Singapore Airlines 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

Singapore Airlines Annual Report 05/06

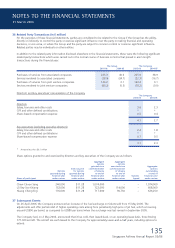

32 Capital and Other Commitments (in $ million) (continued)

(c) Other commitments

In 2002-03, SATS and two of its wholly-owned subsidiary companies entered into a lease agreement with a United States

lessor, whereby the subsidiary companies sold and leased back certain fi xed ground support equipment with net book value

of $93.4 million. The gain arising from this sale and leaseback transaction is deferred and amortised over the lease period

of 18 years commencing October 2002. Under the terms of the agreement, the subsidiary companies prepaid to the lessor

an amount, which is equivalent to the present value of their future lease obligations. SATS has guaranteed the repayment of

these future lease obligations, and accordingly has become the primary obligor under the lease agreement.

The Company has an outstanding commitment to subscribe for shares in a joint venture company amounting to

US$21.1 million.

33 Contingent Liabilities (in $ million)

Flight SQ006

On 31 October 2000, Flight SQ006 crashed on the runway at the Chiang Kai Shek International Airport, Taipei en route to

Los Angeles. There were 83 fatalities among the 179 passengers and crew members aboard the Boeing 747 aircraft. On

26 April 2002, the Taiwan Aviation Safety Council released its fi nal investigation report on the accident. Most of the lawsuits

commenced against the Company by passengers or their next-of-kin relating to the crash have been settled. The Company is

also currently defending lawsuits commenced by crew members or their next-of-kin. The Company maintains substantial

insurance coverage and the Company has received professional advice that this cover will be suffi cient to cover the claims

arising from the crash. Accordingly, the Company believes that the resolution of the claims arising from the crash will have

no material impact on its fi nancial position.

Investigations by competition authorities

Singapore Airlines Cargo Pte Ltd (“SIA Cargo”), a wholly-owned subsidiary of the Company, is one of several airlines cooperating

with investigations by competition authorities in the US, EU, Switzerland and New Zealand regarding whether surcharges, rates

and other similar competitive aspects of air cargo service were lawfully determined. No charges have been pressed or decisions

made against the Company and SIA Cargo as of today.

After the investigations commenced, class-action civil suits were fi led in the US by external parties against the airlines named in

the press as being allegedly subject to the investigations, including the Company and SIA Cargo. As at 31 March 2006, there

were 38 suits against the Company and 26 suits against SIA Cargo. None of the cases has been tried.

As the investigations by the competition authorities are still ongoing and the class-action civil suits have neither been tried nor

have damages been quantifi ed, it is premature to make a determination regarding whether the investigations or civil suits can

be regarded as contingent liabilities and therefore, no provision has been made in the accounts.

Others

There are contingent liabilities in respect of insurance and performance bonds, and bank guarantees given by the Group and

the Company at 31 March 2006 amounting to $58.9 million (2005: $56.4 million) and $22.6 million (2005: $22.8 million)

respectively.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006