Albertsons 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

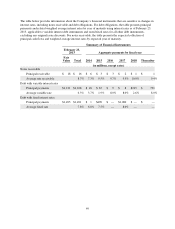

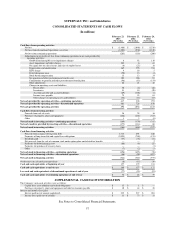

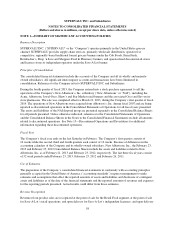

The table below provides information about the Company’s financial instruments that are sensitive to changes in

interest rates, including notes receivable and debt obligations. For debt obligations, the table presents principal

payments and related weighted average interest rates by year of maturity using interest rates as of February 23,

2013, applicable to variable interest debt instruments and stated fixed rates for all other debt instruments,

excluding any original issue discounts. For notes receivable, the table presents the expected collection of

principal cash flows and weighted average interest rates by expected year of maturity.

Summary of Financial Instruments

February 23,

2013 Aggregate payments by fiscal year

Fair

Value Total 2014 2015 2016 2017 2018 Thereafter

(in millions, except rates)

Notes receivable

Principal receivable $ 18 $ 16 $ 6 $ 3$3$ 2$1$ 1

Average rate receivable 8.7% 7.3% 9.5% 9.7% 9.5% 10.0% 9.4%

Debt with variable interest rates

Principal payments $1,121 $1,108 $ 18 $ 67$9$ 8$215 $ 791

Average variable rate 6.5% 3.7% 1.9% 8.0% 8.0% 2.6% 8.0%

Debt with fixed interest rates

Principal payments $1,495 $1,491 $ 1 $490 $ — $1,000 $ — $ —

Average fixed rate 7.8% 6.0% 7.5% — 8.0% — —

49