Albertsons 2013 Annual Report Download - page 101

Download and view the complete annual report

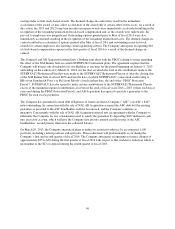

Please find page 101 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.vesting under certain stock-based awards. The deemed change-in-control may result in the immediate

acceleration of the award, or may allow acceleration of the award only if certain other events occur. As a result of

this action, the 2013 and 2012 long-term incentive program awards were immediately accelerated resulting in the

recognition of the remaining unamortized stock-based compensation and, as the awards were underwater, the

pay-out to employees was insignificant. Outstanding options granted prior to May of fiscal 2011 were also

immediately accelerated resulting in the recognition of the remaining unamortized costs. The deemed change-in-

control resulted in acceleration of options granted after May of fiscal 2011 and outstanding restricted stock

awards for certain employees also meeting certain qualifying criteria. The Company anticipates recognizing $10

of stock-based compensation expense in the first quarter of fiscal 2014 as a result of the deemed change-in-

control.

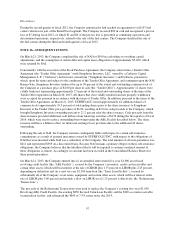

The Company and AB Acquisition entered into a binding term sheet with the PBGC relating to issues regarding

the effect of the NAI Banner Sale on certain SUPERVALU retirement plans. The agreement requires that the

Company will not pay any dividends to its stockholders at any time for the period beginning on January 9, 2013

and ending on the earliest of (i) March 21, 2018, (ii) the date on which the total of all contributions made to the

SUPERVALU Retirement Plan that were made to the SUPERVALU Retirement Plan on or after the closing date

of the NAI Banner Sale is at least $450 and (iii) the date on which SUPERVALU’s unsecured credit rating is

BB+ from Standard & Poor’s or Ba1 from Moody’s (such earliest date, the end of the “PBGC Protection

Period”). SUPERVALU has also agreed to make certain contributions to the SUPERVALU Retirement Plan in

excess of the minimum required contributions at or before the ends of fiscal years 2015—2017 (where such fiscal

years end during the PBGC Protection Period), and AB Acquisition has agreed to provide a guarantee to the

PBGC for such excess payments.

The Company has guaranteed certain debt obligations of American Stores Company (“ASC”) on ASC’s $467

notes outstanding. In connection with the sale of NAI, AB Acquisition assumed the ASC debt but the existing

guarantee as provided to the ASC bondholders will not be released, and the Company continues as

guarantor. Concurrently with the sale of NAI, AB Acquisition entered into an agreement with the Company to

indemnify the Company for any consideration used to satisfy the guarantee by depositing $467 million in cash

into an escrow account, which will give the Company first priority interest and the trustee of the ASC

bondholders’ second priority interest in the collateral balance.

On March 26, 2013, the Company announced plans to reduce its national workforce by an estimated 1,100

positions, including current positions and open jobs. These reductions will predominantly occur during the

Company’s first and second quarter of fiscal 2014. The Company anticipates recognizing severance charges of

approximately $25 to $30 during the first quarter of fiscal 2014 with respect to this workforce reduction which is

incremental to the $27 recognized during the fourth quarter of fiscal 2013.

99