Singapore Airlines 2006 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2006 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

Singapore Airlines Annual Report 05/06

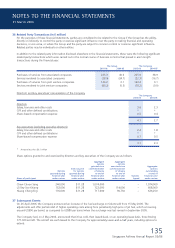

35 Financial Instruments (in $ million) (continued)

(c) Derivative fi nancial instruments and hedging activities (continued)

Cash fl ow hedges (continued)

The Group had outstanding fi nancial instruments to hedge expected future purchases in USD:

Foreign currency contracts maturing in April 2006 – March 2007 (in $ million)

Group Company

Foreign currency USD Effective Foreign currency USD Effective

Currency amount sold purchased rate amount sold purchased rate

AUD 212.8 156.2 0.73 191.3 140.4 0.73

CHF 31.2 24.9 0.80 24.6 19.6 0.80

CNY 15.0 1.9 0.13 9.6 1.2 0.13

EUR 60.8 74.8 1.23 44.2 54.3 1.23

GBP 45.3 80.2 1.77 39.9 70.7 1.77

INR 2,732.0 59.9 0.02 1,736.7 38.1 0.02

JPY 11,050.0 99.7 0.009 8,057.3 72.7 0.009

KRW 41,040.0 40.9 0.001 28,227.6 28.1 0.001

NZD 82.3 54.0 0.66 58.0 37.5 0.66

TWD 671.0 21.5 0.03 316.2 10.1 0.03

The cash fl ow hedges of the expected future purchases in USD in the next 12 months were assessed to be highly effective

and at 31 March 2006, a net fair value gain of $60.6 million, with a related deferred tax charge of $22.8 million, was

included in the fair value reserve [Note 14(b)] in respect of these contracts.

As at 31 March 2006, the Company had the following interest rate swaps:

Interest rate

Notional amount of interest rate swap contracts Receivable Payable Maturity

USD 130 million 8.5% 6M LIBOR + 45 bps 3 February 2007

USD 78 million 8.5% 6M LIBOR + 35 bps 28 March 2007

USD 5 million 6M LIBOR + 36 bps 5.0% 6 March 2007

The cash fl ow hedges of the interest rate contracts were assessed to be highly effective and at 31 March 2006, a net fair

value gain of $12.0 million, with a related deferred tax charge of $2.3 million, was included in the fair value reserve

[Note 14(b)] in respect of these contracts.

The cash fl ow hedges of some of the cross currency swaps were assessed to be highly effective and at 31 March 2006, a net

fair value loss of $0.3 million, with a related deferred tax charge of $0.1 million, was included in the fair value reserve

[Note 14(b)] in respect of these contracts.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2006