BP 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

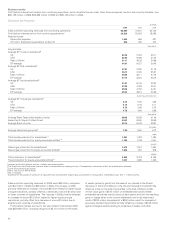

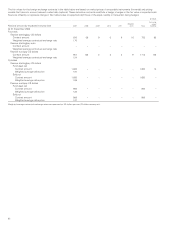

The changes in sales and other operating revenues are explained in more detail below.

$million

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2006 2005 2004

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Sale of crude oil through spot and term contracts 38,577 36,992 21,989

Marketing, spot and term sales of refined products 177,995 155,098 124,458

Other sales including non-oil and to other segments 16,283 21,236 24,192

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

232,855 213,326 170,639

mb/d

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Sale of crude oil through spot and term contracts 2,110 2,464 2,312

Marketing, spot and term sales of refined products 5,801 5,888 6,398

Sales and other operating revenues for 2006 was $233 billion, compared

with $213 billion in 2005 and $171 billion in 2004. The increase in 2006

compared with 2005 was principally due to an increase of around

$23 billion in marketing, spot and term sales of refined products. This

was due to higher prices of $25 billion, partially offset by lower volumes

of $2 billion. Additionally, sales of crude oil, spot and term contracts

increased by $2 billion, reflecting higher prices of $6 billion and lower

volumes of $4 billion, and other sales decreased by $5 billion, primarily

due to lower volumes. The increase in 2005 compared with 2004 was

principally due to an increase of around $31 billion in marketing, spot and

term sales of refined products. This reflected higher prices of $39 billion

and a positive foreign exchange impact due to a weaker dollar of $1 billion,

partially offset by lower volumes of $9 billion. Additionally, sales of crude

oil, spot and term contracts increased by $15 billion due to higher prices

of $13 billion and higher volumes of $2 billion and other sales decreased

by $3 billion, primarily due to lower volumes.

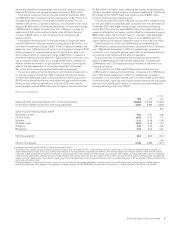

Profit before interest and tax for the year ended 31 December 2006

was $5,041 million, including net disposal gains of $884 million (related

primarily to the sale of BP’s Czech Republic retail business, the disposal

of BP’s shareholding in Zhenhai Refining and Chemicals Company, the

sale of BP’s shareholding in Eiffage, the French-based construction

company, and pipelines assets), and was after inventory holding losses of

$242 million, a charge of $925 million as a result of the ongoing review

of fatality and personal injury compensation claims associated with the

March 2005 incident at the Texas City refinery, an impairment charge of

$155 million, a charge of $155 million in respect of a donation to the BP

Foundation and a charge of $33 million relating to new, and revisions to

existing, environmental and other provisions.

Profit before interest and tax for the year ended 31 December 2005

was $6,926 million, including inventory holding gains of $2,532 million

and net gains of $177 million principally on the divestment of a number of

regional retail networks in the US, and is after a charge of $700 million

in respect of fatality and personal injury compensation claims associated

with the incident at the Texas City refinery, a charge of $140 million

relating to new, and revisions to existing, environmental and other

provisions, an impairment charge of $93 million and a charge of $33 million

for the impairment of an equity-accounted entity.

Profit before interest and tax for the year ended 31 December 2004

was $6,506 million, including inventory holding gains of $1,312 million,

and is after net losses on disposal of $267 million (principally related to

the closure of two manufacturing plants at Hull, UK, the disposal of our

European speciality intermediate chemicals business, the disposal of our

interest in the Singapore Refining Company Private Limited, the closure of

the lubricants operation of the Coryton refinery in the UK and of refining

operations at the ATAS refinery in Mersin, Turkey, and the sale of the

Cushing and other pipeline interests in the US), a charge of $206 million

related to new, and revisions to existing, environmental and other

provisions, a charge of $195 million for the impairment of the

petrochemicals facilities at Hull, UK, and a charge of $32 million for

restructuring, integration and rationalization.

The primary additional factors reflected in profit before interest and

tax for the year ended 31 December 2006 compared with the year

ended 31 December 2005 were a positive impact from IFRS fair value

accounting (compared with a negative impact in 2005), contributing

around $500 million, and lower costs associated with rationalization

programmes of around $320 million. In addition, refining margins,

including the benefits of supply optimization, were higher by some $400

million and retail margins were higher by around $600 million, although

this was partially offset by a deterioration of around $150 million in other

marketing margins. These factors were offset by a reduction of around

$1.1 billion due to the impact of the progressive recommissioning of

Texas City during the year. Efficiency programmes delivered lower

operating costs although the savings have been offset by higher

turnaround and integrity management spend.

The primary additional factors reflected in profit before interest and

tax for the year ended 31 December 2005, compared with the year ended

31 December 2004, were improved refining margins, contributing

approximately $2,000 million, offset by lower retail marketing margins,

reducing profits by approximately $720 million, a reduction of around

$870 million due to the shutdown of the Texas City refinery, along with

other storm-related supply disruptions to a number of our US-based

businesses, an adverse impact of around $400 million due to fair value

accounting for derivatives (see explanation below), a reduction of around

$430 million due to rationalization and efficiency programme charges,

mainly across our marketing activities in Europe.

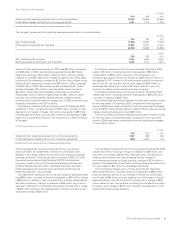

Where derivative instruments are used to manage certain economic

exposures that cannot themselves be fair valued or accounted for as

hedges, timing differences in relation to the recognition of gains and

losses occur. These economic exposures primarily relate to inventories

held in excess of normal operating requirements that are not designated

as held for trading and fair valued and forecast transactions to replenish

inventory. Gains and losses on derivative commodity contracts are

recognized immediately through the income statement while gains and

losses on the related physical transaction are recognized when the

commodity is sold.

Additionally, IFRS requires that inventory designated as held for trading

is fair valued using period end spot prices while the related derivative

instruments are valued using forward prices consistent with the contract

maturity. Depending on market conditions, these forward prices can

be either higher or lower than spot prices resulting in quarterly

timing differences.

The average refining Global Indicator Margin (GIM) in 2006 was lower

than in 2005. Retail margins improved, but this improvement was partially

negated by deterioration in other marketing margins.

Refining throughputs in 2006 were 2,198mb/d, 201mb/d lower than in

2005. Refining availability, excluding the Texas City refinery, was 95.7%,

broadly consistent with 2005. Marketing volumes at 3,872mb/d were

around 2% lower than in 2005.

52