Albertsons 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132

|

|

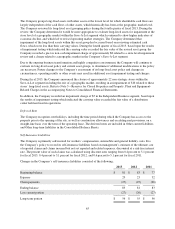

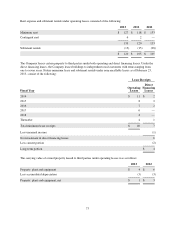

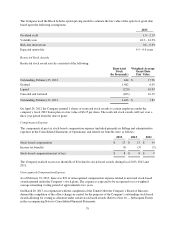

Rent expense and subtenant rentals under operating leases consisted of the following:

2013 2012 2011

Minimum rent $ 127 $ 118 $ 133

Contingent rent 6 2 —

133 120 133

Subtenant rentals (13) (15) (28)

$ 120 $ 105 $ 105

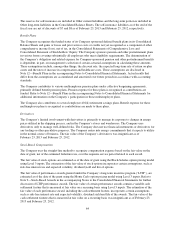

The Company leases certain property to third parties under both operating and direct financing leases. Under the

direct financing leases, the Company leases buildings to independent retail customers with terms ranging from

one to seven years. Future minimum lease and subtenant rentals under noncancellable leases as of February 23,

2013, consist of the following:

Lease Receipts

Fiscal Year

Operating

Leases

Direct

Financing

Leases

2014 $11$ 2

2015 82

2016 72

2017 6—

2018 4—

Thereafter 41

Total minimum lease receipts $ 40 7

Less unearned income (1)

Net investment in direct financing leases 6

Less current portion (2)

Long-term portion $4

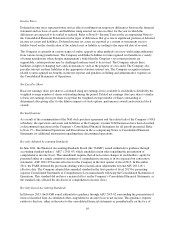

The carrying value of owned property leased to third parties under operating leases was as follows:

2013 2012

Property, plant and equipment $ 4 $ 6

Less accumulated depreciation (3) (3)

Property, plant and equipment, net $ 1 $ 3

73