Albertsons 2013 Annual Report Download - page 93

Download and view the complete annual report

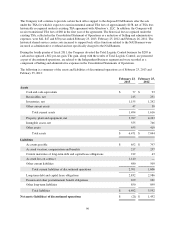

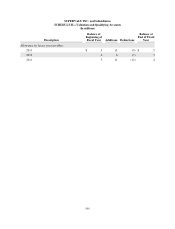

Please find page 93 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Multiemployer Postretirement Benefit Plans Other than Pensions

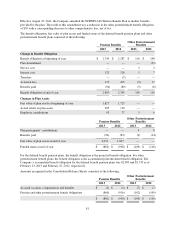

The Company also makes contributions to multiemployer health and welfare plans in amounts set forth in the

related collective bargaining agreements. These plans provide medical, dental, pharmacy, vision, and other

ancillary benefits to active employees and retirees as determined by the trustees of each plan. The vast majority

of the Company’s contributions benefit active employees and as such, may not constitute contributions to a

postretirement benefit plan. However, the Company is unable to separate contribution amounts to postretirement

benefit plans from contribution amounts paid to active plans.

The Company contributed $90, $90 and $102 for fiscal 2013, 2012 and 2011, respectively, to multiemployer

health and welfare plans. If healthcare provisions within these plans cannot be renegotiated in a manner that

reduces the prospective healthcare cost as the Company intends, the Company’s Selling and administrative

expenses could increase in the future.

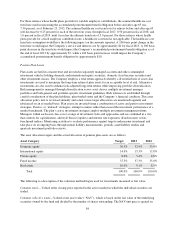

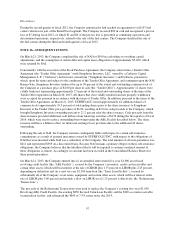

Collective Bargaining Agreements

As of February 23, 2013, the Company had approximately 35,000 employees. Approximately 15,000 employees

are covered by collective bargaining agreements. During fiscal 2013, 13 collective bargaining agreements

covering 5,500 employees were renegotiated and four collective bargaining agreements covering approximately

135 employees expired without their terms being renegotiated. Negotiations are expected to continue with the

bargaining units representing the employees subject to those agreements. During fiscal 2014, 22 collective

bargaining agreements covering approximately 6,000 employees are scheduled to expire.

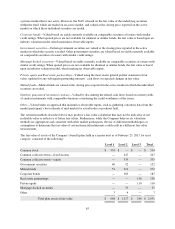

NOTE 13—COMMITMENTS, CONTINGENCIES AND OFF-BALANCE SHEET ARRANGEMENTS

Guarantees

The Company has guaranteed certain leases, fixture financing loans and other debt obligations of various retailers

as of February 23, 2013. These guarantees were generally made to support the business growth of independent

retail customers. The guarantees are generally for the entire terms of the leases or other debt obligations with

remaining terms that range from less than one year to 17 years, with a weighted average remaining term of

approximately nine years. For each guarantee issued, if the independent retail customer defaults on a payment,

the Company would be required to make payments under its guarantee. Generally, the guarantees are secured by

indemnification agreements or personal guarantees of the independent retail customer. The Company reviews

performance risk related to its guarantees of independent retail customers based on internal measures of credit

performance. As of February 23, 2013, the maximum amount of undiscounted payments the Company would be

required to make in the event of default of all guarantees was $84 and represented $60 on a discounted basis.

Based on the indemnification agreements, personal guarantees and results of the reviews of performance risk, the

Company believes the likelihood that it will be required to assume a material amount of these obligations is

remote. Accordingly, no amount has been recorded in the Consolidated Balance Sheets for these contingent

obligations under the Company’s guarantee arrangements.

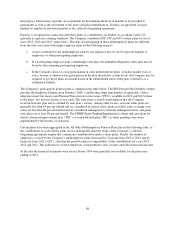

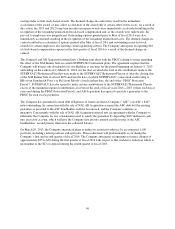

The Company is contingently liable for leases that have been assigned to various third parties in connection with

facility closings and dispositions. The Company could be required to satisfy the obligations under the leases if

any of the assignees are unable to fulfill their lease obligations. Due to the wide distribution of the Company’s

assignments among third parties, and various other remedies available, the Company believes the likelihood that

it will be required to assume a material amount of these obligations is remote.

In the ordinary course of business, the Company enters into supply contracts to purchase products for resale and

purchase and service contracts for fixed asset and information technology commitments. These contracts

typically include either volume commitments or fixed expiration dates, termination provisions and other standard

contractual considerations. As of February 23, 2013, the Company had approximately $364 of non-cancelable

91