BP 2006 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 169

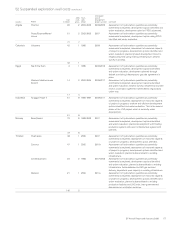

49 First-time adoption of International Financial Reporting Standards continued

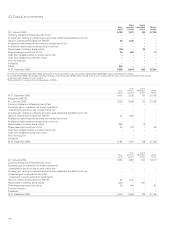

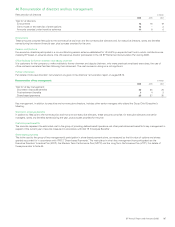

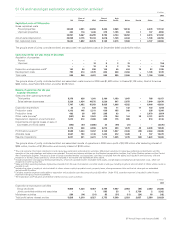

The reconciliation set out below shows the adjustments to the group balance sheet at 1 January 2005 on the adoption of IAS 32 and IAS 39.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Group balance sheet reconcilation $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

IFRS at

31 December

2004

Fair value

hedges

Cash flow

hedges

Non-

qualifying

hedge

derivatives

Other

non-

financial

contracts

at fair

value

Other

non-

financial

contracts

no longer

at fair value

Available-

for-sale

financial

assets

Embedded

derivatives

Elimination

of

deferred

gains/

losses

Total

IAS 39

adjustments

IFRS at

1January

2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Non-current assets

Property, plant and equipment 93,092–––––––– –93,092

Goodwill 10,857–––––––– –10,857

Intangible assets 4,205–––––––– –4,205

Investments in jointly controlled entities 14,556–––––––– –14,556

Investments in associates 5,486–––––––– –5,486

Other investments 394–––––344––344738

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Fixed assets 128,590–––––344––344128,934

Loans 811–––––––– –811

Other receivables 429–––––––– –429

Derivative financial instruments 898 112 79 8 110 (34) – 599 (147) 727 1,625

Prepayments and accrued income 354–––––––– –354

Defined benefit pension plan surplus 2,105–––––––– –2,105

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

133,187 112 79 8 110 (34) 344 599 (147) 1,071 134,258

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Current assets

Loans 193–––––––– –193

Inventories 15,645–––––––– –15,645

Trade and other receivables 37,099–(2)––––––(2)37,097

Derivative financial instruments 5,317 – 141 178 34 47 – 278 – 678 5,995

Prepayments and accrued income 1,671–––––––– –1,671

Current tax receivable 159–––––––– –159

Cash and cash equivalents 1,359–––––––– –1,359

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

61,443 – 139 178 34 47 – 278 – 676 62,119

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total assets 194,630 112 218 186 144 13 344 877 (147) 1,747 196,377

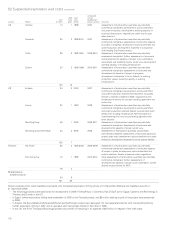

Current liabilities

Trade and other payables 38,540–––––––– –38,540

Derivative financial instruments 5,074 – 16 210 14 – – 402 – 642 5,716

Accruals and deferred income 4,482–––––––– –4,482

Finance debt 10,184–––––––– –10,184

Current tax payable 4,131–––––––– –4,131

Provisions 715–––––––– –715

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

63,126 – 16 210 14 – – 402 – 642 63,768

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Non-current liabilities

Other payables 3,581–––––––– –3,581

Derivative financial instruments 158 129 4 17 12 – – 1,151 – 1,313 1,471

Accruals and deferred income 699–––––––– –699

Finance debt 12,907(17)––––––16414713,054

Deferred tax liabilities 16,701 – 60 (13) 44 5 114 (267) (55) (112) 16,589

Provisions 8,884–––––––– –8,884

Defined benefit pension plan and other

post-retirement benefit plan deficits 10,339–––––––– –10,339

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

53,269 112 64 4 56 5 114 884 109 1,348 54,617

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total liabilities 116,395 112 80 214 70 5 114 1,286 109 1,990 118,385

Net assets 78,235 – 138 (28) 74 8 230 (409) (256) (243) 77,992

BP shareholders’ equity 76,892 – 138 (28) 74 8 230 (409) (256) (243) 76,649

Minority interest 1,343–––––––– –1,343

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total equity 78,235 – 138 (28) 74 8 230 (409) (256) (243) 77,992

The fair values of embedded derivatives are included within non-current and current derivative financial instruments on the group balance sheet as this

is believed to be the most appropriate presentation. Previously, these balances were reported within non-current and current prepayments and accrued

income and accruals and deferred income.