BP 2006 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BP Annual Report and Accounts 2006 149

37 Derivative financial instruments (UK GAAP) continued

The group calculates value at risk on all instruments that are held for trading purposes and that therefore give an exposure to market risk. The value-

at-risk model takes account of derivative financial instruments such as interest rate forward and futures contracts, swap agreements, options and

swaptions; foreign exchange forward and futures contracts, swap agreements and options; and oil, natural gas and power price futures, swap

agreements and options. Financial assets and liabilities and physical crude oil and refined products that are treated as trading positions are also included

in these calculations. The value-at-risk calculation for oil, natural gas and power price exposure also includes cash-settled commodity contracts such as

forward contracts.

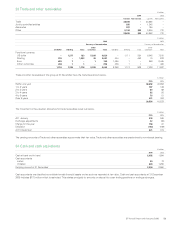

The following table shows values at risk for trading activities.

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

High Low Average Year end

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Interest rate trading 1–––

Foreign exchange trading 4111

Oil price trading 55 18 29 45

Natural gas price trading 23 6 13 10

Power price trading 10144

The presentation of trading results shown in the table below includes certain activities of BP’s trading units that involve the use of derivative financial

instruments in conjunction with physical and paper trading of oil, natural gas and power. It is considered that a more comprehensive representation of

the group’s oil, natural gas and power price trading activities is given by aggregating the gain or loss on such derivatives together with the gain or loss

arising from the physical and paper trades to which they relate, representing the net result of the trading portfolio.

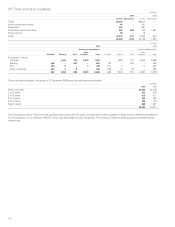

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net gain (loss)

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Interest rate trading 4

Foreign exchange trading 136

Oil price trading 1,371

Natural gas price trading 461

Power price trading 160

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2,132

38 Finance debt

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Within

1 yearaAfter

1year Total

Within

1 yearaAfter

1 year Total

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Bank loans 543 806 1,349 155 547 702

Other loans 12,321 9,525 21,846 8,717 8,962 17,679

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total borrowings 12,864 10,331 23,195 8,872 9,509 18,381

Net obligations under finance leases 60 755 815 60 721 781

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

12,924 11,086 24,010 8,932 10,230 19,162

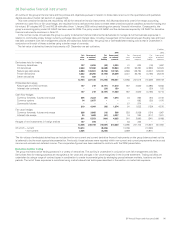

aAmounts due within one year include current maturities of long-term debt.

Included within Other loans repayable within one year above are US Industrial Revenue/Municipal Bonds of $2,744 million (2005 $2,462 million) with

maturity periods ranging from 1 to 34 years. They are classified as repayable within one year as the bondholders typically have the option to tender

these bonds for repayment on interest reset dates. Any bonds that are tendered are usually remarketed and BP has not experienced any significant

repurchases. BP considers these bonds to represent long-term funding when assessing the maturity profile of its finance debt and they are reflected as

such in the borrowings repayment schedule below. Similar treatment is applied for loans associated with long-term gas supply contracts totalling

$1,976 million (2005 $992 million) that mature over 10 years.

At 31 December 2006, the group had substantial amounts of undrawn borrowing facilities available, including committed facilities of $4,700 million,of

which $4,300 million are in place for at least 5 years (2005 $4,500 million all expiring in 2006). These facilities are with a number of international banks

and borrowings under them would be at pre-agreed rates. Certain of these facilities support the group’s commercial paper programme.

At 31 December 2006, the group’s share of third-party finance debt of jointly controlled entities and associates was $4,942 million

(2005 $3,266 million) and $1,143 million (2005 $970 million) respectively. These amounts are not reflected in the group’s debt on the balance sheet.

We have in place a European Debt Issuance Programme (DIP) under which the group may raise $10 billion of debt for maturities of one month or

longer. At 31 December 2006 the amount drawn down against the DIP was $7,893 million. In addition, the group has in place a US Shelf Registration

under which it may raise $10 billion of debt with maturities of one month or longer. At 31 December 2006 there had not been any draw-down.