Albertsons 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.vesting under certain stock-based awards. The deemed change-in-control may result in the immediate

acceleration of the award, or may allow acceleration of the award only if certain other events occur. As a result of

this action, the 2013 and 2012 long-term incentive program awards were immediately accelerated resulting in the

recognition of the remaining unamortized stock-based compensation and, as nearly all the awards were

underwater, the pay-out to employees was insignificant. Outstanding options granted prior to May of fiscal 2011

were also immediately accelerated resulting in the recognition of the remaining unamortized costs. The deemed

change-in-control resulted in acceleration of options granted after May of fiscal 2011 and outstanding restricted

stock awards for certain employees also meeting certain qualifying criteria. The Company recognized $10 of

stock-based compensation expense in the first quarter of fiscal 2014 as a result of the deemed change-in-control.

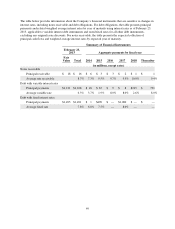

Capital Expenditures

Capital spending for fiscal 2013 was $241, including $13 of non-cash capital leases additions. Capital spending

primarily included store remodeling activity, new retail stores and technology expenditures. The Company’s

capital spending for fiscal 2014 is projected to be approximately $150 to $160 including capital leases.

Pension and Other Postretirement Benefit Obligations

Cash contributions to defined benefit pension plans and other postretirement benefit plans were $98, $83 and

$154 in fiscal 2013, 2012 and 2011, respectively, in accordance with minimum Employee Retirement Income

Security Act of 1974, as amended (“ERISA”) requirements. Cash contributions decreased in fiscal 2012

compared to fiscal 2011 due to pre-funding of $63 in fiscal 2011 for fiscal 2012 contributions. Fiscal 2014 total

defined benefit pension plans and other postretirement benefit plan contributions are estimated to be

approximately $120 to $130.

Liquidity Requirements

Subsequent to the Refinancing Transactions, the Company has approximately $22, $33 and $15 in aggregate debt

maturities due in fiscal 2014, 2015 and 2016, respectively. Payments to reduce capital lease obligations will

approximate $30 for fiscal 2014, 2015, and 2016.

The Company’s funding policy for the defined benefit pension plans is to contribute the minimum contribution

amount required under ERISA and the Pension Protection Act of 2006 as determined by the Company’s external

actuarial consultant. At the Company’s discretion, additional funds may be contributed to the pension plan. The

Company may accelerate contributions or undertake contributions in excess of the minimum requirements from

time to time subject to the availability of cash in excess of operating and financing needs or other factors as may

be applicable. The Company assesses the relative attractiveness of the use of cash including expected return on

assets, discount rates, cost of debt, reducing or eliminating required PBGC variable rate premiums or in order to

achieve exemption from participant notices of underfunding. In addition, the Company has entered into an

agreement with the PBGC relating to the NAI Banner Sale where it has agreed to contribute in excess of the

minimum required amounts by additional contributions of $25 by the end of fiscal 2015, an additional $25 by the

end of fiscal 2016 and an additional $50 by the end of fiscal 2017.

OFF-BALANCE SHEET ARRANGEMENTS

Guarantees

The Company has guaranteed certain leases, fixture financing loans and other debt obligations of various retailers

as of February 23, 2013. These guarantees were generally made to support the business growth of independent

retail customers. The guarantees are generally for the entire terms of the leases or other debt obligations with

remaining terms that range from less than one year to 17 years, with a weighted average remaining term of

approximately nine years. For each guarantee issued, if the independent retail customer defaults on a payment,

45