Singapore Airlines 2006 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

Singapore Airlines Annual Report 05/06

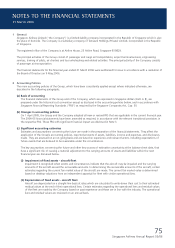

2 Accounting Policies (continued)

(e) Subsidiary, associated and joint venture companies

In the Company’s separate fi nancial statements, investment in subsidiary, associated and joint venture companies are

accounted for at cost less impairment losses.

A subsidiary company is defi ned as a company in which the Group, directly or indirectly controls more than half of the voting

power, or controls the composition of the board of directors.

An associated company is defi ned as a company, not being a subsidiary company or joint venture company, in which the

Group has a long-term interest of not less than 20% and not more than 50% of the voting power and in whose fi nancial

and operating policy decisions the Group exercises signifi cant infl uence.

The Group’s investments in associates are accounted for using the equity method. Under the equity method, the investment

in associate is carried in the balance sheet at cost plus post-acquisition changes in the Group’s share of net assets of the

associate. The Group’s share of the profi t or loss of the associate is recognised in the consolidated profi t and loss account.

Where there has been a change recognised directly in the equity of the associate, the Group recognises its share of such

changes. After application of the equity method, the Group determines whether it is necessary to recognise any additional

impairment loss with respect to the Group’s net investment in the associate. The associate is equity accounted for from the

date the Group obtains signifi cant infl uence until the date the Group ceases to have signifi cant infl uence over the associate.

A list of the Group’s associated companies is shown in Note 21 to the fi nancial statements.

A joint venture company is defi ned as a company, not being a subsidiary company, in which the Group has a long-term

interest of not more than 50% in the equity and has joint control of the company’s commercial and fi nancial affairs.

The Group’s share of the consolidated results of the joint venture companies and their subsidiary companies are included

in the consolidated fi nancial statements under the equity method on the same basis as associated companies. A list of the

Group’s joint venture companies is shown in Note 22 to the fi nancial statements.

The most recently available audited fi nancial statements of the associated and joint venture companies are used by the Group

in applying the equity method. Where the dates of the audited fi nancial statements used are not co-terminous with those of

the Group, the share of results is arrived at from the last audited fi nancial statements available and unaudited management

fi nancial statements to the end of the accounting period.

(f) Intangible assets

(i) Goodwill

Goodwill acquired in a business combination is initially measured at cost being the excess of the cost of the business

combination over the Group’s interest in the net fair value of the identifi able assets, liabilities and contingent liabilities.

Following initial recognition, goodwill is measured at cost less any accumulated impairment losses. Goodwill is reviewed

for impairment, annually or more frequently if events or changes in circumstances indicate that the carrying value may be

impaired.

For the purpose of impairment testing, goodwill acquired in a business combination is, from the acquisition date,

allocated to each of the Group’s cash-generating units, or groups of cash-generating units, that are expected to benefi t

from the synergies of the combination, irrespective of whether other assets or liabilities of the Group are assigned to

those units or groups of units. Each unit or group of units to which the goodwill is so allocated:

• Represents the lowest level within the Group at which the goodwill is monitored for internal management

purposes; and

• Is not larger than a segment based on either the Group’s business or the Group’s geographical reporting segment.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006