BP 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

Part 2 – Non-executive directors’ remuneration

Policy

The board sets the level of remuneration for all non-executive directors

within the limit approved from time to time by shareholders. The

remuneration of the chairman is set by the board rather than the

remuneration committee, in line with BP’s governance policies, as we

believe the performance of the chairman is a matter for the board as a

whole rather than any one committee. The board’s policy is that non-

executive remuneration should be consistent with recognized

best-practice standards. Non-executive directors are encouraged to

establish a holding in BP shares broadly related to one year’s base fee.

Annual fee structure

Non-executive directors’ remuneration consists of the following elements:

– Cash fees, paid monthly, with increments for positions of additional

responsibility, reflecting workload and potential liability.

– A fixed allowance, currently £5,000, for transatlantic or equivalent

inter-continental travel to attend a board or board committee meeting

(excluding the chairman).

– Reasonable travel and related business expenses.

No share or share option awards are made to any non-executive

director in respect of service on the board.

The fees were reviewed in 2005 by an ad hoc board committee and

were increased with effect from 1 January 2005 to reflect the change

in workload and global market rates for independent or non-executive

directors since the previous review in 2002. There was no increase

in 2006.

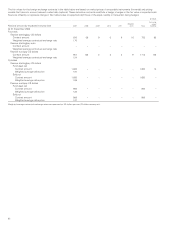

Current fee structure

--------------------------------------------------------------------------------------------------------------------------------------------------

£thousand

--------------------------------------------------------------------------------------------------------------------------------------------------

Chairmana500

Deputy chairmanb100

Board member 75

Committee chairmanship fee 20

Transatlantic attendance allowancec5

aThe chairman is not eligible for committee chairmanship fees or transatlantic

attendance allowance but has the use of a fully maintained office for company

business, a chauffeured car and security advice.

bThe deputy chairman receives a £25,000 increment on top of the standard board

fee. In addition, he is eligible for committee chairmanship fees and the transatlantic

attendance allowance. The deputy chairman is currently chairman of the audit

committee.

cThis allowance is payable to non-executive directors undertaking transatlantic or

equivalent intercontinental travel for the purpose of attending a board meeting or

board committee meeting.

Superannuation gratuities

In accordance with the company’s long-standing practice, non-executive

directors who retired from the board after at least six years’ service are, at

the time of their retirement, eligible for consideration for a superannuation

gratuity. The board is authorized to make such payments under the

company’s Articles of Association. The amount of the payment is

determined at the board’s discretion (having regard to the director’s

period of service as a director and other relevant factors).

In 2002, the board revised its policy with respect to superannuation

gratuities so that: (i) non-executive directors appointed to the board after

1 July 2002 would not be eligible for consideration for such a payment;

and (ii) while non-executive directors in service at 1 July 2002 would

remain eligible for consideration for a payment, service after that date

would not be taken into account by the board in considering the amount

of any such payment.

The board made superannuation gratuity payments during the year

to the following former directors: Mr Miles £46,000 (who retired in

April 2006) and Mr Wilson £21,000 (who resigned from the board in

February 2006). These payments were in line with the policy

arrangements agreed in 2002 (outlined above).

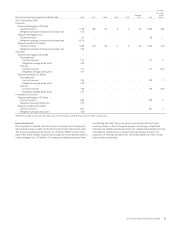

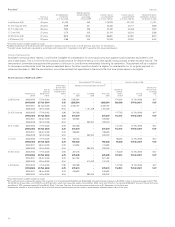

Remuneration of non-executive directors in 2006a

--------------------------------------------------------------------------------------------------------------------------

£thousand

--------------------------------------------------------------------------------------------------------------------------

Current directors 2006 2005

--------------------------------------------------------------------------------------------------------------------------

J H Bryan 110 110

A Burgmans 85 90

Sir William Castellb38.5 n/a

E B Davis, Jr 100 110

D J Flint 100 90

Dr D S Julius 105 107

Sir Tom McKillop 85 90

Dr W E Massey 130 130

Sir Ian Prosser 130 135

P D Sutherland 500 500

Directors leaving the board in 2006

--------------------------------------------------------------------------------------------------------------------------

H M P Milescd 30 90

M H Wilsone22.5 105

aThis information has been subject to audit.

bAppointed on 20 July 2006.

cAlso received a superannuation gratuity of £46,000.

dAlso received £37,500 for serving as a director and non-executive chairman of BP

Pension Trustees Limited.

eAlso received a superannuation gratuity of £21,000.

Based on the current fee structure, the table above shows the 2006

remuneration of each non-executive director.

Non-executive directors have letters of appointment that recognize

that, subject to the Articles of Association, their service is at the

discretion of shareholders. All directors stand for re-election at each AGM.

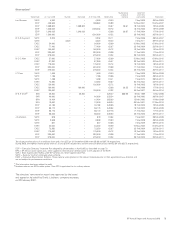

Non-executive directors of Amoco Corporation

Non-executive directors who were formerly non-executive directors of

Amoco Corporation have residual entitlements under the Amoco Non-

Employee Directors’ Restricted Stock Plan. Directors were allocated

restricted stock in remuneration for their service on the board of Amoco

Corporation prior to its merger with BP in 1998. On merger, interests in

Amoco shares in the plan were converted into interests in BP ADSs. The

restricted stock will vest on the retirement of the non-executive director

at the age of 70 (or earlier at the discretion of the board). Since the

merger, no further entitlements have accrued to any director under

the plan. The residual interests, as interests in a long-term incentive

scheme, are set out in the table below, in accordance with the Directors’

Remuneration Report Regulations 2002.

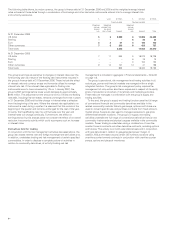

--------------------------------------------------------------------------------------------------------------------------------------------------

Interest in BP ADSs

at 1 Jan 2006 and

31 Dec 2006a

Date on

which director

reaches age 70b

--------------------------------------------------------------------------------------------------------------------------------------------------

J H Bryan 5,546 5 Oct 2006

E B Davis, Jr 4,490 5 Aug 2014

Dr W E Massey 3,346 5 Apr 2008

Director leaving the board in 2006

--------------------------------------------------------------------------------------------------------------------------------------------------

M H Wilsonc3,170 4 Nov 2007

aNo awards were granted and no awards lapsed during the year. The awards were

granted over Amoco stock prior to the merger but their notional weighted average

market value at the date of grant (applying the subsequent merger ratio of 0.66167

of a BP ADS for every Amoco share) was $27.87 per BP ADS.

bFor the purposes of the regulations, the date on which the director retires from

the board at or after the age of 70 is the end of the qualifying period. If the director

retires prior to this date, the board may waive the restrictions.

cMr Wilson resigned from the board on 28 February 2006. Mr Wilson had received

awards of Amoco shares under the plan between 1 November 1993 and 28 April

1998 prior to the merger. These interests had been converted into BP ADSs at the

time of the merger. In accordance with the terms of the plan, the board exercised its

discretion over this award on 11 May 2006 and the shares vested on that date

(when the BP ADS market price was $76.07) without payment by him.