Albertsons 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company will continue to provide certain back office support to the disposed NAI Banners after the sale

under the TSA for which it expects to earn incremental annual TSA fees of approximately $158, net of TSA fees

historically recognized under its existing TSA agreement with Albertson’s, LLC. In addition, the Company will

receive transitional TSA fees of $60 in the first year of the agreement. The historical fees recognized under the

existing TSA, reflected in the Consolidated Statement of Operations as a reduction of Selling and administrative

expenses, were $42, $47 and $50 years ended February 23, 2013, February 25, 2012 and February 26, 2011. The

historical shared service center costs incurred to support back office functions related to the NAI Banners were

incurred as administrative overhead and not specifically charged to the NAI Banners.

During the fourth quarter of fiscal 2011, the Company divested the Total Logistic Control business for $205 in

cash and recognized a $62 pre-tax gain. The gain, along with the results of Total Logistic Control, are presented

as part of discontinued operations, are related to the Independent Business segment and were recorded as a

component of Selling and administrative expenses in the Consolidated Statements of Operations.

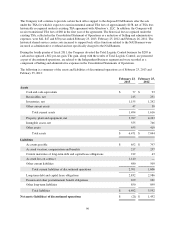

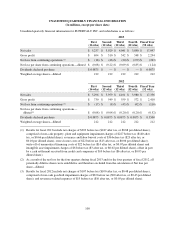

The following is a summary of the assets and liabilities of discontinued operations as of February 23, 2013 and

February 25, 2012:

February 23,

2013

February 25,

2012

Assets

Cash and cash equivalents $ 77 $ 93

Receivables, net 215 231

Inventories, net 1,155 1,242

Other current assets 47 50

Total current assets 1,494 1,616

Property, plant and equipment, net 3,767 4,263

Intangible assets, net 555 746

Other assets 655 419

Total assets $ 6,471 $ 7,044

Liabilities

Accounts payable $ 652 $ 797

Accrued vacation, compensation and benefits 217 257

Current maturities of long-term debt and capital lease obligations 212 43

Accrued loss on contract 1,140 —

Other current liabilities 480 509

Total current liabilities of discontinued operations 2,701 1,606

Long-term debt and capital lease obligations 2,832 2,986

Pension and other postretirement benefit obligations 109 101

Other long-term liabilities 850 899

Total liabilities $ 6,492 5,592

Net assets (liabilities) of discontinued operations $ (21) $ 1,452

96