Singapore Airlines 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

Singapore Airlines Annual Report 05/06

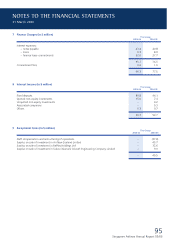

3 Signifi cant Financial Impact of New and Revised Financial Reporting Standards (continued)

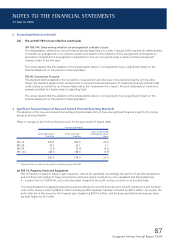

(b) FRS 28: Investments in Associates

FRS 28 requires appropriate adjustments to be made to the associated companies’ fi nancial statements to align them to the

Group’s accounting policies for reporting like transactions and other events in similar circumstances. The alignment of the

different accounting policies has resulted in:

Increased/(decreased) by

$ million

Profit for the financial year 26.1

Fair value reserve as at 1 April 2005 (44.6)

General reserve as at 31 March 2004 (87.8)

General reserve as at 31 March 2005 (87.8)

General reserve as at 1 April 2005 (18.1)

Associated companies as at 31 March 2004 (87.8)

Associated companies as at 31 March 2005 (87.8)

Associated companies as at 1 April 2005 (62.7)

The impact on both the Group’s basic and diluted earnings per share is an increase of 2.1 cents.

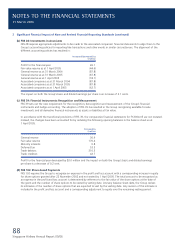

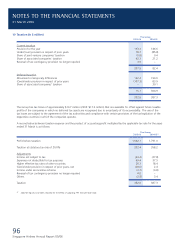

(c) FRS 39: Financial Instruments: Recognition and Measurement

FRS 39 sets out the new requirement for the recognition, derecognition and measurement of the Group’s fi nancial

instruments and hedge accounting. The adoption of FRS 39 has resulted in the Group recognising available-for-sale

investments and all derivative fi nancial instruments as assets or liabilities at fair value.

In accordance with the transitional provisions of FRS 39, the comparative fi nancial statements for FY2004-05 are not restated.

Instead, the changes have been accounted for by restating the following opening balances in the balance sheet as at

1 April 2005.

Increased by

$ million

General reserve 36.9

Fair value reserve 176.4

Minority interests 0.8

Deferred tax 53.5

Trade debtors 310.3

Trade creditors 42.7

Profi t for the fi nancial year decreased by $3.0 million and the impact on both the Group’s basic and diluted earnings

per share is a decrease of 0.2 cent.

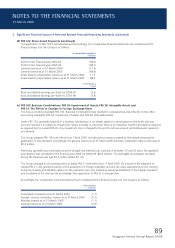

(d) FRS 102: Share-based Payments

FRS 102 requires the Group to recognise an expense in the profi t and loss account with a corresponding increase in equity

for share options granted after 22 November 2002 and not vested by 1 April 2005. The total amount to be recognised as

an expense in the profi t and loss account is determined by reference to the fair value of the share options at the date of

the grant and the number of share options to be vested by vesting date. At every balance sheet date, the Group revises

its estimates of the number of share options that are expected to vest by the vesting date. Any revision of this estimate is

included in the profi t and loss account and a corresponding adjustment to equity over the remaining vesting period.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006