Singapore Airlines 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Singapore Airlines Annual Report 05/06

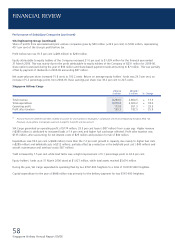

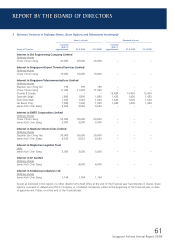

Performance of Subsidiary Companies (continued)

SilkAir

2005-06 2004-05

R1

$ million $ million % Change

Total revenue 344.7 295.5 + 16.6

Total expenditure 331.6 272.6 + 21.6

Operating profit 13.1 22.9 – 42.8

Profit after taxation 20.6 30.0 – 31.3

R1 Financial results for 2004-05 have been restated to account for share options to employees in compliance with Financial Reporting Standards (FRS) 102.

Previously, share options to employees were not charged to the profit and loss account.

SilkAir’s revenue grew $49 million (+16.6 per cent) to $345 million as a result of increased load (+15.0 per cent) and better yield

(+3.2 per cent). The increase in expenditure (+$59 million) was principally due to higher fuel costs, with increases also incurred for

handling charges, depreciation of aircraft, aircraft and maintenance overhaul expenses and inflight meals. These increases were

partially offset by lower aircraft license and insurance costs. As a result, operating profit declined by 42.8 per cent (-$10 million).

Lower tax expense (-$6 million) partially offset by lower surplus on disposal of aircraft, spares and other fixed assets

(-$5 million) resulted in a smaller decline of 31.3 per cent in profit after tax.

Unit cost rose 8.5 per cent to 72.6 cents/ctk while yield improved 3.2 per cent to 138.7 cents/ltk. Consequently, breakeven load

factor deteriorated by 2.5 percentage points to 52.3 per cent.

Equity holders’ funds was $378 million (+6.2 per cent) at 31 March 2006.

Capital expenditure for the year of $114 million was mainly for delivery payment for one A320 and one A319 aircraft, and

pre-delivery payments for two A320 and one A319 aircraft, scheduled for delivery between 2006 and 2007.

SilkAir’s route network spanned 26 cities in 10 Asian countries. During the financial year, SilkAir added three new destinations

– Shenzhen (China), Surabaya (Indonesia), and Kota Kinabalu (Malaysia), and terminated its services to Padang, Hyderabad

and Fuzhou.

The airline plans to increase frequencies to Medan (from 11 times weekly to twice daily), Phuket (from three times daily to

four times daily), Xiamen (from daily to nine times weekly), and one additional flight weekly to Chengdu, Chongqing, Shenzhen,

Langkawi and Phnom Penh.

FINANCIAL REVIEW