Albertsons 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

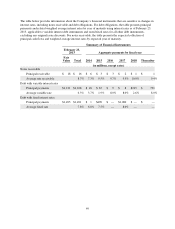

Cash Flow Information

Operating Activities

Net cash provided by operating activities from continuing operations was $417, $328 and $293 in fiscal 2013,

2012 and 2011, respectively.

The increase in net cash provided by operating activities from continuing operations in fiscal 2013 compared to

fiscal 2012 is primarily attributable to an increase in cash provided from changes in operating assets and

liabilities of $111.

The increase in net cash provided by operating activities in fiscal 2012 compared to fiscal 2011 is primarily

attributable to lower Contributions to pension and postretirement benefit plans of $71, primarily due to the

prefunding of $63 of fiscal 2012 contributions during fiscal 2011, and an increase in cash provided by deferred

income taxes of $17, offset in part by a decrease in changes in operating assets and liabilities of $54.

Investing Activities

Net cash used in investing activities from continuing operations was $189, $370 and $315 in fiscal 2013, 2012

and 2011, respectively. The decrease in cash used in investing activities in fiscal 2013 compared to fiscal 2012 is

primarily attributable to $152 less cash used in the purchases of Property, plant and equipment in fiscal 2013.

The increase in net cash used in investing activities in fiscal 2012 compared to fiscal 2011 is due primarily to $79

in additional purchases of Property, plant and equipment, offset in part by $13 of additional proceeds from the

sale of assets.

Financing Activities

Net cash used in financing activities from continuing operations was $496, $493 and $78 in fiscal 2013, 2012 and

2011, respectively. The increase in cash used in financing activities in fiscal 2013 compared to fiscal 2012 is

primarily attributable to $58 of additional cash payments for debt financing costs, primarily offset by a decrease

in cash used for the payment of dividends to stockholders of $37. The increase in cash used in financing activities

in fiscal 2012 compared to fiscal 2011 is primarily attributable to higher net debt and capital lease payments of

$434, primarily due to $545 in additional cash used in the payment of net debt and capital lease obligations in

fiscal 2012.

Annual cash dividends declared for fiscal 2013, 2012 and 2011, were $.0875, $0.3500 and $0.3500 per share,

respectively. In July 2012, the Company announced that it had suspended the payment of the regular quarterly

dividend.

The Company and AB Acquisition LLC entered into a binding term sheet with the Pension Benefit Guaranty

Corporation (the “PBGC”) relating to issues regarding the effect of the NAI Banner Sale on certain

SUPERVALU retirement plans. The agreement requires that the Company will not pay any dividends to its

stockholders at any time for the period beginning on January 9, 2013 and ending on the earliest of (i) March 21,

2018, (ii) the date on which the total of all contributions made to the SUPERVALU Retirement Plan that were

made to the SUPERVALU Retirement Plan on or after the closing date of the NAI Banner Sale is at least $450

and (iii) the date on which SUPERVALU’s unsecured credit rating is BB+ from Standard & Poor’s or Ba1 from

Moody’s (such earliest date, the end of the “PBGC Protection Period”). SUPERVALU has also agreed to make

certain contributions to the SUPERVALU Retirement Plan in excess of the minimum required contributions at or

before the ends of fiscal years 2015—2017 (where such fiscal years end during the PBGC Protection Period), and

AB Acquisition has agreed to provide a guarantee to the PBGC for such excess payments.

41