Albertsons 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross Profit

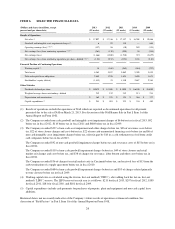

Gross profit for fiscal 2012 was $2,410, compared with $2,400 for fiscal 2011, an increase of $10 or 0.4 percent.

The increase in Gross profit dollars is primarily due to increased Gross profit within the Save-A-Lot business

from higher sales and stronger margin offset in part by a decline in the Independent Business sales volume and

the impact of a national retail customer transition to self-distribution also within the Independent Business

segment and a higher LIFO charge. Gross profit, as a percent of Net sales, was 13.9 percent for fiscal 2012

compared with 13.8 percent for fiscal 2011.

Retail Food gross profit as a percent of Retail Food Net sales was 26.3 percent for fiscal 2012 compared with

26.1 percent for fiscal 2011. The 20 basis point increase in Retail Food gross profit rate is primarily due to a 40

basis point impact from closed stores and lower advertising costs partially offset by a 20 basis point decline in

gross profit due to a higher LIFO charge.

Save-A-Lot gross profit as a percent of Save-A-Lot Net sales was 17.1 percent for fiscal 2012 compared with

16.5 percent for fiscal 2011. The 60 basis point increase in Save-A-Lot Gross profit is primarily due to price pass

through related inflation.

Independent Business gross profit as a percent of Independent Business Net sales was 4.8 percent for fiscal 2012

compared with 5.2 percent for fiscal 2011. The 40 basis point decrease in Independent Business gross profit is

primarily related to the impact of a national retail customer’s transition to self-distribution and a higher LIFO

charge.

Selling and Administrative Expenses

Selling and administrative expenses for fiscal 2012 were $2,222, compared with $2,320 for fiscal 2011, a

decrease of $98, or 4.2 percent. Included in fiscal 2012 is $15 of severance costs and included in fiscal 2011 is

$94 of charges relating primarily to store closures, market exit costs and severance and labor contract buyout

costs. Excluding these items, the remaining reduction in Selling and administrative expenses is primarily due to

lower employee-related costs partially offset by higher consulting and legal fees.

Selling and administrative expenses for fiscal 2012 were 12.8 percent of net sales compared to 13.4 percent of

Net sales for fiscal 2011. When adjusted for the above items, Selling and administrative expense is flat on a rate

basis as a percent of sales.

Goodwill and Intangible Asset Impairment Charges

During fiscal 2012, the Company’s stock price experienced a significant and sustained decline. As a result, the

Company performed reviews of goodwill and intangible assets with indefinite useful lives for impairment, which

indicated that the carrying value of Retail Food’s goodwill exceeded the estimated fair value. The Company

recorded a non-cash goodwill impairment charge of $92. During fiscal 2011, the Company recorded a non-cash

goodwill impairment charge of $110.

The calculation of the impairment charges contains significant judgments and estimates including weighted

average cost of capital, future revenue, profitability, cash flows and fair values of assets and liabilities.

Operating Earnings

Operating earnings for fiscal 2012 was $96 compared with Operating loss of $30 for fiscal 2011. Results for

fiscal 2012 include net charges of $107 comprised of non-cash goodwill impairment charges of $92 and

severance-related expenses of $15. Included in fiscal 2011 is $110 of non-cash goodwill impairment charge and

$94 of charges relating primarily to store closures, market exit costs and severance and labor contract buyout

31