Albertsons 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

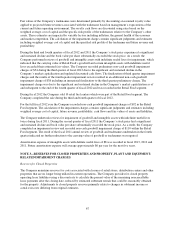

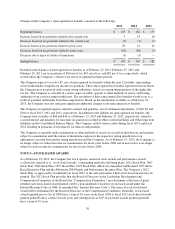

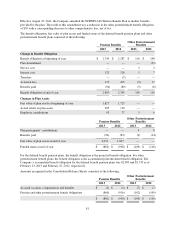

Changes in the Company’s unrecognized tax benefits consisted of the following:

2013 2012 2011

Beginning balance $ 165 $ 182 $ 133

Increase based on tax positions related to the current year 5 14 18

Decrease based on tax positions related to the current year (1) (1) (1)

Increase based on tax positions related to prior years 83 21 41

Decrease based on tax positions related to prior years (62) (46) (9)

Decrease due to lapse of statute of limitations (3) (5) —

Ending balance $ 187 $ 165 $ 182

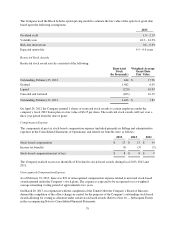

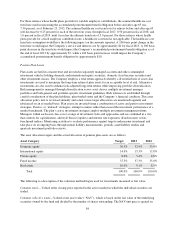

Included in the balance of unrecognized tax benefits as of February 23, 2013, February 25, 2012 and

February 26, 2011 are tax positions of $60 net of tax, $67 net of tax, and $82 net of tax, respectively, which

would reduce the Company’s effective tax rate if recognized in future periods.

The Company expects to resolve $5, net, of unrecognized tax benefits within the next 12 months, representing

several individually insignificant income tax positions. These unrecognized tax benefits represent items in which

the Company may not prevail with certain taxing authorities, based on varying interpretations of the applicable

tax law. The Company is currently in various stages of audits, appeals or other methods of review with taxing

authorities from various taxing jurisdictions. The resolution of these unrecognized tax benefits would occur as a

result of potential settlements from these negotiations. Based on the information available as of February 23,

2013, the Company does not anticipate significant additional changes to its unrecognized tax benefits.

The Company recognized expense related to interest and penalties, net of settlement adjustments, of $20, $2 and

$10 for fiscal 2013, 2012 and 2011, respectively. In addition to the liability for unrecognized tax benefits, the

Company had a liability of $60 and $40 as of February 23, 2013 and February 25, 2012, respectively, related to

accrued interest and penalties for uncertain tax positions recorded in Other current liabilities and Other long-term

liabilities in the Consolidated Balance Sheets. The Company settled various audits during fiscal 2013 and fiscal

2012 resulting in payments of less than $1 for interest and penalties.

The Company is currently under examination or other methods of review in several tax jurisdictions and remains

subject to examination until the statute of limitations expires for the respective taxing jurisdiction or an

agreement is reached between the taxing jurisdiction and the Company. As of February 23, 2013, the Company is

no longer subject to federal income tax examinations for fiscal years before 2008 and in most states is no longer

subject to state income tax examinations for fiscal years before 2006.

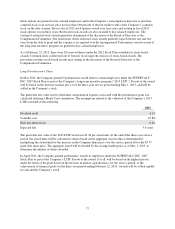

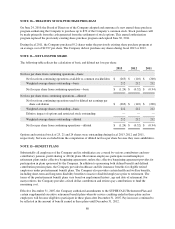

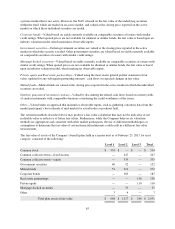

NOTE 9—STOCK-BASED AWARDS

As of February 23, 2013, the Company has stock options, restricted stock awards and performance awards

(collectively referred to as “stock-based awards”) outstanding under the following plans: 2012 Stock Plan, 2007

Stock Plan, 2002 Stock Plan, 1997 Stock Plan, 1993 Stock Plan, Albertsons Amended and Restated 1995 Stock-

Based Incentive Plan and the Albertsons 2004 Equity and Performance Incentive Plan. The Company’s 2012

Stock Plan, as approved by stockholders in fiscal 2013, is the only plan under which stock-based awards may be

granted. The 2012 Stock Plan provides that the Board of Directors or the Leadership Development and

Compensation Committee of the Board (the “Compensation Committee”) may determine at the time of grant

whether each stock-based award granted will be a non-qualified or incentive stock-based award under the

Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”). The terms of each stock-based

award will be determined by the Board of Directors or the Compensation Committee. Generally, stock-based

awards granted prior to fiscal 2006 have a term of 10 years, from fiscal 2006 to fiscal 2012 stock-based awards

granted generally have a term of seven years and starting in fiscal 2013 stock-based awards granted generally

have a term of 10 years.

76