BP 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Quantitative and qualitative disclosures

about market risk

The group is exposed to a number of different market risks arising from

its normal business activities. Market risk is the possibility that changes

in foreign currency exchange rates, interest rates, or oil and natural gas

or power prices will adversely affect the value of the group’s financial

assets, liabilities or expected future cash flows. The group has developed

policies aimed at managing the volatility inherent in certain of these

natural business exposures and in accordance with these policies the

group enters into various transactions using derivative financial and

commodity instruments (derivatives). Derivatives are contracts whose

value is derived from one or more underlying financial or commodity

instruments, indices or prices which are defined in the contract.

The group also trades derivatives in conjunction with its risk

management activities.

All derivative activity, whether for risk management or trading, is carried

out by specialist teams that have the appropriate skills, experience and

supervision. These teams are subject to close financial and management

control, meeting generally accepted industry practice and reflecting

the principles of the group of Thirty Global Derivatives Study

recommendations. Independent control functions monitor compliance

with the group’s policies. A Trading Risk Management Committee has

oversight of the quality of internal control in the group’s trading function.

The control framework includes prescribed trading limits that are

reviewed regularly by senior management, daily monitoring of risk

exposure using value-at-risk principles, marking trading exposures to

market and stress testing to assess the exposure to potentially extreme

market situations. The group’s operational, risk management and trading

activities in oil, natural gas, power and financial markets are managed

within a single integrated function that has the responsibility for ensuring

high and consistent standards of control, making investments in the

necessary systems and supporting infrastructure and providing

professional management oversight.

In market risk management and trading, conventional exchange-

traded derivatives such as futures and options are used, as well as non-

exchange-traded instruments such as ‘over-the-counter’ swaps, options

and forward contracts.

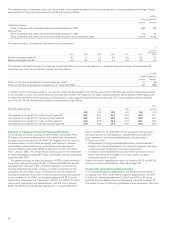

IAS 39 ‘Financial Instruments: Recognition and Measurement’ (IAS 39)

prescribes strict criteria for hedge accounting, whether as a cash flow

or fair value hedge, and requires that any derivative that does not meet

these criteria should be classified as held for trading purposes and fair

valued. BP adopted IAS 32 and IAS 39 with effect from 1 January 2005

without restating prior periods. Consequently, the group’s accounting

policy under UK GAAP has been used for 2004. The policy under UK

GAAP and the disclosures required by UK GAAP for derivative financial

instruments are shown in Financial statements – Note 37 on page 148.

Where derivatives constitute a fair value hedge, the group’s exposure

to market risk created by the derivative is offset by the opposite exposure

arising from the asset, liability or transaction being hedged. Gains and

losses relating to derivatives designated as part of a cash flow hedge are

taken to reserves and recycled through income or to the carrying value of

assets, as appropriate as the hedged item is recognized. By contrast,

where derivatives are held for trading purposes, realized and unrealized

gains and losses are recognized in the period in which they occur.

The group also has embedded derivatives classified as held for trading.

Prior to the development of an active gas trading market, UK gas

contracts were priced using a basket of available price indices, primarily

relating to oil products. Post the development of an active UK gas market,

certain contracts were entered into or renegotiated using pricing formulae

not related directly to gas prices, for example, oil product and power

prices. In these circumstances, pricing formulae have been determined

to be derivatives, embedded within the overall contractual arrangements

that are not clearly and closely related to the underlying commodity. The

resulting fair value relating to these contracts is recognized on the balance

sheet with gains or losses recognized in the income statement.

Further information about BP’s use of derivatives, their characteristics

and the IFRS accounting treatment thereof is given in Financial

statements – Note 1 and Note 36 on pages 100 and 141.

There are minor differences in the criteria for hedge accounting under

IFRS and SFAS No. 133 ‘Accounting for Derivative Instruments and

Hedging Activities’. Prior to 1 January 2005, the group did not designate

any of its derivative financial instruments as part of hedged transactions

under SFAS 133. As a result, all changes in fair value were recognized

through earnings. See Financial statements – Note 53 on page 179 for

further information.

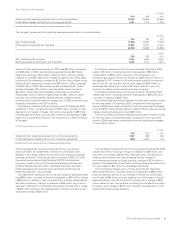

Foreign currency exchange rate risk

Fluctuations in exchange rates can have significant effects on the

group’s reported results. The effects of most exchange rate fluctuations

are absorbed in business operating results through changing cost-

competitiveness, lags in market adjustment to movements in rates and

conversion differences accounted for on specific transactions. For this

reason, the total effect of exchange rate fluctuations is not identifiable

separately in the group’s reported results.

The main underlying economic currency of the group’s cash flows

is the US dollar. This is because BP’s major product, oil, is priced

internationally in US dollars. BP’s foreign exchange management policy is

to minimize economic and material transactional exposures arising from

currency movements against the US dollar. The group co-ordinates the

handling of foreign exchange risks centrally, by netting off naturally

occurring opposite exposures wherever possible, to reduce the risks,

and then dealing with any material residual foreign exchange risks. The

most significant residual exposures are capital expenditure and UK and

European operational requirements. In addition, most of the group’s

borrowings are in US dollars or are hedged with respect to the US dollar.

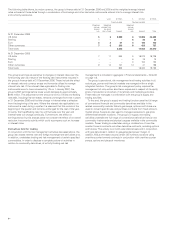

At 31 December 2006, the total of foreign currency borrowings not

swapped into US dollars amounted to $957 million. The principal elements

of this are $195 million of borrowings in euros, $179 million in Australian

dollars, $114 million in Chinese renminbi, $78 million in South African

rand, $35 million in sterling, $224 million in Canadian dollars and

$76 million in Trinidad & Tobago dollars.

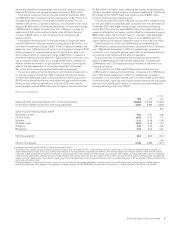

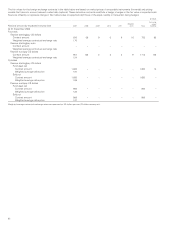

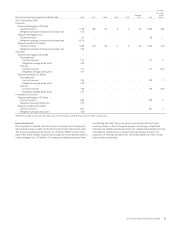

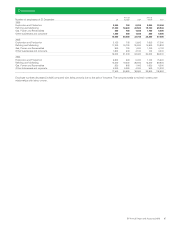

The following table provides information about the group’s foreign

currency derivative financial instruments. These include foreign currency

forward exchange agreements (forwards), cylinder option contracts

(cylinders) and purchased call options that are sensitive to changes in

the sterling/US dollar and euro/US dollar exchange rates. Where foreign

currency denominated borrowings are swapped into US dollars using

forwards or cross-currency swaps such that currency risk is completely

eliminated, neither the borrowing nor the derivative is included in

the table.

For forwards, the tables present the notional amounts and weighted

average contractual exchange rates by contractual maturity dates and

exclude forwards that have offsetting positions. Only significant forward

positions are included in the tables. The notional amounts of forwards are

translated into US dollars at the exchange rate included in the contract at

inception. The fair value represents an estimate of the gain or loss that

would be realized if the contracts were settled at the balance sheet date.

Cylinders consist of purchased call option and written put option

contracts. For cylinders and purchased call options, the tables present

the notional amounts of the option contracts at 31 December and the

weighted average strike rates.

BP Annual Report and Accounts 2006 61