BP 2006 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BP Annual Report and Accounts 2006 193

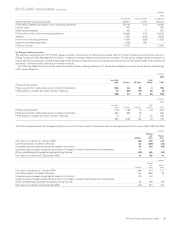

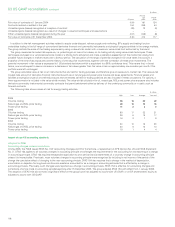

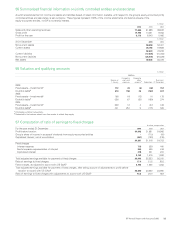

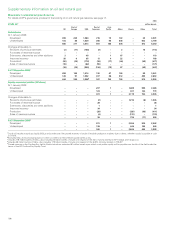

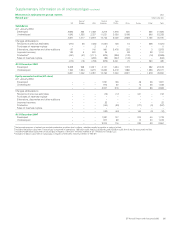

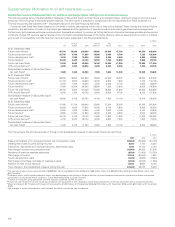

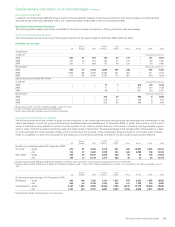

53 US GAAP reconciliation continued

Revenue

In September 2005, the FASB ratified the consensus reached by the EITF regarding Issue No. 04-13 ‘Accounting for Purchases and Sales of Inventory

with the Same Counterparty’. EITF 04-13 addresses accounting issues that arise when a company both sells inventory to and buys inventory from

another entity in the same line of business. The purchase and sale transactions may be pursuant to a single contractual arrangement or separate

contractual arrangements and the inventory purchased or sold may be in the form of raw material, work-in-process or finished goods. At issue is

whether the revenue, inventory cost and cost of sales should be recorded at fair value or whether the transactions should be classified as non-monetary

transactions. EITF 04-13 requires purchases and sales of inventory with the same counterparty that are entered into in contemplation of one another be

combined and recorded as exchanges measured at the book value of the item sold. EITF 04-13 is effective for new arrangements entered into and

modifications or renewals of existing arrangements in accounting periods beginning after 15 March 2006. The group adopted EITF 04-13 with effect

from 1 January 2006. The adoption of EITF 04-13 did not have a significant effect on the group’s profit as adjusted to accord with US GAAP, or on BP

shareholders’ equity as adjusted to accord with US GAAP.

Share-based payments

In February 2006, the FASB issued Staff Position No. FAS 123(R)-4 ‘Classification of Options and Similar Instruments Issued as Employee Compensation

That Allow for Cash Settlement upon the Occurrence of a Contingent Event’. FSP 123(R)-4 clarifies the classification of options and similar instruments

issued as employee compensation that allow for cash settlement upon the occurrence of a contingent event. Under FSP 123(R)-4, an option or similar

instrument with a contingent cash settlement provision is classified as an equity award provided that the contingent event that permits or requires cash

settlement is not considered probable of occurring, the contingent event is not within the control of the employee and the award includes no other features

that would require liability classification. For entities that adopted SFAS 123(R) prior to the issuance of FSP 123(R)-4, FSP 123(R)-4 is effective for accounting

periods beginning after 3 February 2006. The group adopted FSP 123(R)-4 with effect from 1 January 2006. The adoption of FSP 123(R)-4 did not have a

significant effect on the group’s profit as adjusted to accord with US GAAP, or on BP shareholders’ equity as adjusted to accord with US GAAP.

Consolidation of variable interest entities

In April 2006, the FASB issued Staff Position No. FIN 46(R)-6, ‘Determining the Variability to Be Considered in Applying FASB Interpretation No. 46(R)’.

FSP 46(R)-6 clarifies how variability should be considered in applying FIN 46(R). Variability is used in applying FIN 46(R) to determine whether an entity is

a variable interest entity, which interests are variable interests in the entity, and who is the primary beneficiary of the variable interest entity. Under FSP

46(R)-6, the variability to be considered in applying FIN 46(R)-6 is based on the design of the entity, the nature and risks of the entity and the purpose for

which entity was created. FSP 46(R)-6 is effective for accounting periods beginning after 15 June 2006. The group adopted FSP 46(R)-6 with effect from

1 July 2006. The adoption of FSP 46(R)-6 did not have a significant effect on the group’s profit as adjusted to accord with US GAAP, or on BP

shareholders’ equity as adjusted to accord with US GAAP.

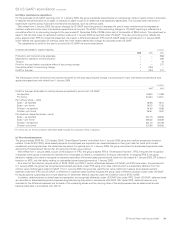

Pensions and other post-retirement benefits

In September 2006, the FASB issued SFAS No. 158 ‘Employers’ Accounting for Defined Benefit Pension and Other Post-retirement Plans, an

amendment of FASB Statements No. 87, 88, 106, and 132(R)’. SFAS 158 requires an employer to recognize the overfunded or underfunded status of a

defined benefit post-retirement plan (other than a multi-employer plan) as an asset or liability in the balance sheet and to recognize changes in that

funded status in other comprehensive income in the year in which the changes occur. The group adopted SFAS 158 with effect from 31 December

2006, resulting in a $599 million decrease in BP shareholders’ equity, as adjusted to accord with US GAAP. Of this total effect, $586 million relates to

group entities and $13 million relates to equity-accounted entities. Further information on the effects of adoption of SFAS 158 is provided in note (h)

Pensions and other post-retirement benefits.

Financial statement misstatements

In September 2006, the staff of the SEC issued Staff Accounting Bulletin No. 108, ‘Considering the Effects of Prior Year Misstatements when Quantifying

Misstatements in Current Year Financial Statements’. SAB 108 was issued to address the diversity in practice in quantifying misstatements from prioryears

and assessing their effect on current year financial statements. SAB 108 is effective for fiscal years ending after 15 November 2006. The adoption of SAB 108

did not have a significant effect on the group’s profit as adjusted to accord with US GAAP, or on BP shareholders’ equity as adjusted to accord with US GAAP.

Not yet adopted

Financial instruments

In February 2006, the FASB issued SFAS No. 155, ‘Accounting for Certain Hybrid Financial Instruments – an amendment of FASB Statements No. 133

and 140’. SFAS 155 simplifies the accounting for certain hybrid financial instruments under SFAS 133 by permitting fair value remeasurement for

financial instruments containing an embedded derivative that otherwise would require separation of the derivative from the financial instrument. SFAS

155 is effective for all financial instruments acquired, issued or subject to a remeasurement event occurring in fiscal years beginning after 15 September

2006. The adoption of SFAS 155 is not expected to have a significant effect on the group’s profit as adjusted to accord with US GAAP, or on BP

shareholders’ equity as adjusted to accord with US GAAP.

Taxes collected from customers

In June 2006, the FASB ratified the consensus reached by the EITF regarding Issue No. 06-3 ‘How Taxes Collected from Customers and Remitted to

Governmental Authorities Should Be Presented in the Income Statement (That Is, Gross versus Net Presentation)’. Under EITF 06-3, taxes collected

from customers and remitted to governmental authorities can be presented either gross within revenue and cost of sales, or net. Where such taxes are

significant, EITF 06-3 requires disclosure of the accounting policy for presenting taxes and the amount of any such taxes that are recognized on a gross

basis. EITF 06-3 is effective for accounting periods beginning after 15 December 2006. The group has not yet adopted EITF 06-3. The group’s

accounting policy with regard to taxes collected from customers and remitted to governmental authorities is to present such taxes net in the income

statement, and as a result the adoption of EITF 06-3 will not have any impact.