BP 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Information on the company

General

Unless otherwise indicated, information in this document reflects 100%

of the assets and operations of the company and its subsidiaries that

were consolidated at the date or for the periods indicated, including

minority interests. Also, unless otherwise indicated, figures for business

sales and other operating revenues include sales between BP businesses.

The British Petroleum Company p.l.c., incorporated in 1909 in England

and Wales, became known as BP Amoco p.l.c. following the merger with

Amoco Corporation (incorporated in Indiana, US, in 1889). The company

subsequently changed its name to BP p.l.c.

BP is one of the world’s leading oil companies on the basis of market

capitalization and proved reserves. Our worldwide headquarters is located

at 1 St James’s Square, London SW1Y 4PD, UK. Telephone +44 (0)20

7496 4000. Our agent in the US is BP America Inc., 4101 Winfield Road,

Warrenville, Illinois 60555. Telephone +1 630 821 2222.

Overview of the group

BP is a global group, with interests and activities held or operated through

subsidiaries, jointly controlled entities or associates established in, and

subject to the laws and regulations of, many different jurisdictions. These

interests and activities cover three business segments, supported by a

number of organizational elements comprising group functions or regions.

The three business segments are Exploration and Production, Refining

and Marketing and Gas, Power and Renewables. Exploration and

Production’s activities include oil and natural gas exploration, development

and production (upstream activities), together with related pipeline,

transportation and processing activities (midstream activities). The

activities of Refining and Marketing include oil supply and trading and the

manufacture and marketing of petroleum products, including aromatics

and acetyls, as well as refining and marketing. Gas, Power and

Renewables activities include marketing and trading of gas and power;

marketing of liquefied natural gas (LNG); natural gas liquids (NGLs); and

low-carbon power generation through our Alternative Energy business.

The group provides high-quality technological support for all its businesses

through its research and engineering activities.

Group functions serve the business segments, aiming to achieve

coherence across the group, manage risks effectively and achieve

economies of scale. Each head of region ensures regional consistency of

the activities of business segments and group functions and represents

BP to external parties.

The group’s system of internal control is described in the BP

management framework. It is designed to meet the expectations of

internal control of the Turnbull Guidance on the Combined Code in the UK

and of COSO (committee of the sponsoring organization for the Treadway

Commission in the US). The system of internal control is the complete set

of management systems, organizational structures, processes, standards

and behaviours that are employed to conduct the business of BP and

deliver returns to shareholders. The design of the management

framework addresses risks and how to respond to them. Each

component of the framework is in itself a device to respond to a particular

type or collection of risks.

The group strategy describes the group’s strategic objectives and the

presumptions made by BP about the future. It describes strategic risks

that arise from making such presumptions and the actions to be taken

to manage or mitigate the risks. The board delegates to the group chief

executive responsibility for developing BP’s strategy and its

implementation through five-year and annual plans (the group plan) that

determine the setting of priorities and allocation of resources. The group

chief executive is obliged to discuss with the board, on the basis of the

strategy and group plan, all material matters currently or prospectively

affecting BP’s performance.

As the group’s business segments are managed on a global, not on a

regional, basis, geographical information for the group and segments is

given to provide additional information for investors but does not reflect

the way BP manages its activities.

We have well-established operations in Europe, the US, Canada,

Russia, South America, Australasia, Asia and parts of Africa. Currently,

around 70% of the group’s capital is invested in Organisation for

Economic Co-operation and Development (OECD) countries, with just

under 40% of our fixed assets located in the US and around 25% located

in the UK and the Rest of Europe.

We believe that BP has a strong portfolio of assets in each of its main

segments:

– In Exploration and Production, we have upstream interests in 26

countries. In addition to our drive to maximize the value of our existing

portfolio, we are continuing to develop new profit centres. Exploration

and Production activities are managed through operating units that

are accountable for the day-to-day management of the segment’s

activities. An operating unit is accountable for one or more fields. Profit

centres comprise one or more operating units. Profit centres are, or

are expected to become, areas that provide significant production and

income for the segment. Our new profit centres are in Asia Pacific

(Australia, Vietnam, Indonesia and China), Azerbaijan, North Africa

(Algeria), Angola, Trinidad & Tobago and the deepwater Gulf of Mexico;

and in Russia/Kazakhstan (including our operations in TNK-BP, Sakhalin

and LukArco), where we believe we have competitive advantage and

which we believe provide the foundation for volume growth and

improved margins in the future. We also have significant midstream

activities to support our upstream interests.

– In Refining and Marketing, we have a strong presence in the US and

Europe. We market under the Amoco and BP brands in the Midwest,

East and Southeast and under the ARCO brand on the West Coast of

the US, and under the BP and Aral brands in Europe. We have a long-

established supply and trading activity responsible for delivering value

across the crude and oil products supply chain. Our Aromatics and

Acetyls business maintains a manufacturing position globally, with

emphasis on growth in Asia. We also have, or are growing, businesses

elsewhere in the world under the BP and Castrol brands, including

a strong global Lubricants portfolio and other business-to-business

marketing businesses (aviation and marine) covering the mobility

sectors. We continue to seek opportunities to broaden our activities

in growing markets such as China and India.

– In Gas, Power and Renewables, we have a growing marketing and

trading business in the US, Canada, UK and continental Europe. Our

marketing and trading activities include natural gas, power and NGLs.

Our international natural gas monetization activities identify and capture

worldwide opportunities for our upstream natural gas resources and

are focused on growing natural gas markets, including the US, Canada,

Spain and many of the emerging markets of the Asia Pacific region,

notably China. We have a significant NGLs processing and marketing

business in North America. In 2005, we established BP Alternative

Energy, which aims to extend significantly our capabilities in solar,

wind, hydrogen power and gas-fired power generation. Alternative

Energy has solar production facilities in US, Spain and India and

Australia, wind farms in the Netherlands and a substantial portfolio of

development projects in the US. We are advancing development of

hydrogen power plants and are involved in power projects in the US,

UK, Spain and South Korea.

Through non-US subsidiaries or other entities, BP conducts or has

conducted limited marketing, licensing and trading activities and technical

studies in certain countries subject to US sanctions, in particular in Iran

and with Iranian counterparties, including the National Iranian Oil

Company (NIOC) and affiliated entities, and has a small representative

office in Iran. BP believes that these activities are immaterial to the group.

In addition, BP has interests in, and is the operator of, two fields outside

Iran in which NIOC and an affiliated entity have interests. However, BP

does not seek to obtain from the government of Iran licences or

agreements for oil and gas projects in Iran and does not own or operate

any refineries or chemicals plants in Iran.

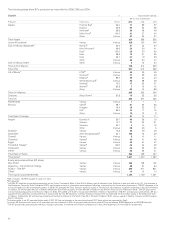

Acquisitions and disposals

In 2006, there were no significant acquisitions. BP purchased 9.6% of

the shares issued under Rosneft’s IPO for a consideration of $1 billion

(included in capital expenditure). This represents an interest of around

1.4% in Rosneft. Disposal proceeds were $6,254 million, which included

$2.1 billion on the sale of our interest in the Shenzi discovery and around

$1.3 billion from the sale of our producing properties on the Outer

Continental Shelf of the Gulf of Mexico to Apache Corporation.

14