BP 2006 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 179

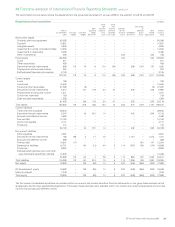

53 US GAAP reconciliation

The consolidated financial statements of the BP group are prepared in accordance with International Financial Reporting Standards (IFRS) as adopted for

use by the EU, which differ in certain respects from US generally accepted accounting principles (US GAAP). IFRS as adopted by the EU differs in

certain respects from IFRS as issued by the International Accounting Standards Board (IASB). However, the consolidated financial statements for the

years presented would be no different had the group applied IFRS as issued by the IASB.

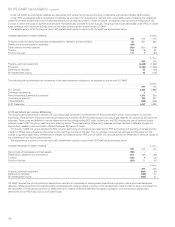

The following is a summary of the adjustments to profit for the year attributable to BP shareholders and to BP shareholders’ equity that would be

required if US GAAP had been applied instead of IFRS.

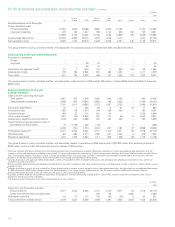

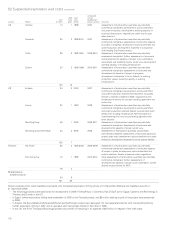

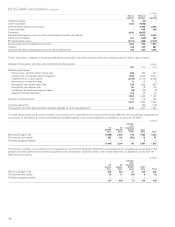

Profit for the year $ million except per share amounts

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

For the year ended 31 December 2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit as reported in the Annual Report and Accounts to accord with IFRS 22,000 22,341 17,075

Texas City provision timing differencea315 (315) –

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit as reported in the Annual Report on Form 20-F to accord with IFRS 22,315 22,026 17,075

Adjustments

Deferred taxation/business combinations (a) (224) (496) (517)

Provisions (b) 177 9(80)

Oil and natural gas reserves differences (c) (243) 11 30

Goodwill and intangible assets (d) 13 –(61)

Derivative financial instruments (e) 142 87 (337)

Inventory valuation (f) 162 (232) 162

Gain arising on asset exchange (g) (10) (12) (107)

Pensions and other post-retirement benefits (h) (873) (486) (47)

Impairments (i) (332) (378) 677

Equity-accounted investments (j) (104) (255) 147

Consolidation of variable interest entities (l) (5) ––

Major maintenance expenditure (m) ––217

Share-based payments (n) 92 624

Other 6156 (93)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit for the year before cumulative effect of accounting change as adjusted to accord with US GAAP 21,116 20,436 17,090

Cumulative effect of accounting change

Major maintenance expenditure (m) –(794) –

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit for the year as adjusted to accord with US GAAP 21,116 19,642 17,090

Dividend requirements on preference shares 222

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit for the year attributable to ordinary shares as adjusted to accord with US GAAP 21,114 19,640 17,088

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Per ordinary share – cents

Basic – before cumulative effect of accounting change 105.42 96.72 78.31

Cumulative effect of accounting change –(3.76) –

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

105.42 92.96 78.31

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Diluted – before cumulative effect of accounting change 104.63 95.62 76.88

Cumulative effect of accounting change –(3.71) –

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

104.63 91.91 76.88

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Per American depositary share – centsb

Basic – before cumulative effect of accounting change 632.52 580.32 469.86

Cumulative effect of accounting change –(22.56) –

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

632.52 557.76 469.86

Diluted – before cumulative effect of accounting change 627.78 573.72 461.28

Cumulative effect of accounting change –(22.26) –

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

627.78 551.46 461.28

aBP’s financial statements for the year ended 31 December 2005 were authorized for issue on 6 February 2006 and were included in the 2005 Annual Report and Accounts.

BP filed its 2005 Annual Report on Form 20-F on 30 June 2006. The financial statements included in this filing were approved on 30 June 2006 and reflected an additional

provision of $315 million (post-tax) relating to the Texas City incident of March 2005 as a result of new information that came to light after 6 February 2006. The amount of

this timing difference therefore appears as a reconciling item between the profit to accord with IFRS reported in the Annual Report and Accounts and the profit to accord

with IFRS reported in the Form 20-F for both 2005 and 2006. Similarly, there was a difference of the same amount between BP shareholders’ equity to accordwithIFRSat

31 December 2005 as reported in the 2005 Annual Report and Accounts and in the Form 20-F.

bOne American depositary share is equivalent to six ordinary shares.