial statements in the period of initial application.

FRS 40: Investment Property

This standard shall be applied in the recognition, measurement and disclosure of investment property. Among other

things, this standard applies to the measurement in a lessee’s fi nancial statements of investment property interests held

under a lease accounted for as a fi nance lease and to the measurement in a lessor’s fi nancial statements of investment

property provided to a lessee under an operating lease.

The Group expects that the adoption of the interpretation above is not expected to have a signifi cant impact on the

fi nancial statements in the period of initial application.

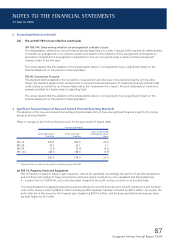

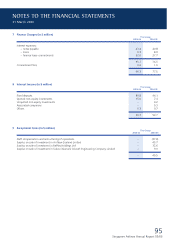

3 Signifi cant Financial Impact of New and Revised Financial Reporting Standards

The adoption of the new and revised Financial Reporting Standards did not have any signifi cant fi nancial impact to the Group

except as discussed below:

Effect of changes to the Profi t and Loss Account for the year ended 31 March 2006.

Increase/(decrease)

Basic and Diluted

Profi t before tax Profi t after tax R1 Earnings per share

$ million $ million Cents

FRS 16 379.9 303.9 24.9

FRS 28 37.2 26.1 2.1

FRS 39 (3.7) (3.0) (0.2)

FRS 102 (48.1) (48.1) (3.9)

365.3 278.9 22.9

R1

The profi t after tax refers to the profi t for the fi nancial year 2005-06.

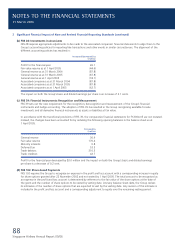

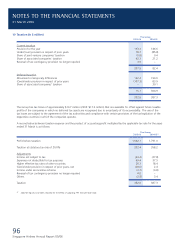

(a) FRS 16: Property, Plant and Equipment

FRS 16 has been revised to require major inspection costs to be capitalised. Accordingly, the portion of aircraft maintenance

and overhaul costs relating to heavy maintenance visits and engine overhauls are now capitalised and depreciated over

4 – 6 years. Prior to FY2005-06, such costs have been charged to the profi t and loss account on an incurred basis.

The revised treatment is applied prospectively and accordingly, the current fi nancial year’s aircraft maintenance and overhaul

costs of the Group is lower by $462.2 million and depreciation expenses has been increased by $82.3 million. As a result, the

profi t after tax of the Group for the fi nancial year is higher by $303.9 million, and the basic and diluted earnings per share

are both higher by 24.9 cents.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006