BP 2006 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 189

53 US GAAP reconciliation continued

(m) Major maintenance expenditure

For the purposes of US GAAP reporting, prior to 1 January 2005, the group capitalized expenditures on maintenance, refits or repairs where it enhanced

or restored the performance of an asset, or replaced an asset or part of an asset that was separately depreciated. This included other elements of

expenditure incurred during major plant maintenance shutdowns, such as overhaul costs.

With effect from 1 January 2005, the group changed its US GAAP accounting policy to expense the part of major maintenance that represents

overhaul costs and similar major maintenance expenditure as incurred. The effect of this accounting change for US GAAP reporting is reflected as a

cumulative effect of an accounting change for the year ended 31 December 2005 of $794 million (net of tax benefits of $354 million). This adjustment is

equal to the net book value of capitalized overhaul costs as of 1 January 2005 as reported under US GAAP. This new accounting policy reflects the

policy applied under IFRS for all periods presented. As a result, a difference between IFRS and US GAAP exists for periods prior to 1 January 2005

which reflects the capitalization of overhaul costs net of the related depreciation charge as calculated under US GAAP.

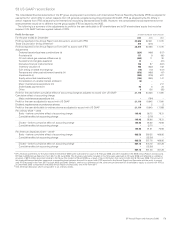

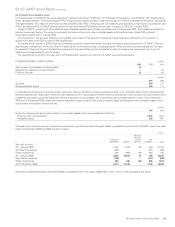

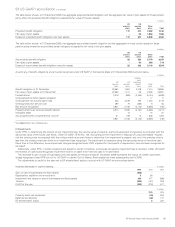

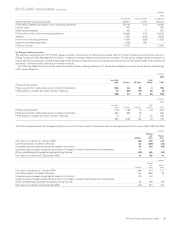

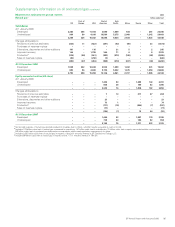

The adjustments to profit for the year to accord with US GAAP are summarized below.

Increase (decrease) in caption heading $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Production and manufacturing expenses –– (586)

Depreciation, depletion and amortization ––296

Taxation ––73

Profit for the year before cumulative effect of accounting change ––217

Cumulative effect of accounting change –(794) –

Profit for the year –(794) 217

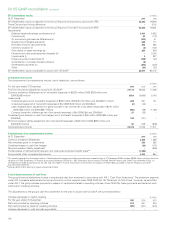

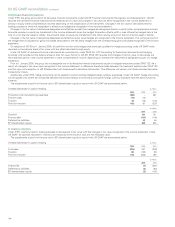

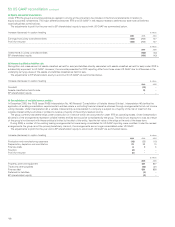

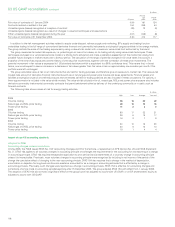

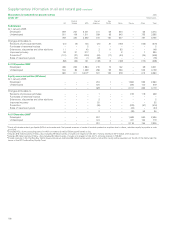

The following pro forma information summarizes the profit for the year assuming the change in accounting for major maintenance expenditure was

applied retrospectively with effect from 1 January 2004.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2005a2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Profit for the year attributable to ordinary shares as adjusted to accord with US GAAP

As reported 19,640 17,088

Pro forma 20,434 16,871

Per ordinary share – cents

Basic – as reported 92.96 78.31

Basic – pro forma 96.72 77.32

Diluted – as reported 91.90 76.88

Diluted – pro forma 95.61 75.97

Per American depositary share – cents

Basic – as reported 557.76 469.86

Basic – pro forma 580.32 463.92

Diluted – as reported 551.40 461.28

Diluted – pro forma 573.66 455.82

aPro forma data for the year ended 31 December 2005 excludes the cumulative effect of adoption.

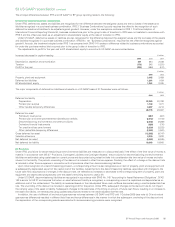

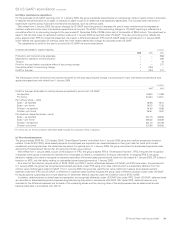

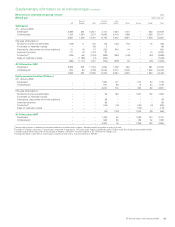

(n) Share-based payments

The group adopted SFAS No. 123 (revised 2004), ‘Share-Based Payment’ with effect from 1 January 2005 using the modified prospective transition

method. Under SFAS 123(R), share-based payments to employees are required to be measured based on their grant date fair value (with limited

exceptions) and recognized over the related service period. For periods prior to 1 January 2005, the group accounted for share-based payments under

Accounting Principles Board Opinion No. 25 using the intrinsic value method.

With effect from 1 January 2005, as part of the adoption of IFRS, the group adopted IFRS 2 ‘Share-based Payment’. IFRS 2 requires the recognition

of expense when goods or services are received from employees or others in consideration for equity instruments. In adopting IFRS 2, the group

elected to restate prior years to recognize an expense associated with share-based payments that were not fully vested at 1 January 2003, BP’s date of

transition to IFRS, and the liability relating to cash-settled share-based payments at 1 January 2003.

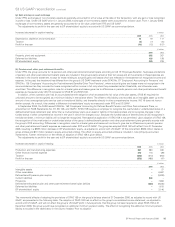

As a result of the transition requirements of SFAS 123(R) and IFRS 2, certain differences between US GAAP and IFRS have arisen. For periods prior

to 1 January 2005, the group has recognized share-based payments under IFRS using a fair value method which is substantially different from the

intrinsic value method used under US GAAP. From 1 January 2005, the group has used the fair value method to measure share-based payment

expense under both IFRS and US GAAP. A difference in expense exists however because the group uses a different valuation model under US GAAP

for issued options outstanding and not yet vested at 31 December 2004 as required under the transition rules of SFAS 123(R).

In addition, deferred taxes on share-based compensation are recognized differently under US GAAP than under IFRS. Under US GAAP, deferred taxes

are recorded on share-based payment expense recognized during the period in accordance with SFAS 109. Under IFRS, deferred taxes are only

recorded on the difference between the tax base of the underlying shares and the carrying value of the employee services as determined at each

balance sheet date in accordance with IAS 12.