Albertsons 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

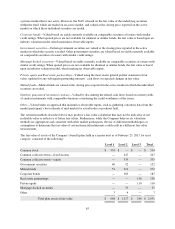

Stock options are granted to key salaried employees and to the Company’s non-employee directors to purchase

common stock at an exercise price not less than 100 percent of the fair market value of the Company’s common

stock on the date of grant. Prior to fiscal 2013 stock options vested over four years and starting in fiscal 2013

stock options vest in three years. Restricted stock awards are also awarded to key salaried employees. The

vesting of restricted stock awards granted is determined at the discretion of the Board of Directors or the

Compensation Committee. The restrictions on the restricted stock awards generally lapse between one and five

years from the date of grant and the expense is recognized over the lapsing period. Performance awards as part of

the long-term incentive program are granted to key salaried employees.

As of February 23, 2013, there were 20 reserved shares under the 2012 Stock Plan available for stock-based

awards. Common stock is delivered out of treasury stock upon the exercise of stock-based awards. The

provisions of future stock-based awards may change at the discretion of the Board of Directors or the

Compensation Committee.

Long-Term Incentive Plans

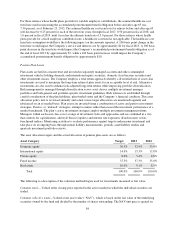

In May 2012, the Company granted 5 performance award units to certain employees under the SUPERVALU

INC. 2007 Stock Plan as part of the Company’s long-term incentive program (“2013 LTIP”). Payout of the award

will be based on the increase in share price over the three-year service period ending May 1, 2015, and will be

settled in the Company’s stock.

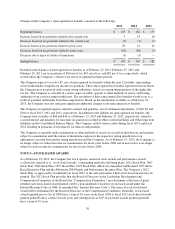

The grant date fair value used to determine compensation expense associated with the performance grant was

calculated utilizing a Monte Carlo simulation. The assumptions related to the valuation of the Company’s 2013

LTIP consisted of the following:

2013

Dividend yield 4.1%

Volatility rate 45.8%

Risk-free interest rate 0.4%

Expected life 3.0 years

The grant date fair value of the 2013 LTIP award was $1.38 per award unit. At the end of the three-year service

period, the award units will be converted to shares based on the aggregate award value as determined by

multiplying the award units by the increase in the Company share price over the service period above the $5.77

grant date share price. The aggregate award will be divided by the closing market price as of May 1, 2015, to

determine the number of shares awarded.

In April 2011, the Company granted performance awards to employees under the SUPERVALU INC. 2007

Stock Plan as part of the Company’s LTIP. Payout of the award, if at all, will be based on the highest payout

under the terms of the grant based on the increase in market capitalization over the service period, or the

achievement of financial goals for the three-year period ending February 22, 2014. Awards will be settled equally

in cash and the Company’s stock.

77