Singapore Airlines 2006 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156

|

|

133

Singapore Airlines Annual Report 05/06

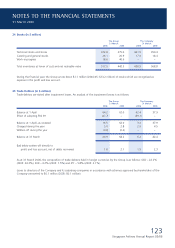

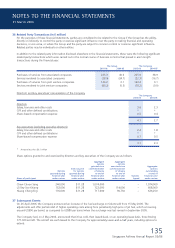

35 Financial Instruments (in $ million) (continued)

(c) Derivative fi nancial instruments and hedging activities

Derivative fi nancial instruments included in the balance sheets are as follows:

The Group The Company

31 March 31 March

2006 2005 2006 2005

Assets*

Forward currency contracts 27.7 – 21.4 –

Jet fuel swap and option contracts 56.7 – 44.5 –

Interest rate swap contracts 15.4 – 11.5 –

99.8 – 77.4 –

Liabilities #

Forward currency contracts 5.3 – 3.6 –

Jet fuel swap contracts 5.4 – 4.3 –

Cross currency contracts 18.5 – – –

Interest rate swap contracts 2.9 – – –

32.1 – 7.9 –

* Included under trade debtors.

# Included under trade creditors.

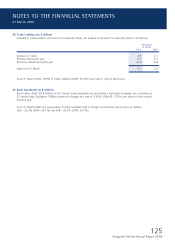

Cash fl ow hedges

The Group entered into jet fuel swaps and options in order to hedge the fi nancial risk related to the price of the fuel. The

Group has applied cash fl ow hedge accounting to these derivatives as they are considered to be highly effective hedging

instruments. A net fair value gain of $82.2 million, with a related deferred tax charge of $34.5 million, was included in the

fair value reserve [Note 14(b)] in respect of these contracts.

The cash fl ows arising from these derivatives are expected to occur and enter into the determination of profi t or loss during

the next three fi nancial years as follows: $55.0 million, $24.5 million and $2.7 million.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006