Singapore Airlines 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

Singapore Airlines Annual Report 05/06

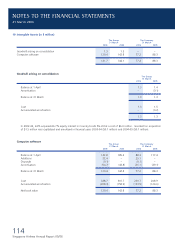

24 Stocks (in $ million)

The Group The Company

31 March 31 March

2006 2005 2006 2005

Technical stocks and stores 472.8 375.0 441.5 350.4

Catering and general stocks 26.1 26.9 17.0 18.4

Work-in-progress 18.6 40.6 – –

Total inventories at lower of cost and net realisable value 517.5 442.5 458.5 368.8

During the financial year, the Group wrote down $1.1 million (2004-05: $13.2 million) of stocks which are recognised as

expense in the profit and loss account.

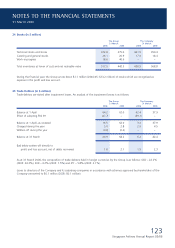

25 Trade Debtors (in $ million)

Trade debtors are stated after impairment losses. An analysis of the impairment losses is as follows:

The Group The Company

31 March 31 March

2006 2005 2006 2005

Balance at 1 April 64.2 62.0 42.4 37.9

Effect of adopting FRS 39 (47.7) – (39.1) –

Balance at 1 April, as restated 16.5 62.0 3.3 37.9

Charged during the year 5.0 2.8 2.9 4.5

Written-off during the year (0.6) (0.6) – –

Balance at 31 March 20.9 64.2 6.2 42.4

Bad debts written-off directly to

profit and loss account, net of debts recovered 1.8 2.1 1.5 2.3

As at 31 March 2006, the composition of trade debtors held in foreign currencies by the Group is as follows: USD – 22.2%

(2005: 24.3%), EUR – 6.2% (2005: 7.5%) and JPY – 5.8% (2005: 6.1%).

Loans to directors of the Company and its subsidiary companies in accordance with schemes approved by shareholders of the

Company amounted to $0.1 million (2005: $0.1 million).

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006