BP 2006 Annual Report Download - page 39

Download and view the complete annual report

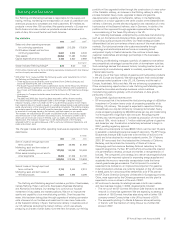

Please find page 39 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In south-east China, the Dapeng LNG import and regasification terminal

and Trunkline Project (BP 30%) in Guangdong province received its first

commissioning cargo during May 2006 and commenced commercial

operations in September. LNG for the terminal is supplied under a long-

term contract signed with Australia LNG in October 2002 that involves

deliveries from the North West Shelf project (BP 16.7% infrastructure and

oil reserves/15.8% gas and condensate reserves).

BP continues to progress options for new terminal development in

the US. The proposed 1.2 billion cubic feet per day (bcf/d) Crown Landing

terminal is to be located on the Delaware River in New Jersey. The

Federal Energy Regulatory Commission (FERC) granted its approval for

the siting, construction and operation of this project during 2006. BP

continues to work with the State agencies in New Jersey to complete

State permitting requirements and with the relevant federal, state and

local authorities to put in place security plans for the facility and

associated shipping activities. BP is also monitoring the progress of a

proceeding filed by the State of New Jersey against the State of

Delaware in the US Supreme Court concerning New Jersey’s jurisdiction

over developments on its shores, including the project’s loading jetty that

extends into the Delaware River. The court has agreed to hear the case.

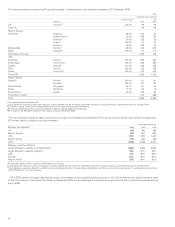

Natural gas liquids

With global demand for NGLs, both as a chemicals feedstock and as a

cleaner fuel, forecast to grow in excess of 3% a year, this business is

expected to offer potential for further growth. Based on sales volumes,

we are one of the leading producers and marketers of NGLs in North

America and hold interests for NGL volumes in the UK and Egypt.

NGLs produced in North America from gas chiefly sourced out of

Alberta, Canada, and the US onshore and Gulf Coast, are used as a

heating fuel and as a feedstock for refineries and chemicals plants. NGLs

are sold to petrochemicals plants and refineries, including our own. In

addition, a significant amount of NGLs are marketed on a wholesale basis

under annual supply contracts that provide for price redetermination

based on prevailing market prices.

We operate natural gas processing facilities across North America, with

a total capacity of 6.4bcf/d. These facilities, which we own or in which we

have an interest, are located in major production areas across North

America, including Alberta, Canada, the US Rockies, the San Juan basin

and the Gulf of Mexico. We also own or have an interest in fractionation

plants (that process the natural gas liquids stream into its separate

component products) in Canada and the US, and own or lease storage

capacity in Alberta, eastern Canada, and the US Gulf Coast, as well as the

US West Coast and mid-continent regions. Our North American NGL

processing capacity utilization in 2006 was 75%. In addition, we have

entered into a long-term supply contract with Aux Sable Liquid Products

to secure additional NGLs to supply our customers in the US Midwest.

BP operates one plant in the UK (capacity 1.2bcf/d) and we are a

partner (33.33%) in a gas processing plant in Egypt with 1.1bcf/d of gas

processing capacity. We have also secured access to the Abibes LPG

terminal in Cremona, northern Italy. During the first quarter of 2006, a

memorandum of understanding was signed with EGAS for a feasibility

study covering construction of a greenfield NGLs plant in the West Nile

Delta, Egypt, that would process gas from future BP equity and third-party

production offshore.

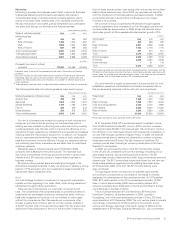

Alternative energy

BP Alternative Energy is focused on the power generation sector – the

largest single source of emissions from the use of fossil fuels – and aims

to extend BP’s capabilities in solar, wind, hydrogen and gas-fired power

generation to produce low-carbon power. Its activities include the

production and marketing of solar panels; development of wind farms;

generation of electricity from hydrogen power using sequestration in

which carbon is captured and stored; and gas-fired power generation,

which typically emits only half as much CO

2

as a conventional coal-fired

station. The business brings together the group’s existing activities in

these technologies with our power marketing and trading capabilities

to form a single business.

In 2005, BP Alternative Energy announced its plans to invest up to

$8 billion over 10 years. This investment is expected to be spread

in broadly equal proportions between solar, wind, hydrogen and high-

efficiency gas-fired power generation.

Solar

BP Solar’s main production facilities are located in Frederick, Maryland,

US; Madrid, Spain; Sydney, Australia; and Bangalore, India. During 2006,

the expansion of our manufacturing facilities in India and Spain doubled

our production capacity from 100MW in 2004 to 200MW, keeping us on

track to triple capacity from 2005 levels by 2008. During 2007, expansion

of cell capacity will continue at our Madrid and Bangalore facilities,

alongside a $70-million project to expand casting capacity at Frederick.

BP Solar achieved sales of 93MW (2005 105MW and 2004 99MW).

We made good use of technology to manage the current silicon supply

issue last year: developing a new silicon growth process named Mono2,

which significantly increases cell efficiency over traditional multi-

crystalline-based solar cells. Solar cells made with these wafers, in

combination with other BP Solar advances in cell process technology, are

expected to be able to produce between 5% and 8% more power than

solar cells made with conventional processes. We also teamed up with

the California Institute of Technology to launch a multi-million dollar

research programme to explore a radically new way of producing solar

cells, based on the growth of silicon on ‘nanorods’, which could improve

efficiency and make solar electricity much more competitive. In Germany,

we signed a co-operation agreement with the Institute of Crystal Growth

(IKZ) to develop a process for depositing silicon on glass that has the

potential to reduce the amount of silicon feedstock used in cell

production. In Spain, BP Solar and Banco Santander have formed an

alliance that will allow for the construction of up to 278 photovoltaic solar

power installations in Spain, with total capacity of 18-25 megawatts peak.

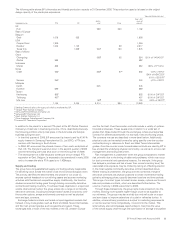

Wind

We are building expertise in wind energy and implementing projects. We

operate two wind farms in the Netherlands, 9MW at our oil terminal in

Amsterdam and 22.5MW at the Nerefco oil refinery (both the refinery and

wind farm are jointly owned with Chevron (BP 69%)), providing electricity

to the local grid.

In the US, we entered into a long-term supply agreement with Clipper

Windpower plc with options to purchase Clipper turbines, with a total

capacity of 2,250MW. During 2007, we plan to begin construction of five

wind power generation projects, located in four states – California,

Colorado, North Dakota and Texas. The projects are expected to deliver a

combined generation capacity of some 550MW.

During 2006, BP Alternative Energy also acquired Orion Energy, LLC,

and Greenlight Energy, Inc. With the acquisition of these large-scale wind

energy developers, our North American wind portfolio includes

opportunities to develop almost 100 projects with potential total

generating capacity of some 15,000MW.

Gas-fired power

Gas-fired power stations typically emit around half as much CO

2

as

conventional coal-fired plants.

We operate a 776MW gas-fired power generation facility and an

associated LNG regasification facility at Bilbao, Spain (BP 25% share in

each) and a 750MW co-generation plant at Texas City, US (50:50 joint

venture with Cinergy Solutions, Inc.), which supplies power and steam to

BP’s largest refining and petrochemicals complex. BP supplies natural gas

to the Texas City plant and will use excess generation capacity to support

power marketing and trading activities. Also, a 50MW co-generation plant

near Southampton, UK (BP 100%), has been in operation since the first

half of 2005. The construction of K-Power’s (BP 35%) 1,074MW gas-fired

combined cycle power plant at Kwangyang, Korea, was completed and

full commercial operations started in the second quarter of 2006.

We have started construction of a new 250MW steam turbine power

generating plant at the Texas City refinery site, which is expected to bring

the total capacity of the site to 1,000MW when completed in 2008. We

also plan to construct a 520MW co-generation facility at Cherry Point,

Washington, US.

Hydrogen power

During 2006, we announced a new strategic relationship with General

Electric to accelerate the development of hydrogen power technology and

the deployment of the concept. Progress on our proposed hydrogen plant

at Carson, California, US, continued and we were awarded $90 million in

US Federal Investment credits.

BP Annual Report and Accounts 2006 37