BP 2006 Annual Report Download - page 25

Download and view the complete annual report

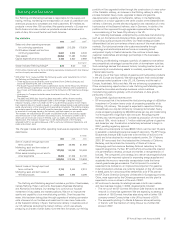

Please find page 25 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.– On 7 August 2006, an orderly and phased shutdown of the Eastern

Operating Area of the Prudhoe Bay oil field began following the

discovery of unexpected corrosion and a small spill from a Prudhoe

Bay oil transit line. In September, we determined that the oil

transit lines in the Eastern Operating Area of Prudhoe Bay could be

returned to service for the purposes of in-line inspection. By the end of

October we had returned to service all three flow stations previously

shut down.

– Current production from Prudhoe Bay is more than 400,000 barrels of

oil and natural gas liquids per day (gross). BP has a 26.4% interest in

the Prudhoe Bay field.

– In response to the recent corrosion discoveries, BP has decided to

replace the main oil transit lines (16 miles) in both the Eastern and

Western Operating Areas of Prudhoe Bay. In addition, BP plans to

spend over $550 million (net) over the next two years on integrity

management in Alaska. BP has retained three eminent corrosion

experts to evaluate independently and make recommendations for

improving the corrosion programme in Alaska. BP has also asked an

independent ombudsman to undertake a review of worker allegations

raised on the North Slope of Alaska since the acquisition of ARCO

in 2000 to determine whether the problems have been addressed

and rectified.

– In February 2007, BP temporarily shut down its Northstar production

facility to repair welds in the low pressure gas piping system. BP is

currently finalising inspections and has begun repairs.

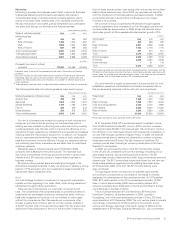

United Kingdom

We are the largest producer of oil and second largest producer of gas in

the UK. BP remains the largest overall producer of hydrocarbons in the

UK. In 2006, total liquids production was 253mb/d, a 9% decrease on

2005, and gas production was 936mmcf/d, a 14% decrease on 2005. This

decrease in production was driven by the natural decline, operational

issues and lower seasonal gas demand. Our activities in the North Sea

are focused on safe operations, efficient delivery of production

and midstream operations, in-field drilling and selected new field

developments. Our development expenditure (excluding

midstream) in the UK was $794 million in 2006, compared with $790

million in 2005 and $679 million in 2004.

Significant events were:

– Drilling continued during 2006 on the Clair Phase 1 development (BP

28.6% and operator) programme and is scheduled to continue through

2008.

– In September 2006, BP reached an agreement, subject to Department

of Trade and Industry (DTI) approval, to acquire acreage in the UK

Central North Sea that contains two discovered fields and further

exploration potential.

– BP and its partner approved the front end engineering and design for

the Harding Area Gas Project (BP 70% and operator) in July 2006.

This represents the first stage of a development project to allow the

production of gas from the Harding area and prolong the life of the field

beyond 2015.

– Progress continued during the year on the Magnus Expansion Project

(BP 85% and operator), with first oil achieved in October 2006.

– The UK government approved the North West Hutton

decommissioning programme in April 2006. BP, on behalf of the

owners of North West Hutton (BP 26% and operator), awarded a

contract in October 2006 for the offshore removal and onshore

recycling of the installation. Detailed engineering work for removal

has begun. Platform removal is expected to start in 2008 and to be

completed by the end of 2009.

– In December 2005, the UK government announced a 10%

supplemental tax increase on North Sea oil profits, taking the total

corporate tax rate to 50%. This tax increase became law in July 2006,

with effect from 1 January 2006.

– In March 2006, we reached agreement for the sale of our 4.84%

interest in the Statfjord oil and gas field. This sale was completed

in June 2006.

Rest of Europe

Development expenditure, excluding midstream, in the Rest of Europe

was $214 million, compared with $188 million in 2005 and $262 million

in 2004.

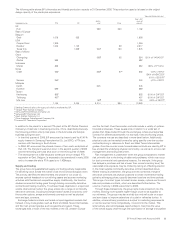

Norway

In 2006, our total production in Norway was 66mboe/d, a 20% decrease

on 2005. This decrease in production was driven by natural decline.

Significant activities were:

– Progress on the Valhall (BP 28.1% and operator) redevelopment

project continued during 2006. A new platform is scheduled to become

operational in 2010, with expected oil production capacity of 150mb/d

and gas handling capacity of 175mmcf/d.

– Drilling continued through 2006 on the Valhall flank development

and water injection projects. The flank drilling programme was

completed in September 2006 and water injection drilling will continue

during 2007.

– In March 2006, we reached agreement for the sale of our interest in

the Luva gas discovery, in the North Sea. This sale was completed in

the second quarter of 2006.

Netherlands

In May 2006, we announced our intention to sell our exploration and

production and gas infrastructure business in the Netherlands. This

includes onshore and offshore production assets and the onshore gas

supply facility, Piek Gas Installatie, at Alkmaar. The sale was completed

on 1 February 2007 to the Abu Dhabi National Energy Company, TAQA.

Rest of World

Development expenditure, excluding midstream, in Rest of World

was $4,522 million in 2006, compared with $3,735 million in 2005

and $3,082 million in 2004.

Rest of Americas

Canada

– In Canada, our natural gas and liquids production was 57mboe/d in

2006, a decrease of 10% compared with 2005. The year-on-year

decrease in production is mainly due to natural field decline.

– BP has been successful in obtaining new licences in British Columbia

and Alberta land sales. The acquired acreage will form part of the Noel

tight gas development project in north-eastern British Columbia. The

project will involve drilling up to 180 horizontal wells and innovative

fracturing technology to develop the remainder of the resources.

Trinidad

– In Trinidad, natural gas production volumes increased by 14% to

2,265mmcf/d in 2006. The increase was driven by higher demand due

to the ramp-up of Atlantic LNG Train 4. Liquids production declined by

2mb/d (5%) to 38mb/d in 2006.

– Cannonball (BP 100%), Trinidad’s first major offshore construction

project executed locally, started production in March 2006. Production

increased during the year and the asset is currently providing gas for

the Atlantic LNG trains.

– BP sanctioned the development projects for Red Mango (BP 100%) in

April 2006 and for Cashima (BP 100%) in August 2006. First production

is expected by the end of 2007 and in 2008 respectively.

Venezuela

– In Venezuela, our 2006 liquids production reduced by 25mb/d

compared with 2005, mainly as a result of the enforced reduction of our

interests in the non-BP-operated Jusepin property and the Boqueron

and Desarollo Zulia Occidental (DZO) reactivation projects, which BP

operated until 31 March 2006 under operating service agreements on

behalf of the state oil company, Petroleos de Venezuela S.A. (PDVSA).

– In August 2006, BP signed conversion agreements to co-operate with

PDVSA in setting up incorporated joint ventures in which PDVSA would

be the majority shareholder. The structures for the incorporated joint

ventures were established in December 2006 and these are now the

operators of the Boqueron and DZO properties.

BP Annual Report and Accounts 2006 23