BP 2006 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

182

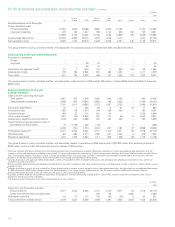

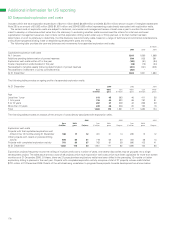

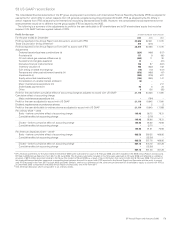

53 US GAAP reconciliation continued

Under US GAAP, environmental liabilities are discounted only where the timing and amounts of payments are fixed and reliably determinable.

Under IFRS, an expected loss is recognized immediately as a provision for an executory contract if the unavoidable costs of meeting the obligations

under the contract exceed the economic benefits expected to be received under it. Under US GAAP, an expected loss can only be recognized if the

contract is within the scope of authoritative literature that specifically provides for such accruals. The group has recognized losses under IFRS on certain

sales contracts with fixed-price ceilings which do not meet loss recognition criteria under US GAAP.

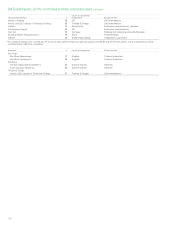

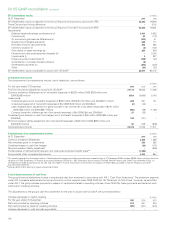

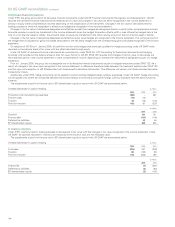

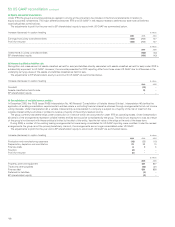

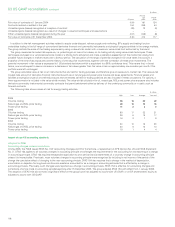

The adjustments to profit for the year and to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Production and manufacturing expenses and depreciation, depletion and amortization 56 201 254

Distribution and administration expenses (108) ––

Other finance (income) expense (245) (201) (196)

Taxation 120 (9) 22

Profit for the year 177 9(80)

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Property, plant and equipment (2,065) (1,842)

Provisions (2,184) (1,666)

Deferred tax liabilities 56 (64)

BP shareholders’ equity 63 (112)

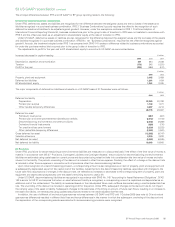

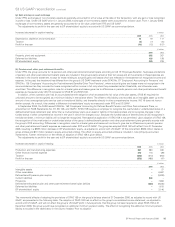

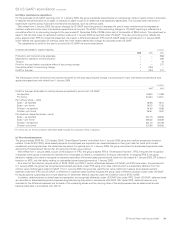

The following data summarizes the movements in the asset retirement obligations, as adjusted to accord with US GAAP.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 1 January 4,429 3,898

Exchange adjustments 94

New provisions/adjustment to provisions 1,679 554

Unwinding of discount 280 237

Utilized/deleted (360) (264)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 31 December 6,037 4,429

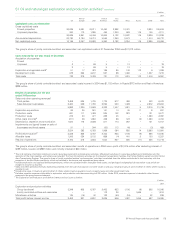

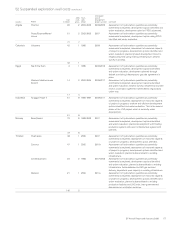

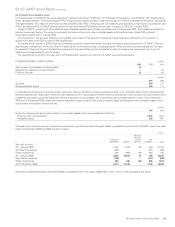

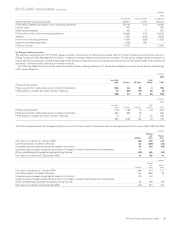

(c) Oil and natural gas reserves differences

The group’s past practice was to use the UK accounting rules contained in the Statement of Recommended Practice ‘Accounting for Oil and Gas

Exploration, Development, Production and Decommissioning Activities’ (SORP) for estimating oil and natural gas reserves for accounting and reporting

purposes. These rules are different in certain respects from the corresponding SEC rules. In particular, the SEC requires the use of year-end prices,

whereas under SORP the group used long-term planning prices. The consequential difference in reserves volumes resulted in different charges for

depreciation, depletion and amortization (DD&A) between IFRS and US GAAP.

At the end of 2006, the group adopted the SEC rules for estimating oil and natural gas reserves for IFRS accounting and reporting purposes and the

charge for DD&A was calculated on this basis for the last three months of the year. This is a change in accounting estimate and the impact of the

change is applied prospectively. Differences in charges for DD&A between IFRS and US GAAP will continue due to the difference in net book values of

the underlying oil and natural gas properties.

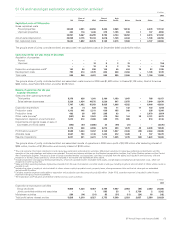

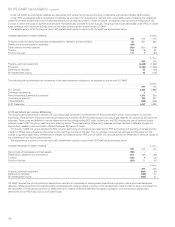

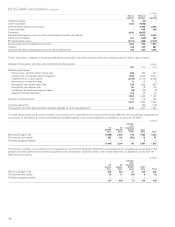

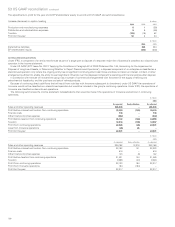

The adjustments to profit for the year and to BP shareholders’ equity to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Gain on sale of businesses and fixed assets (198) ––

Depreciation, depletion and amortization 201 (20) (48)

Taxation (156) 918

Profit for the year (243) 11 30

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Property, plant and equipment (331) 68

Deferred tax liabilities (129) 27

BP shareholders’ equity (202) 41

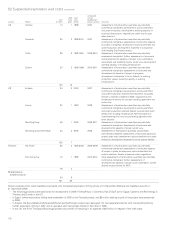

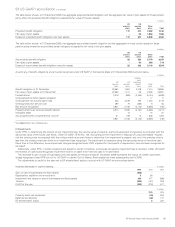

US GAAP requires the unit-of-production depreciation calculation to be based on development expenditure incurred to date and proved developed

reserves. Where production commences before all development wells are drilled, a portion of the development costs incurred to date is excluded from

the calculation. For the group’s portfolio of fields there is no material difference between the group’s charge for unit-of-production depreciation

determined on an IFRS basis and on a US GAAP basis.