Albertsons 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Effective August 23, 2011, the Company amended the SUPERVALU Retiree Benefit Plan to modify benefits

provided by the plan. The result of this amendment was a reduction in the other postretirement benefit obligation

of $39 with a corresponding decrease to other comprehensive loss, net of tax.

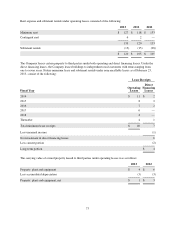

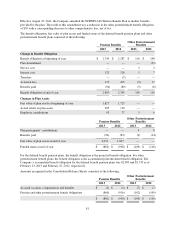

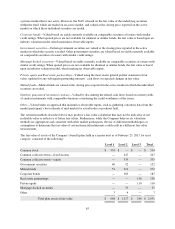

The benefit obligation, fair value of plan assets and funded status of the defined benefit pension plans and other

postretirement benefit plans consisted of the following:

Pension Benefits

Other Postretirement

Benefits

2013 2012 2013 2012

Change in Benefit Obligation

Benefit obligation at beginning of year $ 2,745 $ 2,287 $ 116 $ 148

Plan Amendment — — — (52)

Service cost — — 2 2

Interest cost 123 126 5 7

Transfers — (3) — —

Actuarial loss 119 415 (9) 17

Benefits paid (94) (80) (5) (6)

Benefit obligation at end of year 2,893 2,745 109 116

Changes in Plan Assets

Fair value of plan assets at beginning of year 1,827 1,723 — —

Actual return on plan assets 205 110 — —

Employer contributions 93 77 5 6

Pension Benefits

Other Postretirement

Benefits

2013 2012 2013 2012

Plan participants’ contributions — — 4 8

Benefits paid (94) (83) (9) (14)

Fair value of plan assets at end of year 2,031 1,827 — —

Funded status at end of year $ (862) $ (918) $ (109) $ (116)

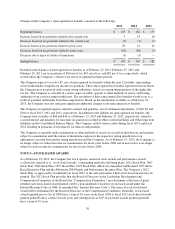

For the defined benefit pension plans, the benefit obligation is the projected benefit obligation. For other

postretirement benefit plans, the benefit obligation is the accumulated postretirement benefit obligation. The

Company’s accumulated benefit obligation for the defined benefit pension plans was $2,893 and $2,739 as of

February 23, 2013 and February 25, 2012, respectively.

Amounts recognized in the Consolidated Balance Sheets consisted of the following:

Pension Benefits

Other Postretirement

Benefits

2013 2012 2013 2012

Accrued vacation, compensation and benefits $ (2) $ (2) $ (7) $ (7)

Pension and other postretirement benefit obligations (860) (916) (102) (109)

$ (862) $ (918) $ (109) $ (116)

81