BP 2006 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 151

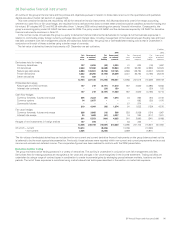

38 Finance debt continued

Finance leases

The group uses finance leases to acquire property, plant and equipment. These leases have terms of renewal but no purchase options and escalation

clauses. Renewals are at the option of the lessee. Future minimum lease payments under finance leases are set out below.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Minimum future lease payments payable within

1year 82 78

2 to 5 years 376 320

Thereafter 873 838

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1,331 1,236

Less finance charges 516 455

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net obligations 815 781

Of which – payable within 1 year 60 60

– payable within 2 to 5 years 164 133

– payable thereafter 591 588

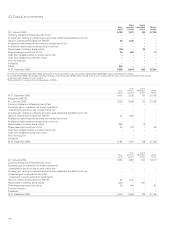

Fair values

For 2006, the estimated fair value of finance debt is shown in the table below together with the carrying amount as reflected in the balance sheet.

Long-term borrowings in the table below include the portion of debt that matures in the year from 31 December 2006, whereas in the balance sheet

the amount would be reported under current liabilities. Long-term borrowings also include US Industrial Revenue/Municipal Bonds and loans associated

with long-term gas supply contracts classified on the balance sheet as current liabilities.

The carrying value of the group’s short-term borrowings, comprising mainly commercial paper, bank loans and overdrafts, approximates their fair

value. The fair value of the group’s long-term borrowings and finance lease obligations is estimated using quoted prices or, where these are not

available, discounted cash flow analyses based on the group’s current incremental borrowing rates for similar types and maturities of borrowing.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fair value

Carrying

amount Fair value

Carrying

amount

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Short-term borrowings 7,040 7,040 3,297 3,297

Long-term borrowings 16,201 16,155 15,313 15,084

Net obligations under finance leases 832 815 803 781

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total finance debt 24,073 24,010 19,413 19,162

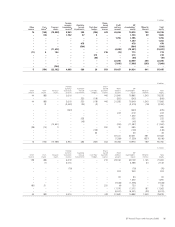

39 Analysis of changes in net debt

Net debt is current and non-current finance debt less cash and cash equivalents. The net debt ratio is the ratio of net debt to net debt plus total equity.

The net debt ratio at 31 December 2006 was 20% (2005 17%).

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Movement in net debt Finance

debt

Cash and

cash

equivalents

Net

debt

Finance

debt

Cash and

cash

equivalents

Net

debt

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 1 January (19,162) 2,960 (16,202) (23,091) 1,359 (21,732)

Adoption of IAS 39 –––(147) – (147)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Restated (19,162) 2,960 (16,202) (23,238) 1,359 (21,879)

Exchange adjustments (172) 47 (125) (44) (88) (132)

Debt acquired (13) – (13) –––

Net cash flow (4,049) (417) (4,466) 3,803 1,689 5,492

Fair value hedge adjustment (581) – (581) 171 – 171

Other movements (33) – (33) 146 – 146

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 31 December (24,010) 2,590 (21,420) (19,162) 2,960 (16,202)

Equity 85,465 80,765