BP 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

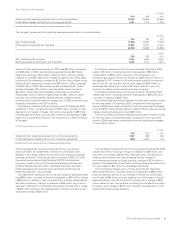

were higher liquids and gas realizations, higher refining margins and

higher contributions from the operating business within the Gas, Power

and Renewables segment, partially offset by lower retail marketing

margins, higher costs (including the Thunder Horse incident, the Texas

City refinery shutdown and planned restructuring actions) and significant

volatility arising under IFRS fair value accounting.

Profits and margins for the group and for individual business segments

can vary significantly from period to period as a result of changes in such

factors as oil prices, natural gas prices and refining margins. Accordingly,

the results for the current and prior periods do not necessarily reflect

trends, nor do they provide indicators of results for future periods.

Employee numbers were approximately 97,000 at 31 December 2006,

96,200 at 31 December 2005 and 102,900 at 31 December 2004. The

decrease in 2005 resulted primarily from the sale of Innovene.

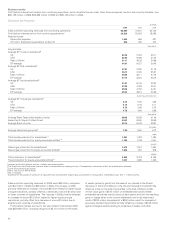

Capital expenditure and acquisitions

$million

--------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

--------------------------------------------------------------------------------------------------------------------------------------------------

Exploration and Production 13,075 10,149 9,648

Refining and Marketing 3,122 2,757 2,862

Gas, Power and Renewables 432 235 530

Other businesses and corporate 281 797 770

--------------------------------------------------------------------------------------------------------------------------------------------------

Capital expenditure 16,910 13,938 13,810

Acquisitions and asset exchanges 321 211 2,841

--------------------------------------------------------------------------------------------------------------------------------------------------

17,231 14,149 16,651

Disposals (6,254) (11,200) (4,961)

--------------------------------------------------------------------------------------------------------------------------------------------------

Net investment 10,977 2,949 11,690

Capital expenditure and acquisitions in 2006, 2005 and 2004 amounted to

$17,231 million, $14,149 million and $16,651 million respectively. There

were no significant acquisitions in 2006 or 2005. Acquisitions during 2004

included $1,354 million for including TNK’s interest in Slavneft within

TNK-BP and $1,355 million for the acquisition of Solvay’s interests in BP

Solvay Polyethylene Europe and BP Solvay Polyethylene North America.

Excluding acquisitions and asset exchanges, capital expenditure for

2006 was $16,910 million compared with $13,938 million in 2005 and

$13,810 million in 2004. In 2006, this included $1 billion in respect of

our investment in Rosneft.

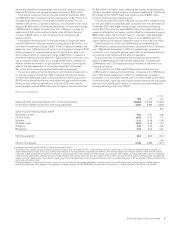

Finance costs and other finance expense

Finance costs comprises group interest less amounts capitalized. Finance

costs for continuing operations in 2006 were $718 million compared with

$616 million in 2005 and $440 million in 2004. These amounts included a

charge of $57 million arising from early redemption of finance leases in

2005. The charge in 2006 reflected higher interest rates and costs, offset

by an increase in capitalized interest compared with 2005. Compared with

2004, the charge for 2005 also reflected higher interest rates and costs

offset by an increase in capitalized interest.

Other finance expense included net pension finance costs, the interest

accretion on provisions and the interest accretion on the deferred

consideration for the acquisition of our investment in TNK-BP. Other

finance expense for continuing operations in 2006 was a credit of

$202 million compared with charges of $145 million in 2005 and

$340 million in 2004. The decrease in 2006 compared with 2005 primarily

reflected a reduction in net pension finance costs owing to a higher return

on pension assets due to the increased market value of the pension asset

base. The decrease in 2005 compared with 2004 primarily reflected a

reduction in net pension finance costs. This was primarily due to a higher

expected return on investment driven by a higher pension fund asset

value at the start of 2005 compared with the start of 2004, while the

expected long-term rate of return was similar.

Taxation

The charge for corporate taxes for continuing operations in 2006 was

$12,331 million, compared with $9,473 million in 2005 and $7,082 million

in 2004. The effective rate was 36% in 2006, 30% in 2005 and 28% in

2004. The increase in the effective rate in 2006 compared with 2005

primarily reflected the impact of the increase in the North Sea tax rate

enacted by the UK government in July 2006 and the absence of

non-recurring benefits that were present in 2005. The increase in

the effective rate in 2005 compared with 2004 was primarily due to a

higher proportion of income in countries bearing higher tax rates,

and other factors.

BP Annual Report and Accounts 2006 49