BP 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

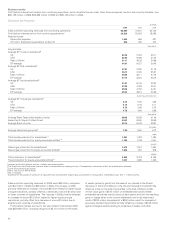

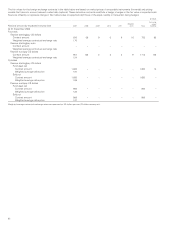

Environmental expenditure

$million

--------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

--------------------------------------------------------------------------------------------------------------------------------------------------

Operating expenditure 596 494 526

Clean-ups 59 43 25

Capital expenditure 806 789 524

Additions to environmental

remediation provision 423 565 587

Additions to decommissioning

provision 2,142 1,023 286

Operating and capital expenditure on the prevention, control, abatement

or elimination of air, water and solid waste pollution is often not incurred

as a separately identifiable transaction. Instead, it forms part of a larger

transaction that includes, for example, normal maintenance expenditure.

The figures for environmental operating and capital expenditure in the

table are therefore estimates, based on the definitions and guidelines of

the American Petroleum Institute.

The increase in environmental operating expenditure in 2006 is largely

related to expenditure incurred on reducing air emissions at US refineries.

The increase in capital expenditure in 2005 compared with 2004 is largely

related to clean fuels investment. Similar levels of operating and capital

expenditures are expected in the foreseeable future. In addition to

operating and capital expenditures, we also create provisions for future

environmental remediation. Expenditure against such provisions is

normally in subsequent periods and is not included in environmental

operating expenditure reported for such periods. The charge for

environmental remediation provisions in 2006 includes $378 million

resulting from a reassessment of existing site obligations and $45 million

in respect of provisions for new sites.

Provisions for environmental remediation are made when a clean-up is

probable and the amount reasonably determinable. Generally, their timing

coincides with commitment to a formal plan of action or, if earlier, on

divestment or on closure of inactive sites.

The extent and cost of future remediation programmes are inherently

difficult to estimate. They depend on the scale of any possible

contamination, the timing and extent of corrective actions and also the

group’s share of liability. Although the cost of any future remediation

could be significant and may be material to the result of operations in the

period in which it is recognized, we do not expect that such costs will

have a material effect on the group’s financial position or liquidity. We

believe our provisions are sufficient for known requirements; and we do

not believe that our costs will differ significantly from those of other

companies engaged in similar industries, or that our competitive position

will be adversely affected as a result.

In addition, we make provisions on installation of our oil- and gas-

producing assets and related pipelines to meet the cost of eventual

decommissioning. On installation of an oil or natural gas production facility

a provision is established which represents the discounted value of the

expected future cost of decommissioning the asset. Additionally, we

undertake periodic reviews of existing provisions. These reviews take

account of revised cost assumptions, changes in decommissioning

requirements and any technological developments. The level of increase

in the decommissioning provision varies with the number of new fields

coming on stream in a particular year and the outcome of the periodic

reviews.

Provisions for environmental remediation and decommissioning are

usually set up on a discounted basis, as required by IAS 37 ‘Provisions,

Contingent Liabilities and Contingent Assets’.

Further details of decommissioning and environmental provisions

appear in Financial statements – Note 40 on page 152. See also

Environmental protection on page 42.

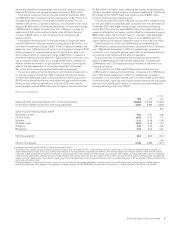

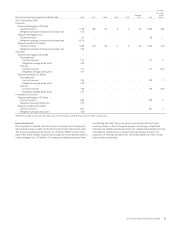

Liquidity and capital resources

Cash flow

The following table summarizes the group’s cash flows.

$million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net cash provided by operating activities of continuing operations 28,172 25,751 24,047

Net cash provided by (used in) operating activities of Innovene operations –970 (669)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net cash provided by operating activities 28,172 26,721 23,378

Net cash used in investing activities (9,518) (1,729) (11,331)

Net cash used in financing activities (19,071) (23,303) (12,835)

Currency translation differences relating to cash and cash equivalents 47 (88) 91

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Increase (decrease) in cash and cash equivalents (370) 1,601 (697)

Cash and cash equivalents at beginning of year 2,960 1,359 2,056

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Cash and cash equivalents at end of year 2,590 2,960 1,359

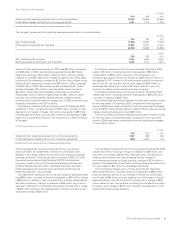

Net cash provided by operating activities for the year ended

31 December 2006 was $28,172 million, compared with $26,721 million

for the equivalent period of 2005, reflecting a decrease in working capital

requirements of $4,817 million, an increase in profit before taxation from

continuing operations of $2,721 million and an increase in dividends from

jointly controlled entities and associates of $1,662 million, partially offset

by an increase in income taxes paid of $4,705 million and a higher net

credit for impairment and gain/loss on sale of businesses and fixed assets

of $2,095 million.

Net cash provided by operating activities for the year ended

31 December 2005 was $26,721 million compared with $23,378 million

for the equivalent period of 2004, reflecting an increase in profit before

taxation from continuing operations of $6,955 million, an increase in

net cash provided by operating activities of Innovene of $1,639 million,

a lower charge for provisions, less payments of $710 million and an

increase in dividends received from jointly controlled entities and

associates of $634 million. This was partially offset by an increase in

income taxes paid of $2,640 million, an increase of $1,320 million in

working capital requirements, an increase in earnings from jointly

controlled entities and associates of $1,263 million, a higher net credit for

impairment and gain/loss on sale of businesses and fixed assets of

$775 million, an increase in interest paid of $429 million and an increase in

the net operating charge for pensions and other post-retirement benefits,

less contributions of $351 million.

Net cash used in investing activities was $9,518 million in 2006,

compared with $1,729 million and $11,331 in 2005 and 2004. The

increase in 2006 reflected a reduction in disposal proceeds of

$4,946 million and an increase in capital expenditure of $2,844 million.

The reduction in 2005 compared with 2004 reflected an increase in

disposal proceeds of $6,239 million, primarily from the sale of Innovene,

and a decrease in spending on acquisitions of $2,693 million.

54