Singapore Airlines 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Singapore Airlines Annual Report 05/06

Performance of the Company (continued)

Finance Charges

Finance charges increased 38.7 per cent due mainly to higher interest rates on lease liabilities and higher interest rates on surplus

funds from subsidiary companies.

Interest income was 82.9 per cent higher due mainly to an increase in income from deposits.

Surplus on Disposal of Aircraft, Spares and Spare Engines

Surplus on the disposal of aircraft, spares and spare engines was $119 million lower than the year before due mainly to fewer

disposals this year. During the year, one B747-400 and two A310-300 aircraft were sold and one B747-400 and two A310-300

aircraft were traded-in.

Gross Dividends from Subsidiary and Associated Companies

Gross dividends from subsidiary and associated companies decreased by $435 million mainly due to lower dividends received from

Singapore Airport Terminal Services (-$305 million), SIA Engineering Company (-$148 million), and Virgin Atlantic Limited

(-$1 million).

Impairment of Long-term Investments

The $1 million impairment of long-term investments pertained to investments in AeroXchange.

Taxation

There was a tax charge of $195 million, comprising current tax of $213 million and write back of deferred tax of $18 million. As

at 31 March 2006, the Company’s deferred taxation account stood at $1,951 million.

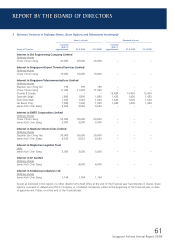

Average Staff Strength and Productivity

The Company’s average staff strength was 13,729, an increase of 157 over the previous year. The distribution of employee

strength by category and location is as follows:

2005-06 2004-05 % Change

Category

Senior staff (administrative and higher ranking officers) 1,284 1,265 + 1.5

Technical crew 2,024 1,912 + 5.9

Cabin crew 6,784 6,637 + 2.2

Other ground staff 3,637 3,758 – 3.2

13,729 13,572 + 1.2

Location

Singapore 11,452 11,261 + 1.7

East Asia 974 1,001 – 2.7

Europe 435 460 – 5.4

South West Pacific 370 364 + 1.6

West Asia and Africa 256 247 + 3.6

Americas 242 239 + 1.3

13,729 13,572 + 1.2

FINANCIAL REVIEW