Singapore Airlines 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

Singapore Airlines Annual Report 05/06

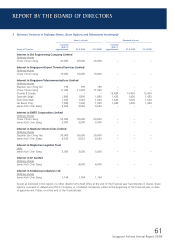

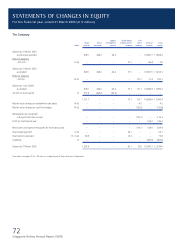

STATEMENTS OF CHANGES IN EQUITY

For the financial year ended 31 March 2006 (in $ million)

The Group

Attributable to Equity Holders of the Company

Foreign

Capital currency Share-based Fair

Share Share redemption Capital translation compensation value General Minority Total

Notes capital premium reserve reserve reserve reserve reserve reserve Total interests equity

Balance at 31 March 2005,

as previously reported 609.1 448.2 64.4 41.9 8.8 – – 11,263.7 12,436.1 303.9 12,740.0

Effects of adopting

– FRS 21 – – – – (5.7) – – – (5.7) (1.1) (6.8)

– FRS 28 – – – – – – – (87.8) (87.8) – (87.8)

– FRS 102 14 (a) – – – – – 48.4 – (48.4) – – –

– FRS 103 – – – – – – – (0.3) (0.3) – (0.3)

Balance at 31 March 2005,

as restated 609.1 448.2 64.4 41.9 3.1 48.4 – 11,127.2 12,342.3 302.8 12,645.1

Effects of adopting

– FRS 28 14 (b) – – – – – – (44.6) 69.7 25.1 – 25.1

– FRS 39 14 (b) – – – – – – 176.4 36.9 213.3 0.8 214.1

Balance at 1 April 2005,

as restated 609.1 448.2 64.4 41.9 3.1 48.4 131.8 11,233.8 12,580.7 303.6 12,884.3

Transfer to share capital 13 512.6 (448.2) (64.4) – – – – – – – –

1,121.7 – – 41.9 3.1 48.4 131.8 11,233.8 12,580.7 303.6 12,884.3

Currency translation differences – – – – (33.6) – – – (33.6) (1.3) (34.9)

Net fair value changes on

available-for-sale assets 14 (b) – – – – – – 5.9 – 5.9 – 5.9

Net fair value changes on

cash flow hedges 14 (b) – – – – – – (137.1) – (137.1) – (137.1)

Share of joint venture and associated

companies’ fair value reserve 14 (b) – – – – – – 163.0 – 163.0 – 163.0

Share of joint venture and associated

companies’ capital reserve 21, 22 – – – (1.1) – – – – (1.1) – (1.1)

Surplus on dilution of interest in

subsidiary companies due to

share options exercised – – – – – – – 25.4 25.4 41.9 67.3

Net income and expense not recognised

in the profit and loss account – – – (1.1) (33.6) -- 31.8 25.4 22.5 40.6 63.1

Profit for the financial year – – – – – – – 1,240.7 1,240.7 68.8 1,309.5

Net income and expense recognised – – – (1.1) (33.6) – 31.8 1,266.1 1,263.2 109.4 1,372.6

for the financial year

Issuance of share capital by – – – – – – – – – 12.0 12.0

subsidiary companies

Share-based payment 14 (a) – – – – – 45.9 – – 45.9 2.2 48.1

Share options exercised 13, 14 (a) 80.9 – – – – (12.5) – – 68.4 – 68.4

Dividends 12 – – – – – – – (487.6) (487.6) (30.9) (518.5)

Balance at 31 March 2006 1,202.6 – – 40.8 (30.5) 81.8 163.6 12,012.3 13,470.6 396.3 13,866.9

The notes on pages 75 to 135 form an integral part of these fi nancial statements.