BP 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

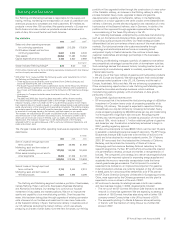

The following table shows BP’s Aromatics and Acetyls production capacity at 31 December 2006. This production capacity is based on the original

design capacity of the plants plus expansions.

thousand tonnes per year

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Geographic area PTA PX

Acetic

acid Other

Total – BP

share of

capacity

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

UK

Hull 529 633 1,162

Rest of Europe

Belgium

Geel 1,076 552 1,628

USA

Cooper River 1,309 1,309

Decatur 1,043 1,145 29 2,217

Texas City 1,309 543a123 1,975

Rest of World

China

Chongqing 202b52 254 (51% of YARACO)b

Zhuhai 582 582

Indonesia

Merak 252 252 (50% of PT Ami)

Korea

Ulsan 553c242d57e852 (47% of SPC)c

(34% of ASACCO)e

(51% of SS-BP)d

Seosan 353c353 (47% of SPC)c

Malaysia

Kertih 545 545

Kuantan 699 699

Taiwan

Kaohsiung 822f822 (61% of CAPCO)f

Taichung 457f457 (61% of CAPCO)f

Mai Liao 153g153 (50% of FBPC)g

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

7,146 3,006 2,214 894 13,260

aSterling Chemicals plant, the output of which is marketed by BP.

bYangtze River Acetyls Company.

cSamsung-Petrochemicals Company Ltd.

dSamsung-BP Chemicals Ltd.

eAsian Acetyls Company Ltd.

fChina American Petrochemical Company Ltd.

gFormosa BP Chemicals Corporation.

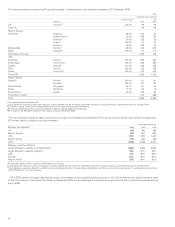

In addition to the plans for a second PTA plant at the BP Zhuhai Chemical

Company Limited site in Guandong province, China, described previously,

the following portfolio activity took place in the Aromatics and Acetyls

business during the year:

– In the third quarter of 2006, BP announced its intent to sell its 47.41%

equity interest in Samsung Petrochemical Co. Ltd (SPC), a PTA joint

venture with Samsung in South Korea.

– In 2004, BP announced the phased closure of two acetic acid plants at

Hull, UK. The first plant was shut down in the second quarter of 2005

and the remaining plant was shut down in the third quarter of 2006.

– The development of a 350 thousand tonnes per annum (ktepa) PTA

expansion at Geel, Belgium, is expected to be operational in early 2008

and to increase the site’s PTA capacity to 1,426ktepa.

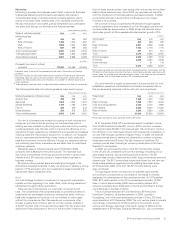

Supply and trading

The group has a long-established supply and trading activity responsible

for delivering value across the overall crude and oil products supply chain.

This activity identifies the best markets and prices for our crude oil,

sources optimal feedstock to our refining assets and sources marketing

activities with flexible and competitive supply. Additionally, the function

creates incremental trading gains through holding commodity derivative

contracts and trading inventory. To achieve these objectives in a liquid and

volatile international market, the group enters into a range of commodity

derivative contracts, including exchange traded futures and options, over-

the-counter options, swaps and forward contracts as well as physical

term and spot contracts.

Exchange traded contracts are traded on liquid regulated markets that

transact in key crude grades, such as Brent and West Texas Intermediate,

and the main product grades, such as gasoline and gasoil. These

exchanges exist in each of the key markets in the US, western Europe

and the Far East. Over-the-counter contracts include a variety of options,

forwards and swaps. These swaps price in relation to a wider set of

grades than those traded through the exchanges, where counterparties

contract for differences between, for example, fixed and floating prices.

The contracts we use are described in more detail below. Additionally,

physical crude can be traded forward by using specific over-the-counter

contracts pricing in reference to Brent and West Texas Intermediate

grades. Over-the-counter crude forward sales contracts are used by BP to

buy and sell the underlying physical commodity, as well as to act as a risk

management and trading instrument.

Risk management is undertaken when the group is exposed to market

risk, primarily due to the timing of sales and purchases, which may occur

for both commercial and operational reasons. For example, if the group

has delayed a purchase and has a lower than normal inventory level, the

associated price exposure may be limited by taking an offsetting position

in the most suitable commodity derivative contract described above.

Where trading is undertaken, the group actively combines a range of

derivative contracts and physical positions to create incremental trading

gains by arbitraging prices, typically between locations and time periods.

This range of contract types includes futures, swaps, options and forward

sale and purchase contracts, which are described further below. The

volume of activity in 2006 was similar to 2005.

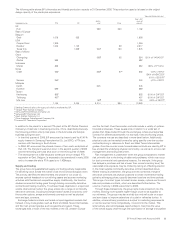

Through these transactions, the group sells crude production into the

market, allowing more suitable higher-margin crude to be supplied to

our refineries. The group may also actively buy and sell crude on a spot

and term basis to improve selections of crude for refineries further. In

addition, where refinery production is surplus to marketing requirements

or can be sourced more competitively, it is sold into the market. This

latter activity also encompasses opportunities to maximize the value

of the whole supply chain through the optimization of storage and pipeline

BP Annual Report and Accounts 2006 33