BP 2006 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.technical and commercial evaluations, including appraisal drilling. Our

most significant discoveries in 2006 included the following:

– In Angola, we made further discoveries in the ‘ultra deepwater’

(greater than 1,500 metres) in Block 31 (BP 26.7% and operator) with

Urano, Titania and Terra wells, bringing the total number of discoveries

in Block 31 to 12.

– In the deepwater Gulf of Mexico, we made a discovery with the

Kaskida well.

Reserves and production

BP manages its hydrocarbon resources in three major categories:

prospect inventory, non-proved resources and proved reserves. When a

discovery is made, volumes usually transfer from the prospect inventory

to the non-proved resource category. The resources move through

various non-proved resource sub-categories as their technical and

commercial maturity increases through appraisal activity.

Resources in a field will only be categorized as proved reserves when

all the criteria for attribution of proved status have been met, including

an internally imposed requirement for project sanction or for sanction

expected within six months and, for additional reserves in existing fields,

the requirement that the reserves be included in the business plan and

scheduled for development, typically within three years. Where, on

occasion, the group decides to book reserves where development is

scheduled to commence beyond three years, these reserves will be

booked only where they satisfy the SEC’s criteria for attribution of proved

status. Internal approval and final investment decision are what we refer

to as project sanction.

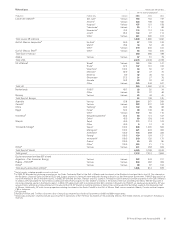

At the point of sanction, all booked reserves will be categorized as

proved undeveloped (PUD). Volumes will subsequently be recategorized

from PUD to proved developed (PD) as a consequence of development

activity. When part of a well’s reserves depends on a later phase of

activity, only that portion of reserves associated with existing, available

facilities and infrastructure moves to PD. The first PD bookings will occur

at the point of first oil or gas production. Major development projects

typically take one to four years from the time of initial booking to the

start of production. Changes to reserves bookings may be made due

to analysis of new or existing data concerning production, reservoir

performance, commercial factors, acquisition and divestment activity and

additional reservoir development activity.

BP has an internal process to control the quality of reserves bookings

that forms part of a holistic and integrated system of internal control. BP’s

process to manage reserves bookings has been centrally controlled for

more than 15 years and it currently has several key elements.

The first element is the accountabilities of certain officers of the

company to ensure that there are effective controls in the proved

reserves verification and approval process of the group’s reserves

estimates and the timely reporting of the related financial impacts of

proved reserves changes. These officers of the company are responsible

for carrying out verification of proved reserves estimates and are

independent of the operating business unit to ensure integrity and

accuracy of reporting.

The second element is the capital allocation processes whereby

delegated authority is exercised to commit to capital projects that are

consistent with the delivery of the group’s business plan. A formal review

process exists to ensure that both technical and commercial criteria are

met prior to the commitment of capital to projects.

The third element is Internal Audit, whose role includes systematically

examining the effectiveness of the group’s financial controls designed

to assure the reliability of reporting and safeguarding of assets and

examining the group’s compliance with laws, regulations and internal

standards.

The fourth element is a quarterly due diligence review, which is

separate and independent from the operating business units, of proved

reserves associated with properties where technical, operational or

commercial issues have arisen.

The fifth element is the established criteria whereby proved

reserves changes above certain thresholds require central authorization.

Furthermore, the volumes booked under these authorization levels are

reviewed on a periodic basis. The frequency of review is determined

according to field size and ensures that more than 80% of the BP

reserves base undergoes central review every two years and more than

90% is reviewed every four years.

For the executive directors and senior management, no specific portion

of compensation bonuses is directly related to oil and gas reserves

targets. Additions to proved reserves is one of several indicators by which

the performance of the Exploration and Production business segment

is assessed by the remuneration committee for the purposes of

determining compensation bonuses for the executive directors and senior

management. Other indicators include a number of financial and

operational measures.

BP’s variable pay programme for the other senior managers in the

Exploration and Production business segment is based on individual

performance contracts. Individual performance contracts are based on

agreed items from the business performance plan, one of which, if they

choose, could relate to oil and gas reserves.

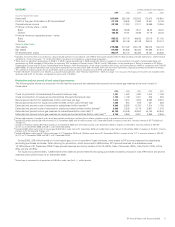

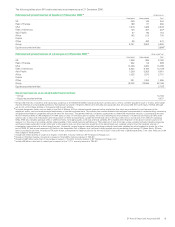

Details of our net proved reserves of crude oil, condensate, natural

gas liquids and natural gas at 31 December 2006, 2005 and 2004 and

reserves changes for each of the three years then ended are set out in

the Supplementary information on oil and natural gas section beginning on

page 196. We separately disclose our share of reserves held in equity-

accounted companies (jointly controlled entities and associates), although

we do not control these entities or the assets held by such entities.

All the group’s oil and gas reserves held in consolidated companies

have been estimated by the group’s petroleum engineers. Of the

equity-accounted volumes in 2006, 17% were based on estimates

prepared by group petroleum engineers and 83% were based on

estimates prepared by independent engineering consultants, although

all the group’s oil and gas reserves held in equity-accounted companies

are reviewed by the group’s petroleum engineers before making the

assessment of volumes to be booked by BP.

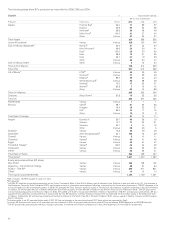

Our proved reserves are associated with both concessions (tax and

royalty arrangements) and production-sharing agreements (PSAs). In

a concession, the consortium of which we are a part is entitled to the

reserves that can be produced over the licence period, which may be the

life of the field. In a PSA, we are entitled to recover volumes that equate

to costs incurred to develop and produce the reserves and an agreed

share of the remaining volumes or the economic equivalent. As part

of our entitlement is driven by the monetary amount of costs to be

recovered, price fluctuations will have an impact on both production

volumes and reserves. Fifteen per cent of our proved reserves are

associated with PSAs. The main countries in which we operate under

PSAs are Algeria, Angola, Azerbaijan, Egypt, Indonesia and Vietnam.

At the end of 2006, BP adopted the SEC rules for estimating reserves

for all accounting and reporting purposes. Previously, BP applied the UK

accounting rules contained in the Statement of Recommended Practice

‘Accounting for Oil and Gas Exploration, Development, Production and

Decommissioning Activities’ (UK SORP). These changes are explained in

Financial statements – Note 3 on page 110. The company’s proved

reserves estimates for the year ended 31 December 2006 reflect

year-end prices and application of SEC interpretations of SEC regulations

relating to the use of technology (mainly seismic) to estimate reserves in

the reservoir away from wellbores and the reporting of fuel gas (i.e. gas

used for fuel in operations on the lease) within proved reserves.

Consequently, these reserves quantities differ from those that would

be reported under application of the UK SORP. The 2006 year-end

marker prices used were Brent $58.93/bbl (2005 $58.21/bbl and 2004

$40.24/bbl) and Henry Hub $5.52/mmBtu (2005 $9.52/mmBtu and

2004 $6.01/mmBtu). The other 2006 movements in proved reserves

are reflected in the tables showing movements in oil and gas reserves

by region in Financial statements – Supplementary information on oil

and natural gas on pages 196-197.

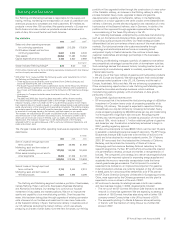

Total hydrocarbon proved reserves, on an oil equivalent basis and

excluding equity-accounted entities, comprised 13,163mmboe at

31 December 2006, a decrease of 6.1% compared with 31 December

2005. Natural gas represents about 55% of these reserves. This reduction

includes net sales of 227mmboe, largely comprising a number of assets

in Latin America, the UK and the US.

The proved reserves replacement ratio, excluding equity-accounted

entities, was 34% (2005 68% and 2004 78%). The proved reserves

replacement ratio (also known as the production replacement ratio) is the

extent to which production is replaced by proved reserves additions. This

BP Annual Report and Accounts 2006 17