BP 2006 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

146

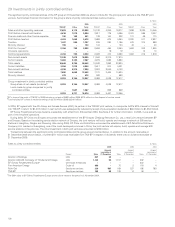

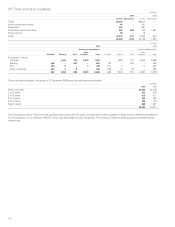

36 Derivative financial instruments continued

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Less than

1 year 1-2 years 2-3 years 3-4 years 4-5 years

Over

5 years Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Natural gas and LNG embedded derivatives

Fair value 330 176 76 5 – – 587

Notional value 425 484 465 450 429 2,367 4,620

Embedded derivative liabilities have the following fair values, contractual or notional values and maturities.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Less than

1 year 1-2 years 2-3 years 3-4 years 4-5 years

Over

5 years Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Natural gas and LNG embedded derivatives

Fair value (444) (433) (320) (218) (186) (570) (2,171)

Notional value 1,352 1,229 1,279 1,278 1,249 5,423 11,810

Interest rate embedded derivatives

Fair value –(26)––––(26)

Notional value –150––––150

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Less than

1 year 1-2 years 2-3 years 3-4 years 4-5 years

Over

5 years Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Natural gas and LNG embedded derivatives

Fair value (953) (703) (472) (237) (180) (553) (3,098)

Notional value 740 870 1,097 832 767 4,257 8,563

Interest rate embedded derivatives

Fair value – – (30) – – – (30)

Notional value ––150–––150

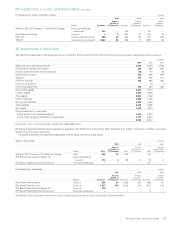

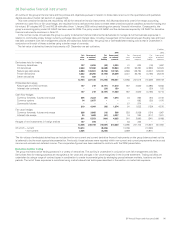

The following tables show the net fair value of embedded derivatives at 31 December analysed by maturity period and by methodology of fair value

estimation.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Less than

1 year 1-2 years 2-3 years 3-4 years 4-5 years

Over

5 years Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Prices actively quoted –––––––

Prices sourced from observable data or market corroboration 4958––––107

Prices based on models and other valuation methods (444) (459) (320) (218) (186) (570) (2,197)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(395) (401) (320) (218) (186) (570) (2,090)

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Less than

1 year 1-2 years 2-3 years 3-4 years 4-5 years

Over

5 years Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Prices actively quoted –––––––

Prices sourced from observable data or market corroboration 5128––––79

Prices based on models and other valuation methods (674) (542) (426) (231) (182) (565) (2,620)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

(623) (514) (426) (231) (182) (565) (2,541)

The net change in fair value of contracts based on models and other valuation methods during the year is a gain of $423 million (2005 loss of

$1,773 million).

Sensitivity analysis

Detailed below for the natural gas embedded derivatives is a sensitivity of the fair value to immediate 10% favourable and adverse changes in the key

assumptions.

At 31 December 2006 At 31 December 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Remaining contract terms 2to12years 3 to 13 years

Contractual / notional amount 4,968 million therms 8,220 million therms

Discount rate – nominal risk free 4.5% 4.5%

Fair value asset (liability) $(2,171) million $(2,590) million