Singapore Airlines 2006 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Singapore Airlines Annual Report 05/06

34 Financial Risk Management Objectives and Policies (continued)

(e) Counterparty risk

Surplus funds are invested in interest-bearing bank deposits and other high quality short-term liquid investments.

Counterparty risks are managed by limiting aggregated exposure on all outstanding fi nancial instruments to any individual

counterparty, taking into account its credit rating. Such counterparty exposures are regularly reviewed, and adjusted as

necessary. This mitigates the risk of material loss arising in the event of non-performance by counterparties.

(f) Liquidity risk

At 31 March 2006, the Group had at its disposal, cash and short-term deposits amounting to $3,151.6 million

(2005: $2,840.2 million). In addition, the Group had available short-term credit facilities of about $1,449.1 million

(2005: $1,417.1 million). The Group also has Medium Term Note Programmes under which it may issue notes up to

$1,500 million (2005: $1,500 million). Under these Programmes, notes issued by the Company may have maturities as may

be agreed with the relevant fi nancial institutions, and notes issued by one of its subsidiary companies may have maturities

between one month and ten years.

The Group’s holdings of cash and short-term deposits, together with committed funding facilities and net cash fl ow from

operations, are expected to be suffi cient to cover the cost of all fi rm aircraft deliveries due in the next fi nancial year. It is

expected that any shortfall would be met by bank borrowings or public market funding. Due to the necessity to plan aircraft

orders well in advance of delivery, it is not economical for the Group to have committed funding in place at present for all

outstanding orders, many of which relate to aircraft which will not be delivered for several years. The Group’s policies in this

regard are in line with the funding policies of other major airlines.

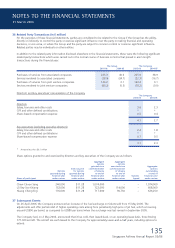

35 Financial Instruments (in $ million)

(a) Fair values

The fair value of a fi nancial instrument is the amount at which the instrument could be exchanged or settled between

knowledgeable and willing parties in an arm’s length transaction, other than in a forced or liquidation sale.

Financial instruments carried at fair value

The Group and Company have carried all investment securities that are classifi ed as available-for-sale fi nancial assets and all

derivative instruments at their fair values as required by FRS 39.

The fair value of jet fuel swap and jet fuel option contracts are determined by reference to available market information

and the Black-Scholes option valuation model. As the Group hedges its jet fuel requirements in Mean of Platts Singapore

(“MOPS”) and that the majority of the Group’s fuel uplifts are in MOPS, the MOPS price (as at 31 March 2006: USD79.54/

BBL) is used as the input for market fuel price to the Black-Scholes option valuation model. Consequently, the annualised

volatility (2005-06: 26.36%) of the jet fuel swap and jet fuel option contracts is also estimated with daily MOPS price. The

continuously compounded risk-free rate estimated as average of the past 12 months SGS benchmark issues’ one-year yield

(2005-06: 2.4%) was also applied to each individual jet fuel swap and jet fuel option contracts to derive their estimated fair

values as at 31 March 2006.

The fair value of forward currency contracts is determined by reference to current forward prices for contracts with similar

maturity profi les.

The fair value of interest rate contracts is calculated using rates assuming these contracts are liquidated at balance sheet date.

Financial instruments whose carrying amounts approximate fair value

The carrying amounts of the following fi nancial assets and liabilities approximate their fair values due to their short-term

nature: cash and bank balances, bank overdrafts, funds from subsidiary companies, amounts owing by/to subsidiary,

associated and joint venture companies, loans, trade debtors and creditors.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006