BP 2006 Annual Report Download - page 28

Download and view the complete annual report

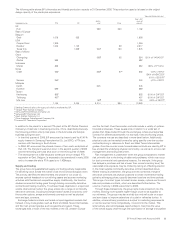

Please find page 28 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.North Slope oil to West Coast refineries. BP took delivery of the first

three tankers between August 2004 and November 2005. As existing

ships were retired, the replacements were constructed in accordance

with the Oil Pollution Act of 1990. For discussion of the Oil Pollution

Act of 1990, see Environmental Protection – Maritime oil spill

regulations on page 44.

– Work progressed during 2006 on the strategic reconfiguration project

to upgrade and automate four pump stations. This project will install

electrically driven pumps at four critical pump stations, combined with

increased automation and upgraded control systems. Start-up of the

first pump station is expected to occur in the first quarter of 2007, with

thesecondexpectedtobeonlinebytheendof2007.Theremaining

two reconfigured pump stations are expected to come online

sequentially after 2007.

– There are a number of unresolved protests regarding intrastate tariffs

charged for shipping oil through TAPS. These protests were filed

between 1986 and 2003 with the Regulatory Commission of Alaska

(RCA). These matters are proceeding through the Alaska judicial and

regulatory systems. Pending the resolution of these matters, the RCA

has imposed intrastate rates effective 1 July 2003 that are consistent

with its 2002 Order requiring refunds to be made to TAPS shippers of

intrastate crude oil.

– Tariffs for interstate and intrastate transportation on TAPS are

calculated utilizing the Federal Energy Regulatory Commission (FERC)

endorsed TAPS Settlement Methodology (TSM) entered into with

the State of Alaska in 1985. In February 2006, FERC combined and

consolidated all 2005 and 2006 rate complaints filed by the State,

Anadarko, Tesoro and Tesoro Alaska. The complaints were filed on a

variety of grounds. We are confident that the rates are in accordance

with the TSM and are continuing to evaluate the disputes. BP will

continue to collect its TSM-based interstate tariffs; however, our tariffs

are subject to refund depending on the outcome of the challenges.

Interstate transport makes up roughly 93% of total TAPS throughput.

North Sea

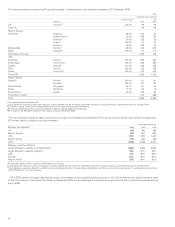

– FPS (BP 100%) is an integrated oil and NGLs transportation and

processing system that handles production from more than 50 fields

in the Central North Sea. The system has a capacity of more than

1mmb/d, with average throughput in 2006 at 545mb/d. In January

2007, FPS completed the tying in of the Buzzard field, which is

expected to be a significant user of FPS capacity.

– BP operates and has a 29.5% interest in CATS, a 400-kilometre natural

gas pipeline system in the central UK sector of the North Sea. The

pipeline has a transportation capacity of 1.7bcf/d to a natural gas

terminal at Teesside in north-east England. CATS offers natural gas

transportation and processing services. In 2006, throughput was

1.1bcf/d (gross), 326mmcf/d (net).

– In addition, BP operates the Dimlington/Easington gas processing

terminal (BP 100%) on Humberside and the Sullom Voe oil and gas

terminal in the Shetlands.

Asia (including the former Soviet Union)

– BP, as operator, manages and holds a 30.1% interest in the BTC oil

pipeline. The 1,768-kilometre pipeline is expected to carry 750,000

barrels of oil a day by the end of 2007 from the BP-operated ACG oil

field in the Caspian Sea to the eastern Mediterranean port of Ceyhan.

Loading of the first tanker at Ceyhan occurred in June 2006 and the

official inauguration of the Turkish section of the BTC oil export

pipeline, the new Ceyhan marine export terminal and the full BTC

pipeline export system was held on 13 July 2006.

– The South Caucasus Pipeline for the transport of gas from Shah

Deniz in Azerbaijan to the Turkish border was ready for operation in

November 2006. BP is the operator and holds a 25.5% interest.

– Through the LukArco joint venture, BP holds a 5.75% interest (with

a 25% funding obligation) in the Caspian Pipeline Consortium (CPC)

pipeline. CPC is a 1,510-kilometre pipeline from Kazakhstan to the

Russian port of Novorossiysk and carries crude oil from the Tengiz field

(BP 2.3%). In addition to our interest in LukArco, we hold a separate

0.87% interest (3.5% funding obligation) in CPC through a 49%

holding in Kazakhstan Pipeline Ventures. In 2006, CPC total throughput

reached 31.2 million tonnes. During 2006, negotiations continued

between the CPC shareholders towards the approval of an expansion

plan. The expansion would require the construction of 10 additional

pump stations, additional storage facilities and a third offshore

mooring point.

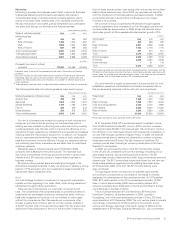

Liquefied natural gas

Within BP, Exploration and Production is responsible for the supply of

LNG and the Gas, Power and Renewables business is responsible for

the subsequent marketing and distribution of LNG. (See details under

Gas, Power and Renewables – Liquefied natural gas on page 36).BP’s

Exploration and Production segment has interests in four major LNG

plants: the Atlantic LNG plant in Trinidad (BP 34% in Train 1, 42.5% in

each of Trains 2 and 3 and 37.8% in Train 4); in Indonesia, through our

interests in the Sanga-Sanga PSA (BP 38%), which supplies natural gas

to the Bontang LNG plant, and Tangguh (PSA, BP 37.2%), which is under

construction; and in Australia through our share of LNG from the NWS

natural gas development (BP 16.7% infrastructure and oil reserves/15.8%

gas and condensate reserves).

Assets and activities:

– We have a 10% equity shareholding in the Abu Dhabi Gas Liquefaction

Company, which in 2006 supplied 5.6 million tonnes (290bcf) of LNG,

up 3.6% on 2005.

– In Australia, we are one of six equal partners in the NWS Venture.

Each partner holds a 16.7% interest in the infrastructure and oil

reserves and a 15.8% interest in the gas reserves and condensate. The

joint venture operation covers offshore production platforms, a floating

production and storage vessel, trunklines, onshore gas processing

plants and LNG carriers. Construction continued during 2006 on a fifth

LNG train that is expected to process 4.7 million tonnes of LNG a year

and will increase the plant’s capacity to 16.6 million tonnes a year. The

train is expected to be commissioned during the second half of 2008.

NWS produced 12.0 million tonnes (544bcf) of LNG, an increase of 2%

on 2005.

– In Indonesia, BP is involved in two of the three LNG centres in the

country. BP participates in Indonesia’s LNG exports through its

holdings in the Sanga-Sanga PSA (BP 38%). Sanga-Sanga currently

delivers around 15.5% of the total gas feed to Bontang, one of the

world’s largest LNG plants. The Bontang plant produced 19.5 million

tonnes (886bcf) of LNG in 2006, compared with 19.4 million tonnes

in 2005.

– Also in Indonesia, BP has interests in the Tangguh LNG joint venture

(BP 37.2% and operator) and in each of the Wiriagar (BP 38% and

operator), Berau (BP 48% and operator) and Muturi (BP 1%) PSAs in

north-west Papua that are expected to supply feed gas to the Tangguh

LNG plant. During 2006, construction continued on two trains, with

start-up planned late in 2008. Tangguh is expected to be the third

LNG centre in Indonesia, with an initial capacity of 7.6 million tonnes

(388bcf) a year. Tangguh has signed sales contracts for delivery to

China, Korea and North America’s West Coast.

– In Trinidad, construction of the Atlantic LNG Train 4 (BP 37.8%) was

completed in December 2005, with the first LNG cargo delivered in

January 2006. Train 4 is now the largest producing LNG train in the

world and is designed to produce 5.2 million tonnes (253bcf) a year of

LNG. BP expects to supply at least two-thirds of the gas to the train.

The facilities will be operated under a tolling arrangement, with the

equity owners retaining ownership of their respective gas. The LNG

is expected to be sold in the US, Dominican Republic and other

destinations. BP’s net share of the capacity of Atlantic LNG Trains 1, 2,

3 and 4 is 6.5 million tonnes (305bcf) of LNG a year.

26