Albertsons 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.included in Inventories, all of the Company’s pharmacy scripts, included in Intangible assets, net and all credit

card receivables of wholly-owned stores, included in Cash and cash equivalents in the Consolidated Balance

Sheets.

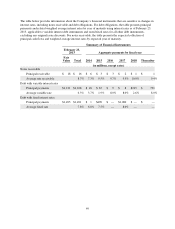

In November 2011, the Company amended and extended its accounts receivable securitization program until

November 2014. The Company had the ability to borrow up to $200 on a revolving basis, with borrowings

secured by eligible accounts receivable, which remained under the Company’s control. As of February 23, 2013,

there was $40 of outstanding borrowings under this facility at 1.98 percent. Facility fees on the unused portion

are 0.70 percent. As of February 23, 2013, there was $282 of accounts receivable pledged as collateral, classified

in Receivables in the Consolidated Balance Sheet. As discussed below, this facility was repaid and terminated on

March 21, 2013 in connection with the NAI Banner Sale.

In 2006, the Company issued $500 of senior unsecured notes bearing an interest rate of 7.50% due in 2014. In

2009, the Company issued $1,000 of senior unsecured notes bearing an interest rate of 8.00% due in 2016. These

senior unsecured notes contain operating covenants, including limitations on liens and on sale and leaseback

transactions. The Company was in compliance with all such covenants and provisions for all periods presented.

As of February 23, 2013 and February 25, 2012, the Company had $18 and $28, respectively, of debt with

current maturities that are classified as long-term debt due to the Company’s intent to refinance such obligations

with the Revolving Credit Facility or other long-term debt.

On March 21, 2013, the Company completed the sale NAI for $100 in cash subject to working capital

adjustments, and the assumption of certain debt and capital lease obligations of approximately $3,200, which

were retained by NAI.

Concurrently with the execution of the Stock Purchase Agreement, the Company entered into a Tender Offer

Agreement (the “Tender Offer Agreement”) with Symphony Investors, LLC, owned by a Cerberus Capital

Management, L.P. (“Cerberus”)-led investor consortium (“Symphony Investors”) and Cerberus, pursuant to

which, upon the terms and subject to the conditions of the Tender Offer Agreement, and contingent upon the NAI

Banner Sale, Symphony Investors tendered for up to 30 percent of the issued and outstanding common stock of

the Company at a purchase price of $4.00 per share in cash (the “Tender Offer”). Approximately 12 shares were

validly tendered, representing approximately 5.5 percent of the issued and outstanding shares at the time of the

Tender Offer expiration on March 20, 2013. All shares that were validly tendered and not properly withdrawn

were accepted for payment in accordance with the terms of Tender Offer. In addition, pursuant to the terms of the

Tender Offer Agreement, on March 21, 2013, SUPERVALU issued approximately 42 additional shares of

common stock (approximately 19.9 percent of outstanding shares prior to the share issuance) to Symphony

Investors at the Tender Offer price per share of $4.00, resulting in $170 in cash proceeds to the Company, which

brought Symphony Investors ownership percent to 21.2 percent after the share issuance. Cash proceeds from the

share issuance provided additional cash inflows from financing activities of $170 during the first quarter of fiscal

2014, which were used to reduce outstanding borrowings under the ABL Facility described below. The share

issuance will have a dilutive effect on future net earnings (loss) per share due to the additional 42 shares

outstanding.

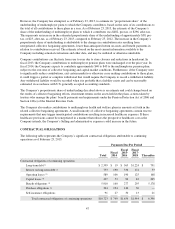

On March 21, 2013, the Company entered into (i) an amended and restated five-year $1,000 asset-based

revolving credit facility (the “ABL Facility”), secured by the Company’s inventory, credit card receivables and

certain other assets, which will bear interest at the rate of LIBOR plus 1.75 percent to LIBOR plus 2.25 percent,

depending on utilization and (ii) a new six-year $1,500 term loan (the “Term Loan Facility”), secured by

substantially all of the Company’s real estate, equipment and certain other assets, which will bear interest at the

rate of LIBOR plus 5.00 percent and include a floor on LIBOR set at 1.25 percent (collectively, the “Refinancing

Transactions”).

The proceeds of the Refinancing Transactions were used to replace the Company’s existing five-year $1,650

Revolving ABL Credit Facility, the existing $850 Secured Term Loan Facility and the $200 accounts receivable

securitization facility, and refinanced the $490 of 7.5% senior notes due 2014.

43