BP 2006 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Russia

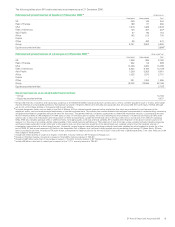

TNK-BP

– TNK-BP, a joint venture between BP (50%) and Alfa Group and

Access-Renova (AAR) (50%), is an integrated oil company operating in

Russia and the Ukraine. The TNK-BP group’s major assets are held in

OAO TNK-BP Holding. Other assets include the BP-branded retail sites

in Moscow and the Moscow region, OAO Rusia Petroleum and the

OAO Slavneft group. The workforce is about 70,000 people.

– BP’s investment in TNK-BP is held by the Exploration and Production

business and the results of TNK-BP are accounted for under the equity

method in this segment.

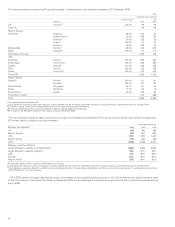

– TNK-BP has proved reserves of 6.1 billion boe (including its 49.9%

equity share of Slavneft), of which 4.8 billion are developed. In 2006,

average liquids production was 1.9mmboe/d, a decrease of just over

2% compared with 2005, reflecting the disposal of the Urdmurt and

Saratov assets in 2006 and 2005. The production base is largely

centred in West Siberia (Samotlor, Nyagan and Megion), which

contributes about 1.4mmboe/d, together with Volga Urals (Orenburg)

contributing some 0.4mmboe/d. About 50% of total oil production is

currently exported as crude oil and 20% as refined product.

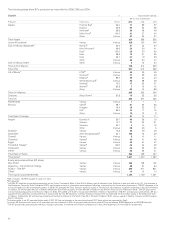

– Downstream, TNK-BP owns five refineries in Russia and the Ukraine

(including Ryazan and Lisichansk), with throughput of 0.6 million barrels

a day (28 million tonnes a year). In retail, TNK-BP operates more than

1,600 filling stations in Russia and the Ukraine, with a share of the

Moscow retail market in excess of 20%.

– During 2006, four of TNK-BP’s licences were extended by 25 years,

including two key licences covering the Samotlor field and the

Khokhryakovskoye and Permyakovskoye licences.

– In October, TNK-BP’s subsidiary Rusia Petroleum received a letter from

the Russian authorities alleging a number of violations of the conditions

related to a licence covering part of the Kovykta field in East Siberia.

In February 2007, the status of the licence was reviewed by the

authorities, who we anticipate will issue formal findings shortly. Rusia

Petroleum continues to discuss this matter with the authorities in order

to address any outstanding concerns.

– In November, following a review of the results of an inspection by

the licensing authorities, regional prosecutors made a request for

revocation of the two licences held by TNK-BP subsidiary Rospan

International on grounds of violation of licence conditions and

applicable legislation. Following discussion with the licensing

authorities, renewal was granted of certain documents associated

with the licences for which TNK-BP had previously applied. In addition,

Rospan presented a plan to rectify the licence non-compliances,

following which the licensing authorities have granted a six-month

period to fulfil this plan.

– On 23 October 2006, TNK-BP received decisions from the Russian

tax authorities in relation to the tax audits of certain TNK-BP group

companies for the years 2002 and 2003, resulting in a payment by

TNK-BP of approximately $1.4 billion in settlement of these claims.

At the present time, BP believes that its provisions are adequate for

its share of any liabilities arising from these and other outstanding tax

decisions not covered by the indemnities provided by our co-venturers

in respect of historical tax liabilities related to assets contributed to the

joint venture.

– In August 2006, TNK-BP completed the sale of its interest in OAO

Udmurtneft to Sinopec.

– In January 2007, TNK-BP announced the acquisition of Occidental

Petroleum’s 50% interest in the West Siberian joint venture,

Vanyoganneft, for $485 million. The transaction is expected to close

during the first quarter of 2007, subject to Russian regulatory

approvals. On completion of the purchase, TNK-BP will own 100%

of the Vanyoganneft asset.

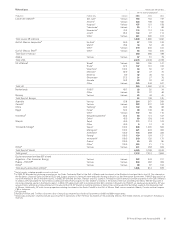

Sakhalin

– BP participates in exploration activity through Elvaryneftegas (BP 49%),

an equity-accounted joint venture with Rosneft in Sakhalin, where

three discoveries have been made. Exploratory drilling continued in

2006 and preliminary work is under way to prepare for development

if commercial reserves are discovered. Further drilling is planned

during 2007.

Other

– In July 2006, BP purchased 9.6% of the shares issued in Rosneft’s IPO

for $1 billion. This represents an interest of around 1.4% in Rosneft.

Other

Azerbaijan

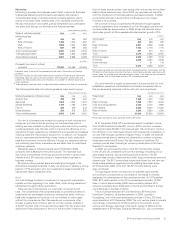

– BP, as operator of the Azerbaijan International Operating Company

(AIOC), manages and has a 34.1% interest in the Azeri-Chirag-Gunashli

(ACG) oil fields in the Caspian Sea, offshore Azerbaijan. Phase 2 of

the Azeri project delivered first oil from the West Azeri platform to

Sangachal terminal on 3 January 2006 and was completed on

21 October 2006 with the delivery of first oil from the East Azeri

platform to Sangachal, four months ahead of schedule. Phase 3 of the

project, which will develop the deepwater Gunashli area of ACG,

remains on schedule to begin production in 2008.

– Construction and the Stage 1 pre-drill programme of the project to

develop the Shah Deniz natural gas field (BP 25.5% and operator) were

completed in 2006, with first gas in December 2006.

Middle East and Pakistan

– Production in the Middle East consists principally of the production

entitlement of associates in Abu Dhabi, where we have equity

interests of 9.5% and 14.7% in onshore and offshore concessions

respectively. In 2006, production in Abu Dhabi was 164mb/d, up 11%

from 2005 as a result of capacity enhancements.

– In Pakistan, BP is one of the leading foreign operators, producing 22%

of the country’s oil and 6% of its natural gas on a gross basis in 2006.

– In July 2006, BP was awarded three offshore blocks in Pakistan’s

offshore Indus Delta. The blocks cover an area of approximately

20,000km

2

and include the right to operate any commercially

viable discoveries.

– In January 2007, we were awarded development rights to the Khazzan/

Makarem fields in Oman. These provide access to a significant volume

of tight gas resource in place, which we believe can be developed

using the same technology as we are currently deploying at our

Wamsutter field in the US.

India

– In November 2006, BP signed a PSA with the Indian government to

explore for coal bed methane in the Birbhun district of India’s eastern

West Bengal state.

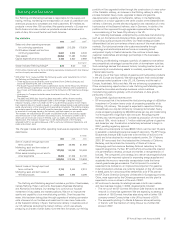

Midstream activities

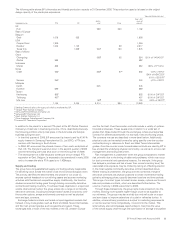

Oil and natural gas transportation

The group has direct or indirect interests in certain crude oil transportation

systems, the principal ones being the Trans Alaska Pipeline System

(TAPS) in the US and the Forties Pipelines System (FPS) in the UK sector

of the North Sea. We also operate the Central Area Transmission System

(CATS) for natural gas in the UK sector of the North Sea.

BP, as operator, manages and holds a 30.1% interest in the

Baku-Tbilisi-Ceyhan (BTC) oil pipeline, which was fully commissioned in

July 2006. BP, as operator of AIOC, also operates the Western Export

Route Pipeline between Azerbaijan and the Black Sea coast of Georgia

and the Azeri leg of the Northern Export Route Pipeline between

Azerbaijan and Russia.

Our onshore US crude oil and product pipelines and related

transportation assets are included under Refining and Marketing (see

page 27). Revenue is earned on pipelines through charging tariffs. Our

gas marketing business is included in our Gas, Power and Renewables

segment (see page 35).

Activity in oil and natural gas transportation during 2006 included:

Alaska

– BP owns a 46.9% interest in TAPS, with the balance owned by four

other companies. Production transported by TAPS from Alaska North

Slope fields averaged 748mb/d during 2006.

– The use of US-built and US-flagged ships is required when transporting

Alaskan oil to markets in the US. In September 2006, BP completed

the replacement of its US-flagged fleet with the delivery of its fourth

ship, the Alaska Legend. BP had contracted for the delivery of four

1.3 million-barrel-capacity double-hulled tankers for use in transporting

BP Annual Report and Accounts 2006 25