Singapore Airlines 2006 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

151

Singapore Airlines Annual Report 05/06

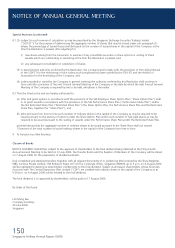

NOTICE OF ANNUAL GENERAL MEETING

Explanatory note

1. In relation to Ordinary Resolution No. 3, Sir Brian Pitman will, upon re-appointment, continue to serve as a member of the Board

Compensation & Industrial Relations and Board Safety & Risk Committees. Sir Brian Pitman is considered as an independent

Director. Please refer to the sections on Board of Directors and Corporate Governance in the Annual Report for further details on

Sir Brian Pitman.

2. In relation to Ordinary Resolution No. 4, Mr Chia Pei-Yuan will, upon re-election, continue to serve as a member of the Board

Audit and Board Safety & Risk Committees. Mr Ho Kwon Ping will, upon re-election, continue to serve as Chairman of the Board

Audit Committee and member of the Board Nominating Committee. Mr Davinder Singh will, upon re-election, continue to serve

as Chairman of the Board Nominating Committee and member of the Board Executive Committee. Mr Chia, Mr Ho and Mr

Singh are considered as independent Directors. Please refer to the sections on Board of Directors and Corporate Governance in

the Annual Report for further details on Mr Chia, Mr Ho and Mr Singh respectively.

3. In relation to Ordinary Resolution No. 5, Article 89 of the Company’s Articles of Association permits the Directors to appoint any

person approved in writing by the Special Member to be a Director, either to fi ll a casual vacancy or as an addition to the existing

Directors. Any Director so appointed shall hold offi ce only until the next following Annual General Meeting, and shall then be

eligible for re-election. Mr James Koh Cher Siang & Mr David Michael Gonski were appointed on 1 August 2005 and

9 May 2006 respectively and are seeking re-election at the forthcoming Thirty-Fourth Annual General Meeting. Mr James Koh

Cher Siang will upon re-election continue to serve as Chairman of the Board Safety & Risk Committee and as member of the

Board Audit Committee. Mr Koh and Mr Gonski are considered as independent Directors. Please refer to the sections on Board of

Directors and Corporate Governance in the Annual Report for further details on Mr Koh and Mr Gonski respectively.

4. Ordinary Resolution No. 6 is to approve the payment of Directors’ Fees of $966,000 (FY2004/05: $962,000) for the year ended

31 March 2006, for services rendered by Directors on the Board as well as on various Board Committees. The fee structure

(disclosed in the Corporate Governance Report in the Annual Report) remains the same as FY2004/05.

5. Ordinary Resolution No. 8.1, if passed, will empower Directors to issue shares, make or grant instruments convertible into

shares and to issue shares pursuant to such instruments, from the date of the above Meeting until the date of the next Annual

General Meeting. The number of shares which the Directors may issue under this Resolution will not exceed 50 per cent of the

issued shares in the capital of the Company with a sub-limit of 10 per cent for issues other than on a pro rata basis. The 10 per

cent sub-limit for non-pro rata issues is lower than the 20 per cent sub-limit allowed under the Listing Manual of the Singapore

Exchange Securities Trading Limited and the Articles of Association of the Company. For the purpose of determining the

aggregate number of shares which may be issued, the percentage of issued shares shall be based on the number of issued shares

in the capital of the Company at the time this Ordinary Resolution is passed, after adjusting for (a) new shares arising from the

conversion or exercise of any convertible instruments or share options or vesting of share awards which are outstanding at the

time this Ordinary Resolution is passed and (b) any subsequent consolidation or subdivision of shares.

6. Ordinary Resolution No. 8.2, if passed, will empower the Directors to offer and grant options and/or awards and to allot and

issue ordinary shares in the capital of the Company pursuant to the SIA Employee Share Option Plan, the SIA Performance Share

Plan and the SIA Restricted Share Plan. The SIA Employee Share Option Plan was adopted at the Extraordinary General Meeting

of the Company held on 8 March 2000 and modifi ed at the Extraordinary General Meetings of the Company held on 14 July

2001 and 26 July 2003 respectively. The SIA Performance Share Plan and the SIA Restricted Share Plan were adopted at the

Extraordinary General Meeting of the Company held on 28 July 2005.

Notes

1. A member of the Company entitled to attend and vote at the Meeting is entitled to appoint not more than two proxies to attend and vote instead of him. A proxy

need not be a member of the Company.

2. The instrument appointing a proxy or proxies must be deposited at Robinson Road Post Offi ce P O Box 3911, Singapore 905911 not less than 48 hours before the

time fi xed for holding the Meeting.