Singapore Airlines 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

Singapore Airlines Annual Report 05/06

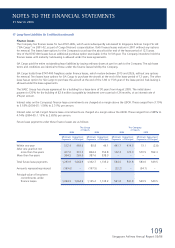

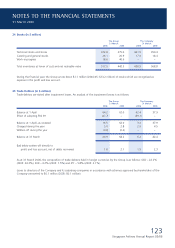

21 Associated Companies (in $ million)

The Group The Company

31 March 31 March

2006 2005 R1 2006 2005

Share of net assets of associated companies

at acquisition date 431.0 409.7 – –

Goodwill on acquisition of associated companies 1,759.6 1,753.5 – –

Unquoted investments at cost 2,190.6 2,163.2 1,736.0 1,729.9

Impairment loss (18.5) (18.5) (20.3) (20.3)

2,172.1 2,144.7 1,715.7 1,709.6

Goodwill written-off to reserves (1,613.0) (1,613.0) – –

Accumulated amortisation of intangible assets (14.8) (7.1) – –

Currency realignment (29.0) (6.3) – –

Share of post-acquisition reserves

– general reserve 325.1 138.2 – –

– fair value reserve 115.6 – – –

– capital reserve 30.5 32.1 – –

986.5 688.6 1,715.7 1,709.6

Loans to associated companies 15.1 12.0 6.5 6.5

Write-down of loans (5.3) (5.5) – –

9.8 6.5 6.5 6.5

996.3 695.1 1,722.2 1,716.1

Amounts owing by associated companies 3.7 15.8 – 12.5

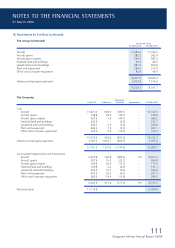

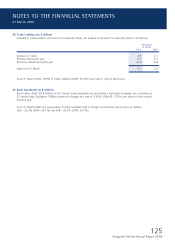

Intangible assets

The intangible assets arose from the acquisition of associated companies and the Group has engaged an independent third

party to perform a fair valuation of these separately identifi ed intangible assets. The useful life of these intangible assets was

determined to be fi ve years and the assets will be amortised on a straight-line basis over the useful life. The amortisation is

included in the line of “share of profi ts of associated companies” in the consolidated profi t and loss account.

R1 2005 fi gures have been restated for the effect of changes in accounting policies (see Note 3).

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006