BP 2006 Annual Report Download - page 212

Download and view the complete annual report

Please find page 212 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

210

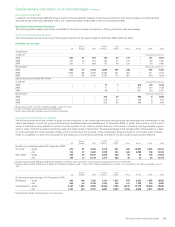

1 Accounting policies continued

Actuarial gains and losses may result from: differences between the expected return and the actual return on plan assets; differences between the

actuarial assumption underlying the plan liabilities and actual experience during the year; or changes in the actuarial assumptions used in the valuation of

the plan liabilities. Actuarial gains and losses, and taxation thereon, are recognized in the statement of total recognized gains and losses.

Deferred taxation

Deferred tax is recognized in respect of all timing differences that have originated but not reversed at the balance sheet date where transactions or

events have occurred at that date that will result in an obligation to pay more, or a right to pay less, tax in the future.

Deferred tax assets are recognized only to the extent that it is considered more likely than not that there will be suitable taxable profits from which

the underlying timing differences can be deducted.

Deferred tax is measured on an undiscounted basis at the tax rates that are expected to apply in the periods in which timing differences reverse,

based on tax rates and laws enacted or substantively enacted at the balance sheet date.

Use of estimates

The preparation of accounts in conformity with generally accepted accounting practice requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities at the date of the accounts and the reported amounts of revenues and expenses during the

reporting period. Actual outcomes could differ from these estimates.

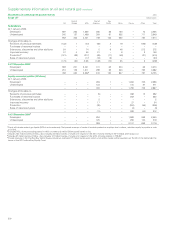

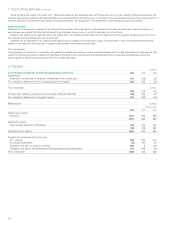

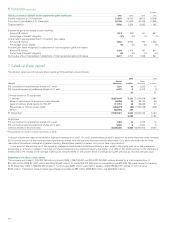

2 Taxation

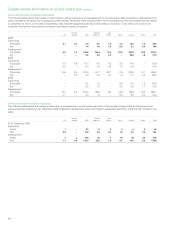

$ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Tax included in statement of total recognized gains and losses 2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Deferred tax

Origination and reversal of temporary differences in the current year 336 348 59

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Tax included in statement of total recognized gains and losses 336 348 59

This comprises: $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Actuarial gain relating to pensions and other post-retirement benefits 336 348 59

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Tax included in statement of changes in equity 336 348 59

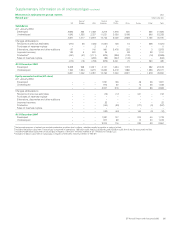

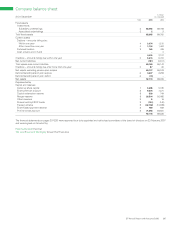

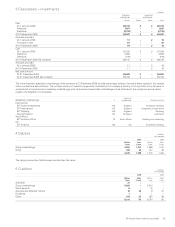

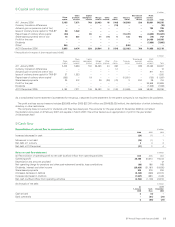

Deferred tax $ million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Balance sheet

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Deferred tax liability

Pensions 1,671 968 628

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

1,671 968 628

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Deferred tax asset

Other taxable temporary differences 165 436 362

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

165 436 362

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net deferred tax liability 1,506 532 266

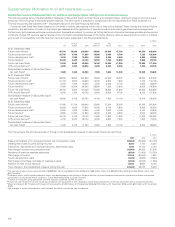

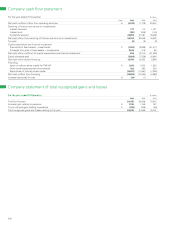

Analysis of movements during the year

At 1 January 532 265 213

Exchange adjustments (18) (87) 40

Charge for the year on ordinary activities 656 6(47)

Charge for the year in the statement of total recognized gains and losses 336 348 59

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

At 31 December 1,506 532 265