Singapore Airlines 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

Singapore Airlines Annual Report 05/06

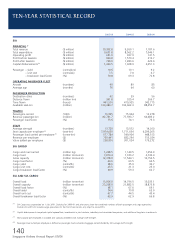

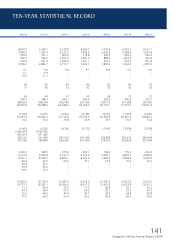

2005-06 2004-05 2003-04 2002-03 2001-02

CASH FLOW ($ million)

Cash flow from operations 2,380.3 2,853.3 1,811.3 1,892.1 1,421.1

Internally generated cash flow R1 3,101.2 3,990.2 3,385.5 3,207.7 3,054.1

Capital expenditure 2,058.8 2,068.1 2,692.6 3,086.3 3,862.9

PER SHARE DATA

Earnings before tax (cents) 136.3 147.0 56.2 80.2 76.0

Earnings after tax (cents) – basic 101.7 111.0 61.6 87.4 51.9

– diluted 101.6 111.0 61.6 87.4 51.9

Cash earnings ($) R2 2.08 2.10 1.61 1.77 1.31

Net asset value ($) 11.00 10.13 9.33 8.79 8.08

SHARE PRICE ($)

High 14.90 12.70 12.90 14.40 14.90

Low 11.10 9.40 8.25 8.55 7.00

Closing 14.00 11.90 11.00 8.75 14.40

DIVIDENDS

Gross dividends (cents per share) 45.0 40.0 25.0 15.0 15.0 R3

Dividend cover (times) 2.3 2.8 2.5 6.4 4.1

PROFITABILITY RATIOS (%)

Return on equity holders’ funds R4 9.6 11.4 6.8 10.4 6.4

Return on total assets R5 5.8 6.7 4.1 5.9 3.8

Return on turnover R6 9.8 11.7 8.2 10.6 7.4

PRODUCTIVITY AND EMPLOYEE DATA

Value added ($ million) 5,534.0 5,533.6 3,898.9 4,367.0 3,718.2

Value added per employee ($) R7 193,781 193,794 131,126 144,397 126,375

Revenue per employee ($) R7 467,158 420,708 328,308 347,684 318,904

Average employee strength 28,558 28,554 29,734 30,243 29,422

S$ per US$ exchange rate as at 31 March 1.6181 1.6496 1.6759 1.7640 1.8405

R1 Internally generated cash flow comprises cash generated from operations, dividends from joint venture and associated companies, and proceeds from sale

of aircraft and other fixed assets.

R2 Cash earnings is defined as profit attributable to equity holders of the Company plus depreciation and amortisation.

R3 Includes 4.0 cents per share tax-exempt dividend.

R4 Return on equity holders’ funds is the profit attributable to equity holders of the Company expressed as a percentage of the average equity holders’ funds.

R5 Return on total assets is the profit after tax expressed as a percentage of the average total assets.

R6 Return on turnover is the profit after tax expressed as a percentage of the total revenue.

R7 Based on average staff strength.

FIVE-YEAR FINANCIAL SUMMARY OF THE GROUP