BP 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

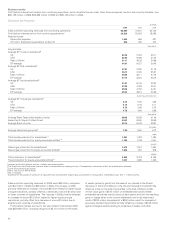

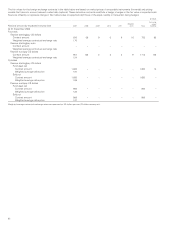

The assumed rate of investment return and discount rate have a significant effect on the amounts reported. A one-percentage-point change in these

assumptions for the group’s plans would have had the following effects.

$million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

One-percentage-point

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Increase Decrease

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Investment return

Effect on pension and other post-retirement benefit expense in 2007 (383) 383

Discount rate

Effect on pension and other post-retirement benefit expense in 2007 (52) 75

Effect on pension and other post-retirement benefit obligation at 31 December 2006 (5,013) 6,433

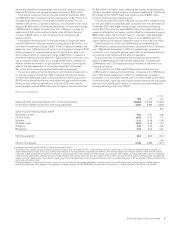

The assumed future US healthcare cost trend rate is shown below.

%

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2007 2008 2009 2010 2011 2012

2013 and

subsequent

years

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Beneficiaries aged under 65 8.0 7.5 7.0 6.5 6.0 5.5 5.0

Beneficiaries aged over 65 10.0 9.5 8.5 7.5 6.5 5.5 5.0

The assumed US healthcare cost trend rate has a significant effect on the amounts reported. A one-percentage-point change in the assumed US

healthcare cost trend rate would have had the following effects.

$million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

One-percentage-point

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Increase Decrease

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Effect on US other post-retirement benefit expense in 2007 31 (25)

Effect on US other post-retirement obligation at 31 December 2006 349 (289)

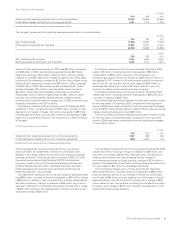

In addition to the financial assumptions, we regularly review the demographic and mortality assumptions. Mortality assumptions reflect best practice

in the countries in which we provide pensions and have been chosen with regard to the latest available published tables adjusted where appropriate

to reflect the experience of the group and an extrapolation of past longevity improvements into the future. BP’s most substantial pension liabilities

are in the UK, the US and Germany, where our assumptions are as follows.

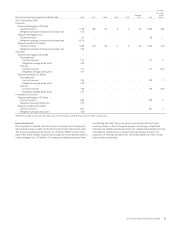

Years

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Mortality assumptions UK USA Germany

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2006 2005 2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Life expectancy at age 60 for a male currently aged 60 23.9 23.0 24.2 21.9 22.2 22.1

Life expectancy at age 60 for a female currently aged 60 26.8 26.0 26.0 25.6 26.9 26.7

Life expectancy at age 60 for a male currently aged 40 25.0 23.9 25.8 21.9 25.2 25.0

Life expectancy at age 60 for a female currently aged 40 27.8 26.9 26.9 25.6 29.6 29.4

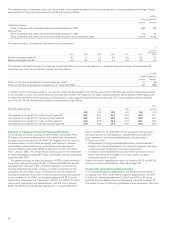

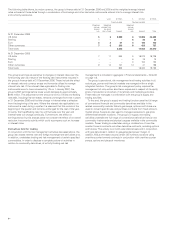

Adoption of International Financial Reporting Standards

For all periods up to and including the year ended 31 December 2004,

BP prepared its financial statements in accordance with UK generally

accepted accounting practice (UK GAAP). BP, together with all other EU

companies listed on an EU stock exchange, was required to prepare

consolidated financial statements in accordance with International

Financial Reporting Standards (IFRS) as adopted by the EU with effect

from 1 January 2005. The Annual Report and Accounts for the year ended

31 December 2005 comprised BP’s first consolidated financial statements

prepared under IFRS.

The general principle for first-time adoption of IFRS is that standards in

force at the first reporting date (for BP, 31 December 2005) are applied

retrospectively. However, IFRS 1 ‘First-time Adoption of International

Financial Reporting Standards’ contains a number of exemptions that

companies are permitted to apply. BP elected to take the exemption

allowing comparative information on financial instruments to be prepared

in accordance with UK GAAP and the group adopted IAS 32 ‘Financial

Instruments: Disclosure and Presentation’ (IAS 32) and IAS 39 ‘Financial

Instruments: Recognition and Measurement’ (IAS 39) from 1 January

2005. Had IAS 32 and IAS 39 been applied from 1 January 2003, BP’s

date of transition for all other IFRS in force at the first reporting date,

the following are the most significant adjustments that would have

been necessary in the financial statements for the year ended

31 December 2004:

– All derivatives, including embedded derivatives, would have been

brought on to the balance sheet at fair value and changes in fair value

would have been recognized in the income statement.

– Available-for-sale investments would have been carried at fair value

rather than at cost and changes in fair value would have been

recognized directly in equity.

Further information regarding the impact of adopting IAS 32 and IAS 39

is shown in Financial statements – Note 49 on page 168.

US generally accepted accounting principles

The consolidated financial statements of the BP group are prepared in

accordance with IFRS, which differs in certain respects from US GAAP.

The principal differences between US GAAP and IFRS for BP group

reporting are discussed in Financial statements – Note 53 on page 179.

The impact of new US accounting standards is also disclosed in that note.

60